Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q. 5 AL Rasheed Company 'began operations on July 1st2004, the Accounting Department has started the fixed asset and depreciation schedule presented below, you have

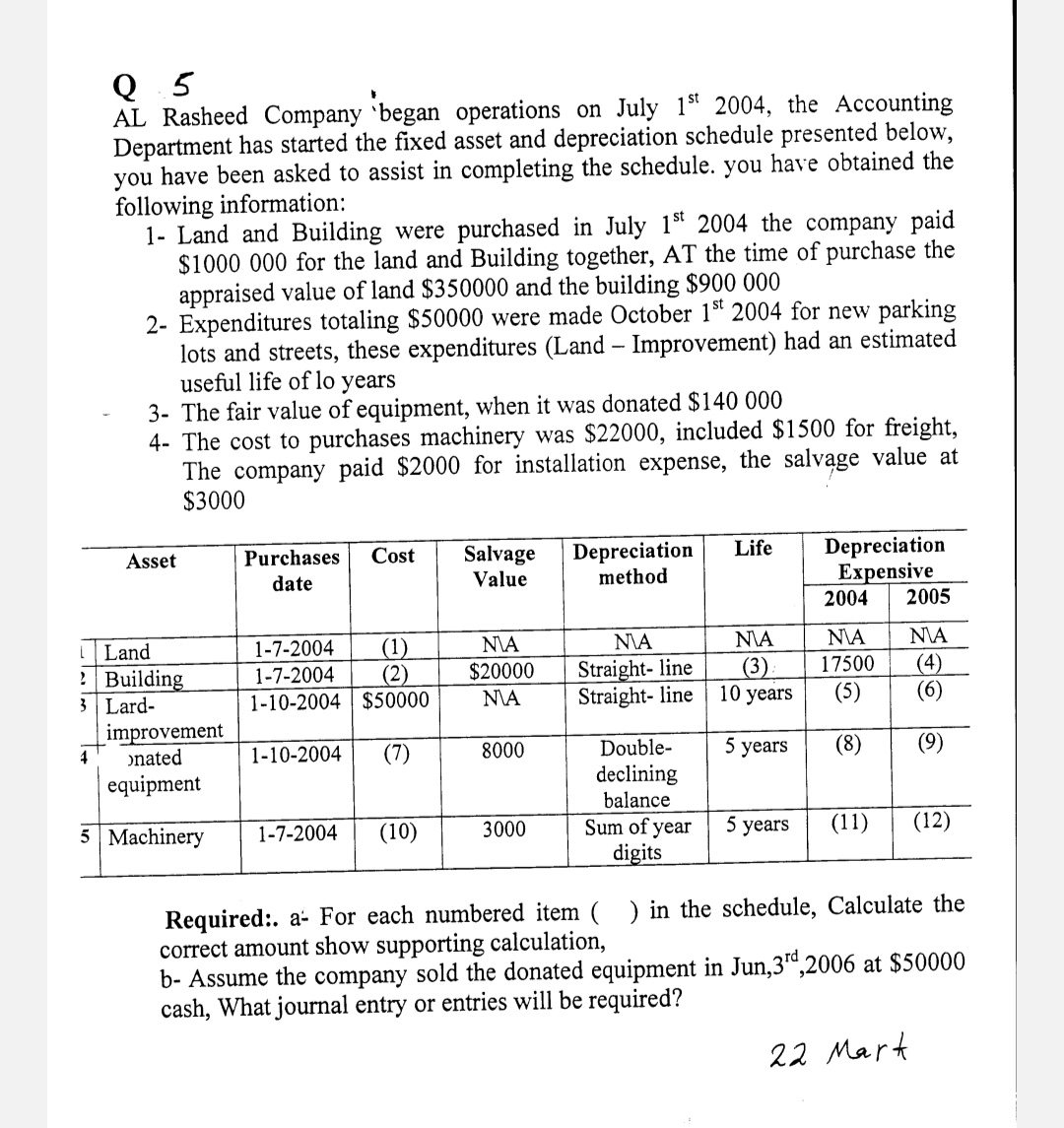

Q. 5 AL Rasheed Company 'began operations on July 1st2004, the Accounting Department has started the fixed asset and depreciation schedule presented below, you have been asked to assist in completing the schedule. you have obtained the following information: 1- Land and Building were purchased in July 1st2004 the company paid $1000000 for the land and Building together, AT the time of purchase the appraised value of land $350000 and the building $900000 2- Expenditures totaling $50000 were made October 1st2004 for new parking lots and streets, these expenditures (Land - Improvement) had an estimated useful life of lo years 3- The fair value of equipment, when it was donated $140000 4- The cost to purchases machinery was $22000, included $1500 for freight, The company paid $2000 for installation expense, the salvage value at $3000 Required:. a- For each numbered item ( ) in the schedule, Calculate the correct amount show supporting calculation, b- Assume the company sold the donated equipment in Jun, 3rd,2006 at $50000 cash, What journal entry or entries will be required

Q. 5 AL Rasheed Company 'began operations on July 1st2004, the Accounting Department has started the fixed asset and depreciation schedule presented below, you have been asked to assist in completing the schedule. you have obtained the following information: 1- Land and Building were purchased in July 1st2004 the company paid $1000000 for the land and Building together, AT the time of purchase the appraised value of land $350000 and the building $900000 2- Expenditures totaling $50000 were made October 1st2004 for new parking lots and streets, these expenditures (Land - Improvement) had an estimated useful life of lo years 3- The fair value of equipment, when it was donated $140000 4- The cost to purchases machinery was $22000, included $1500 for freight, The company paid $2000 for installation expense, the salvage value at $3000 Required:. a- For each numbered item ( ) in the schedule, Calculate the correct amount show supporting calculation, b- Assume the company sold the donated equipment in Jun, 3rd,2006 at $50000 cash, What journal entry or entries will be required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started