q

q

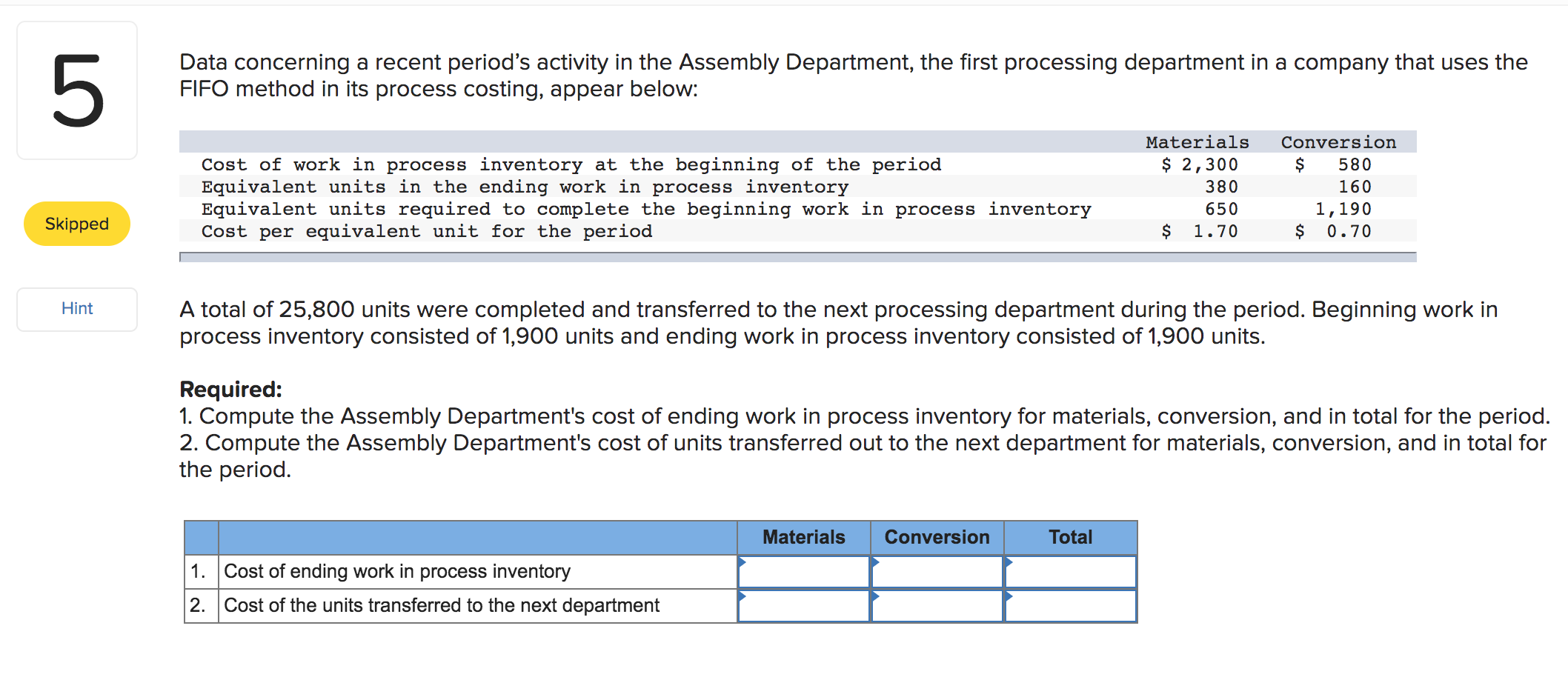

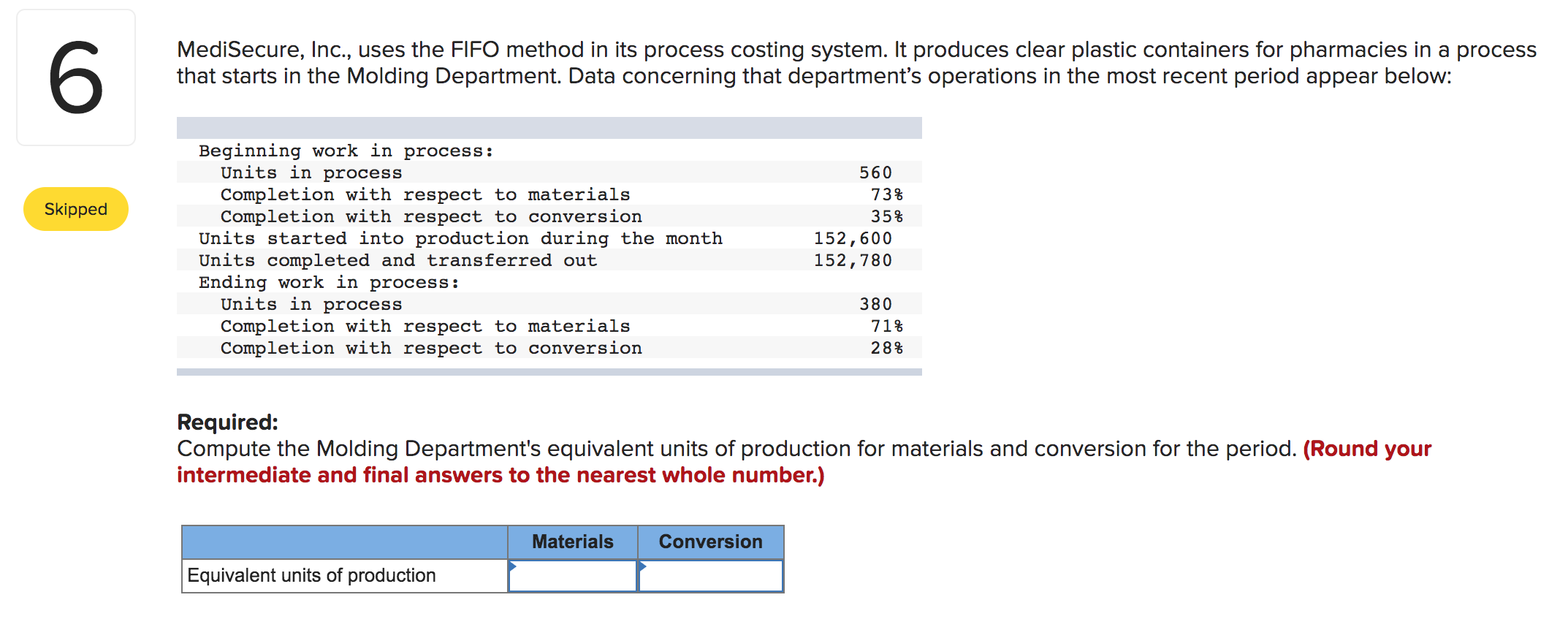

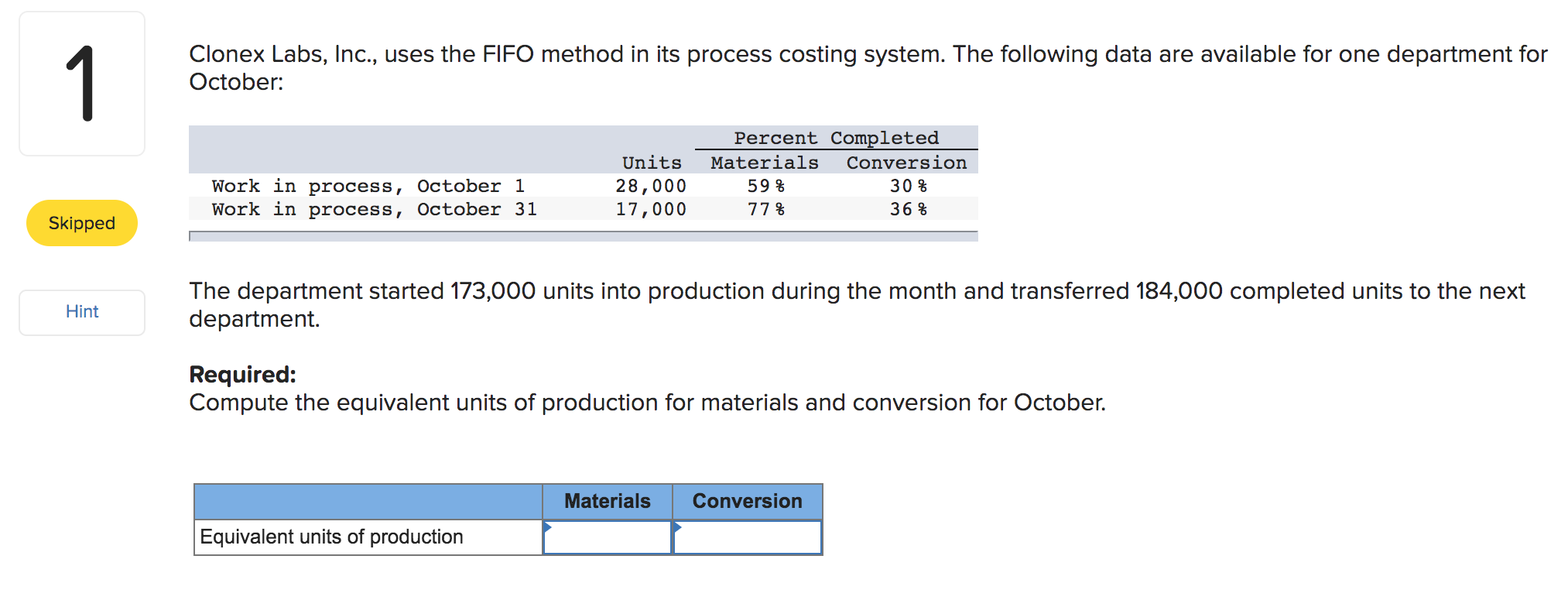

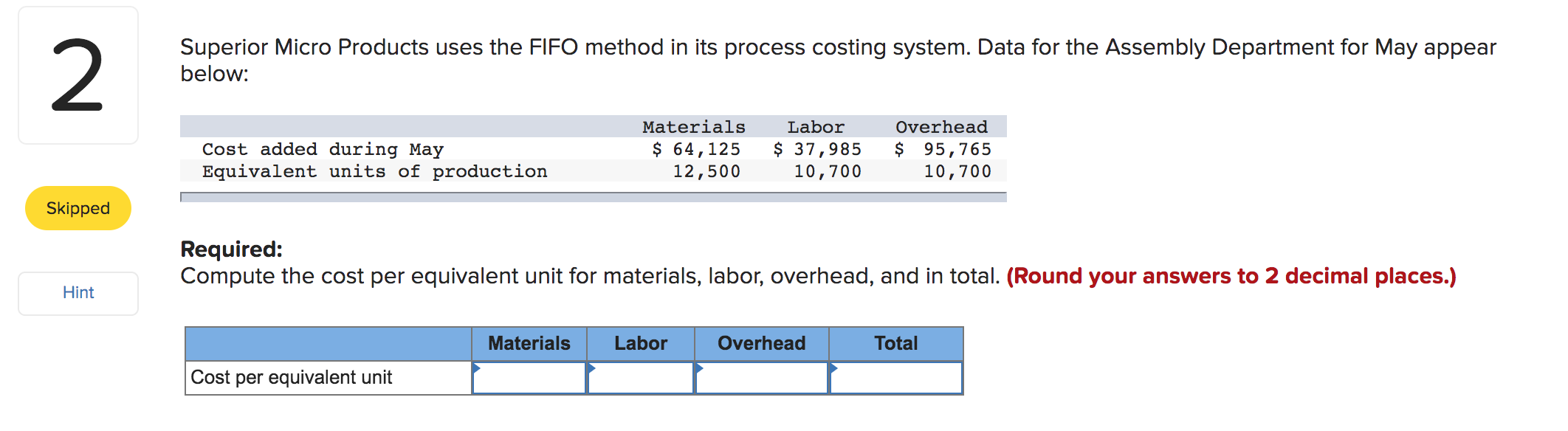

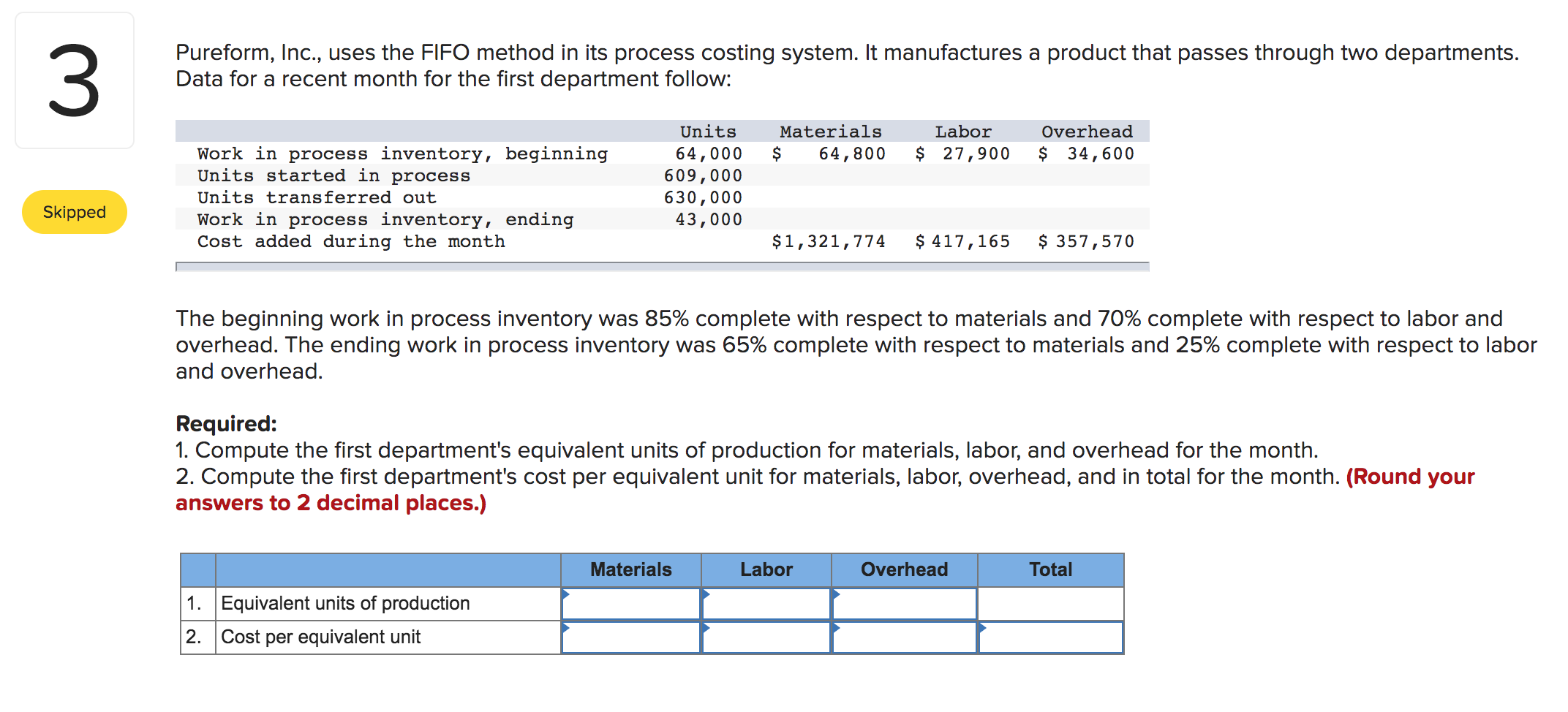

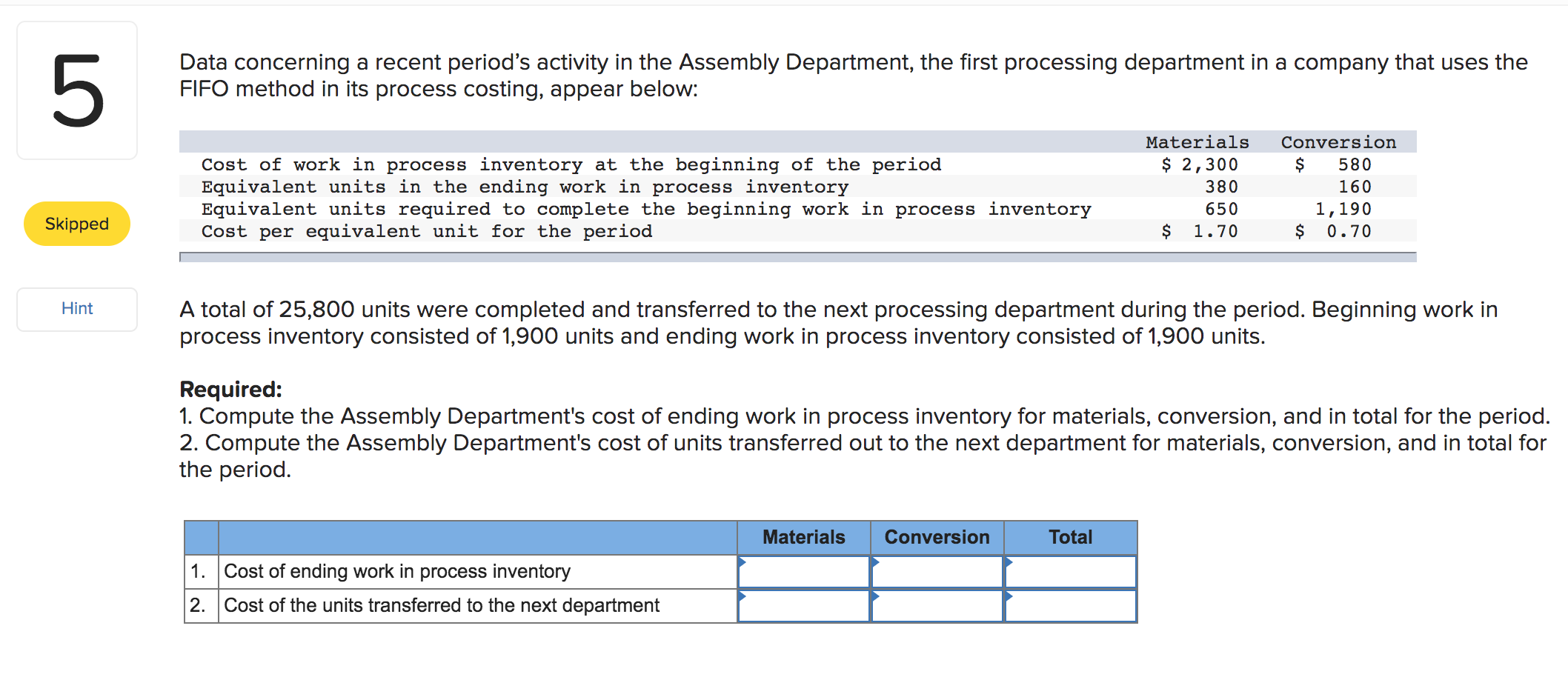

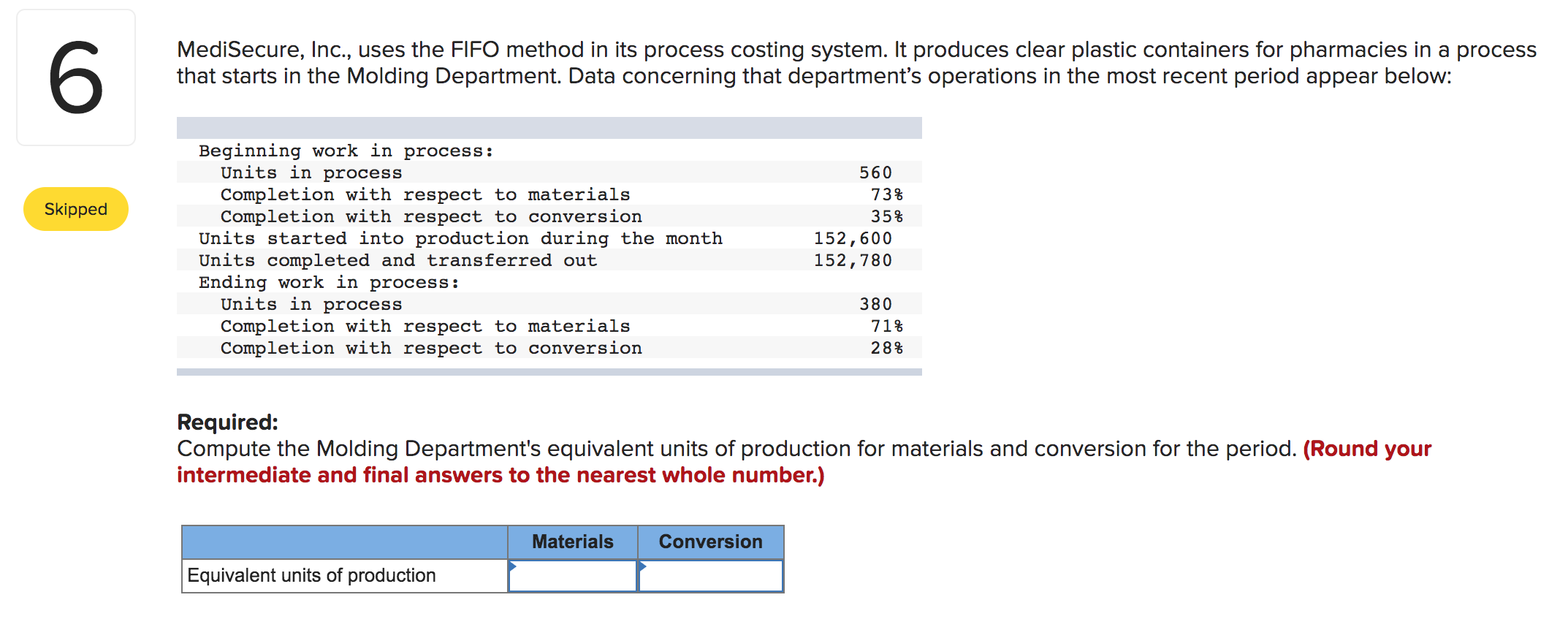

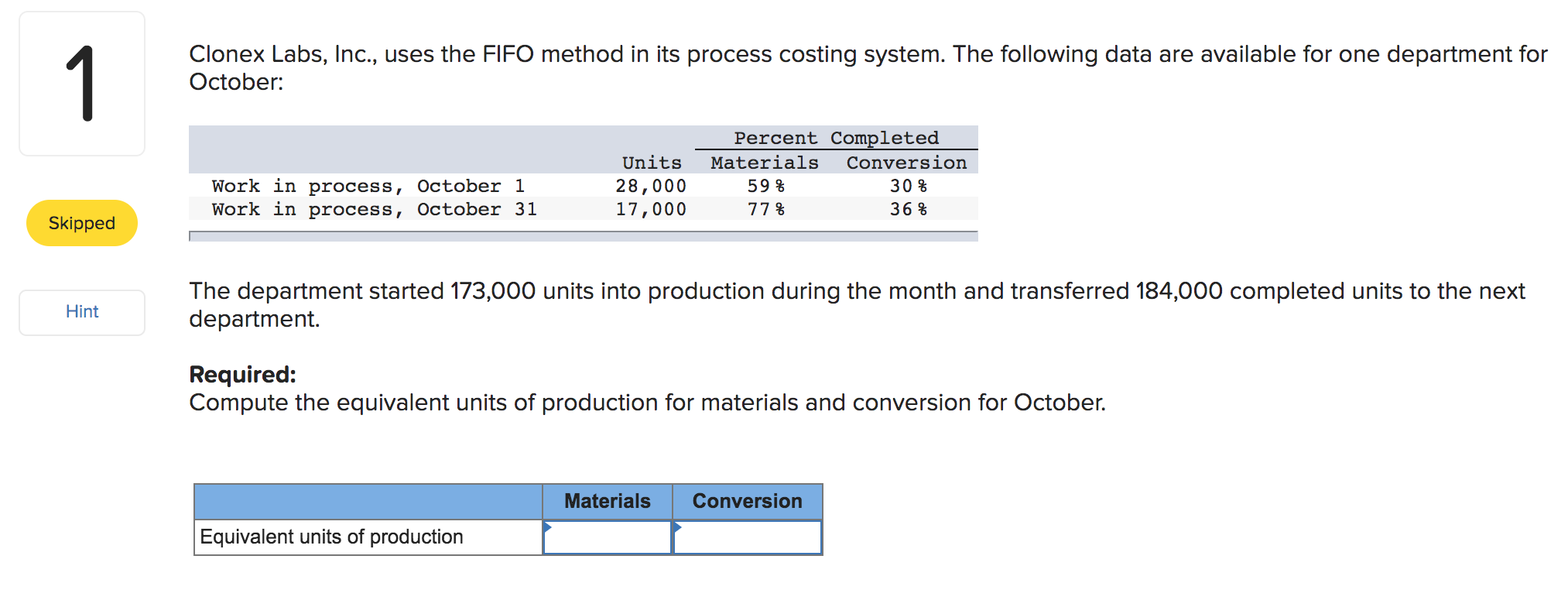

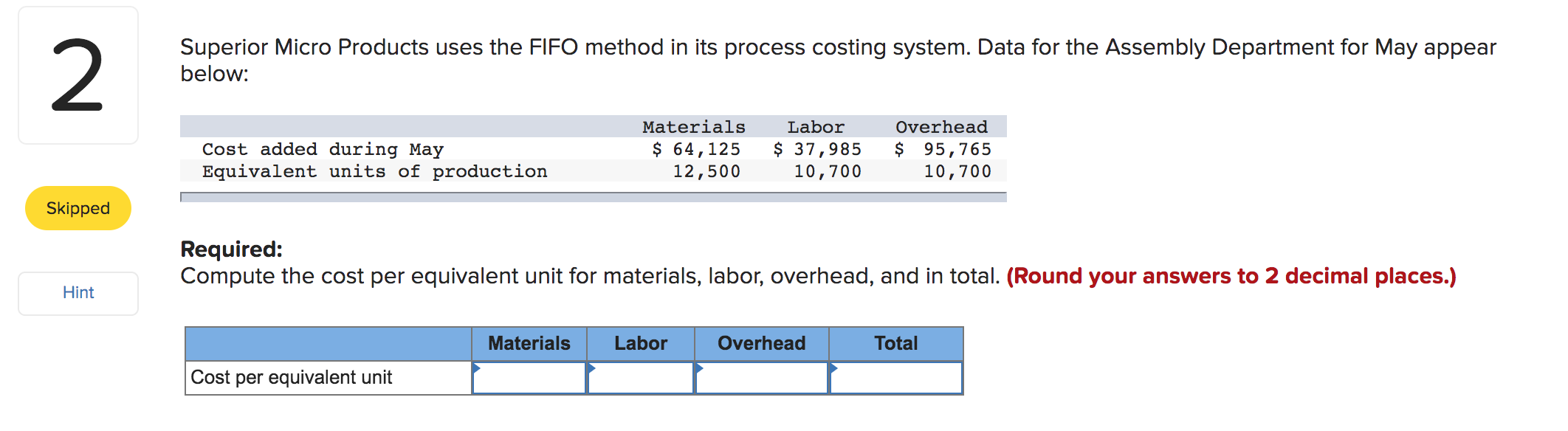

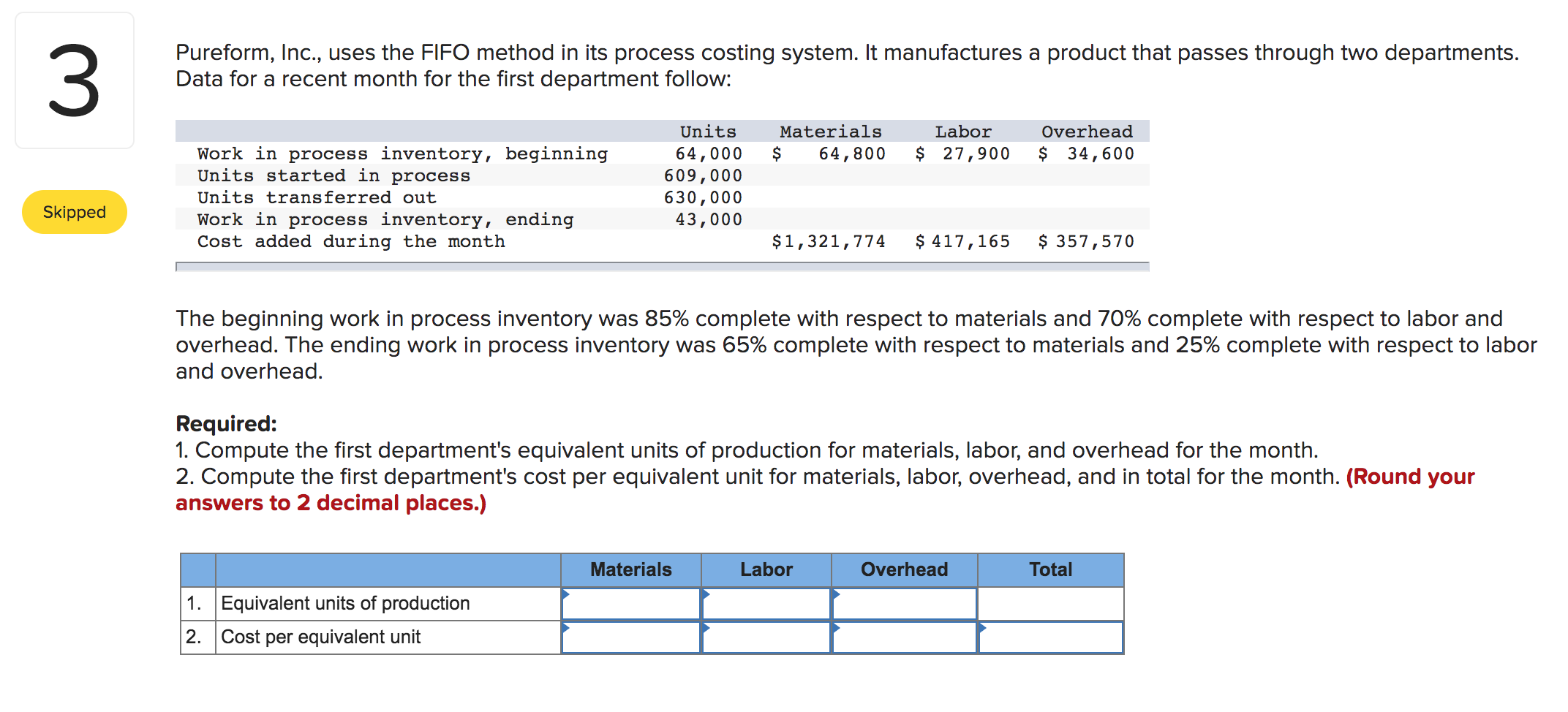

5 Data concerning a recent period's activity in the Assembly Department, the first processing department in a company that uses the FIFO method in its process costing, appear below: Cost of work in process inventory at the beginning of the period Equivalent units in the ending work in process inventory Equivalent units required to complete the beginning work in process inventory Cost per equivalent unit for the period Materials $ 2,300 380 650 $ 1.70 Conversion $ 580 160 1,190 $ 0.70 Skipped Hint A total of 25,800 units were completed and transferred to the next processing department during the period. Beginning work in process inventory consisted of 1,900 units and ending work in process inventory consisted of 1,900 units. Required: 1. Compute the Assembly Department's cost of ending work in process inventory for materials, conversion, and in total for the period. 2. Compute the Assembly Department's cost of units transferred out to the next department for materials, conversion, and in total for the period. Materials Conversion Total 1. Cost of ending work in process inventory 2. Cost of the units transferred to the next department 6 MediSecure, Inc., uses the FIFO method in its process costing system. It produces clear plastic containers for pharmacies in a process that starts in the Molding Department. Data concerning that department's operations in the most recent period appear below: Skipped Beginning work in process: Units in process Completion with respect to materials Completion with respect to conversion Units started into production during the month Units completed and transferred out Ending work in process: Units in process Completion with respect to materials Completion with respect to conversion 560 73% 35% 152,600 152,780 380 71% 28% Required: Compute the Molding Department's equivalent units of production for materials and conversion for the period. (Round your intermediate and final answers to the nearest whole number.) Materials Conversion Equivalent units of production 1 Clonex Labs, Inc., uses the FIFO method in its process costing system. The following data are available for one department for October: Percent Completed Materials Conversion 59% 30% 77% 36% Units 28,000 17,000 Work in process, October 1 Work in process, October 31 Skipped Hint The department started 173,000 units into production during the month and transferred 184,000 completed units to the next department. Required: Compute the equivalent units of production for materials and conversion for October. Materials Conversion Equivalent units of production 2. Superior Micro Products uses the FIFO method in its process costing system. Data for the Assembly Department for May appear below: Cost added during May Equivalent units of production Materials $ 64, 125 12,500 Labor $ 37,985 10,700 Overhead $ 95,765 10,700 Skipped Required: Compute the cost per equivalent unit for materials, labor, overhead, and in total. (Round your answers to 2 decimal places.) Hint Materials Labor Overhead Total Cost per equivalent unit 3 Pureform, Inc., uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: Materials $ 64,800 Labor $ 27,900 Overhead $ 34,600 Work in process inventory, beginning Units started in process Units transferred out Work in process inventory, ending Cost added during the month Units 64,000 609,000 630,000 43,000 Skipped $1,321,774 $ 417,165 $ 357,570 The beginning work in process inventory was 85% complete with respect to materials and 70% complete with respect to labor and overhead. The ending work in process inventory was 65% complete with respect to materials and 25% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. (Round your answers to 2 decimal places.) Materials Labor Overhead Total 1. Equivalent units of production 2. Cost per equivalent unit

q

q