Answered step by step

Verified Expert Solution

Question

1 Approved Answer

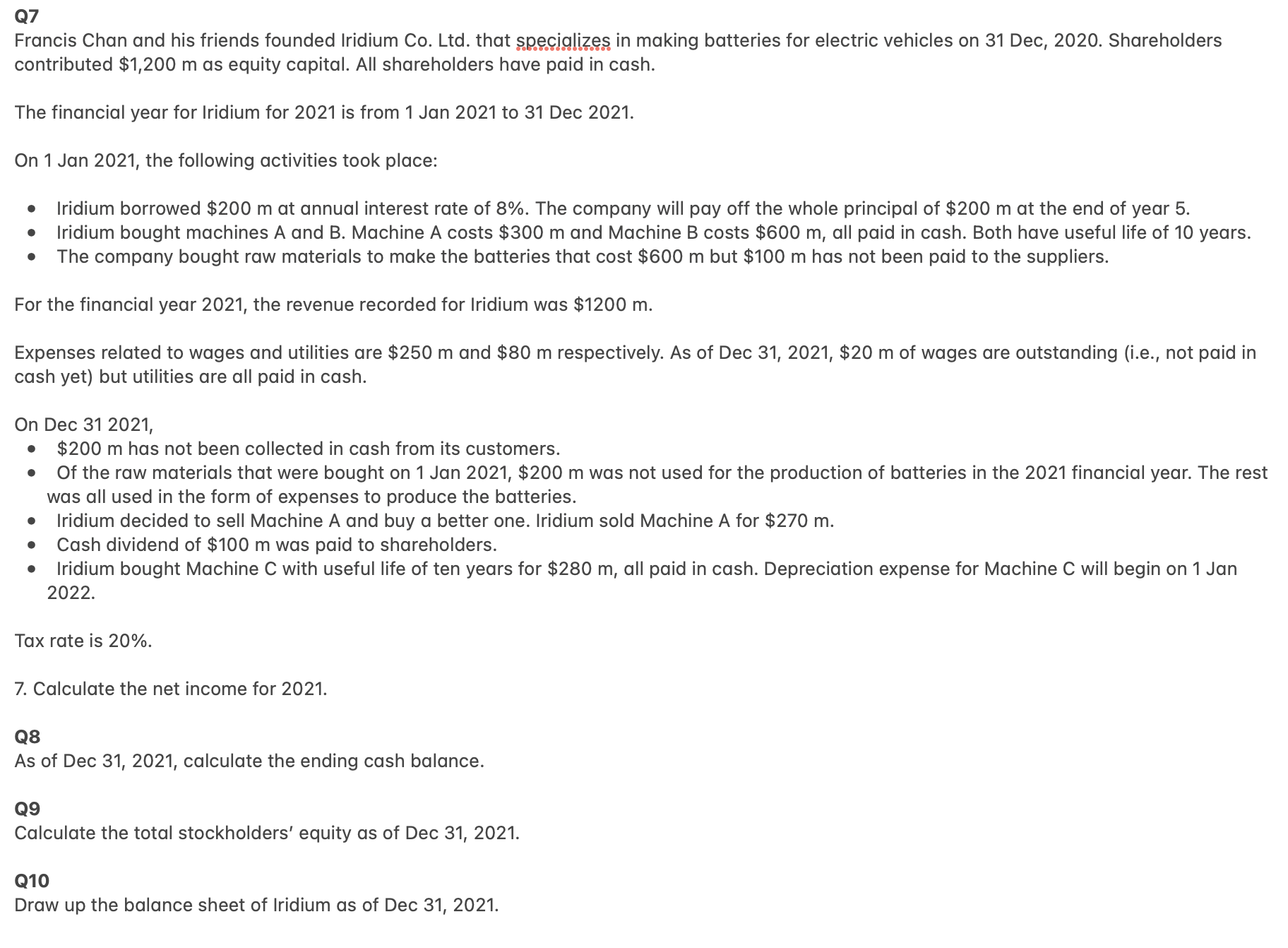

Q 7 Francis Chan and his friends founded Iridium Co . Ltd . that speceiglizes in making batteries for electric vehicles on 3 1 Dec,

Q

Francis Chan and his friends founded Iridium Co Ltd that speceiglizes in making batteries for electric vehicles on Dec, Shareholders

contributed $ as equity capital. All shareholders have paid in cash.

The financial year for Iridium for is from Jan to Dec

On Jan the following activities took place:

Iridium borrowed $ at annual interest rate of The company will pay off the whole principal of $ at the end of year

Iridium bought machines A and B Machine A costs $ and Machine B costs $ all paid in cash. Both have useful life of years.

The company bought raw materials to make the batteries that cost $ but $ has not been paid to the suppliers.

For the financial year the revenue recorded for Iridium was $

Expenses related to wages and utilities are $ and $ respectively. As of Dec $ of wages are outstanding ie not paid in

cash yet but utilities are all paid in cash.

On Dec

$ has not been collected in cash from its customers.

Of the raw materials that were bought on Jan $ was not used for the production of batteries in the financial year. The rest

was all used in the form of expenses to produce the batteries.

Iridium decided to sell Machine A and buy a better one. Iridium sold Machine A for $

Cash dividend of $ was paid to shareholders.

Iridium bought Machine C with useful life of ten years for $ all paid in cash. Depreciation expense for Machine C will begin on Jan

Tax rate is

Calculate the net income for

Q

As of Dec calculate the ending cash balance.

Q

Calculate the total stockholders' equity as of Dec

Q

Draw up the balance sheet of Iridium as of Dec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started