Q)

continue question

Q2)

continue question

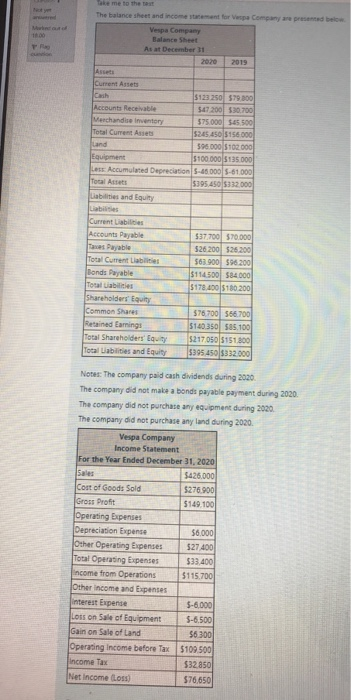

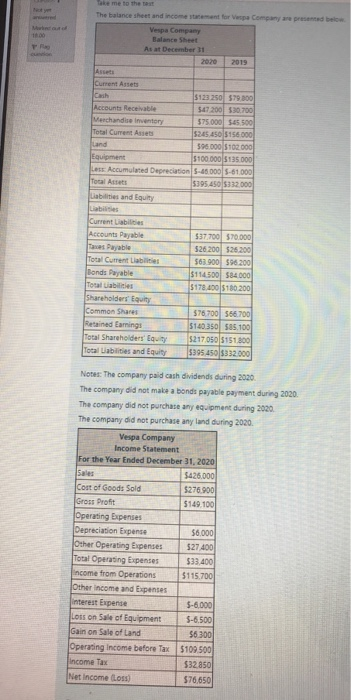

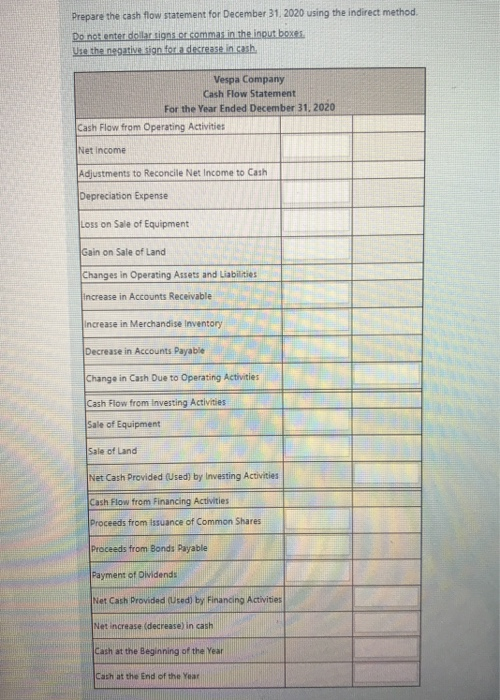

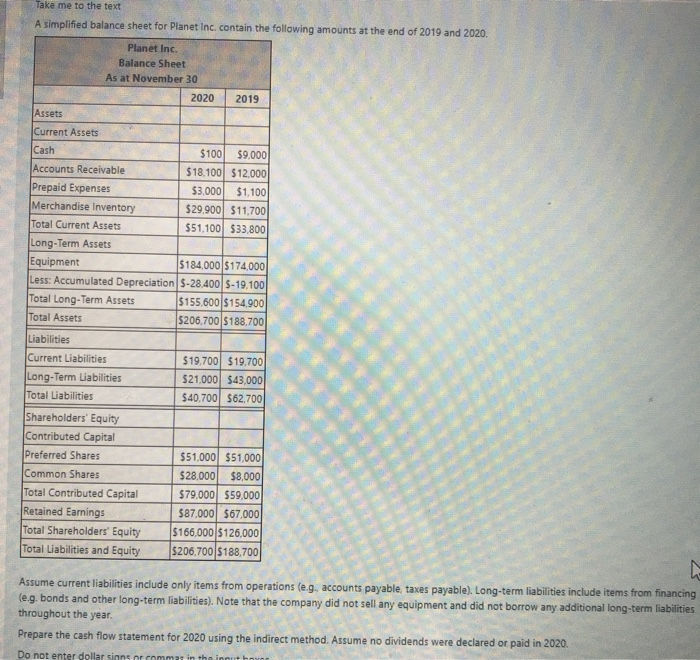

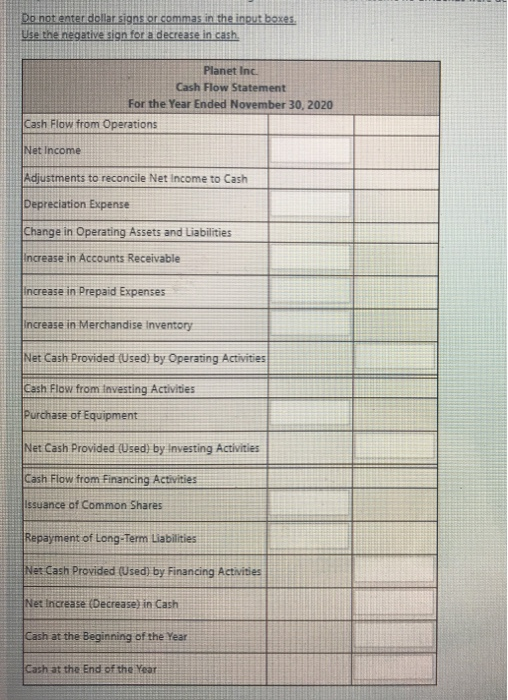

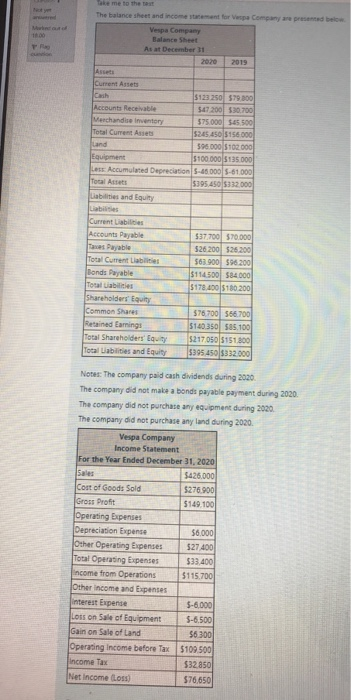

boke me to the The balance sheet and inconstant for Vespa Concare presented below Vespa Company Atat December 2020 2019 $123250 57900 Accounts Receivable 54672001 1700 Merchandise Inventory $75 000 $ 5500 Total Current Asses 5245 450 5156 000 596.000 5102 000 S100 000 15000 Less Accumulated Depreciation S-4500 -61 000 $39545015732 000 liabilities and Equity abilities Current Liabile Accounts Payable 5377000 70000 Payable 526200526.200 Total Current Lab 563 900 Bonds Payable $114.500 584.000 Total abilities 5178.400 5180 200 Shareholders Equity Common Shares 576.700 566.700 Retained Earnings $140.350 585.100 Total Shareholders Equity $217,050 3151300 Total abilities and Equity 5395 450 5332.000 Note: The company paid cash dividends during 2020 The company did not make a bonds payable payment during 2020 The company did not purchase any equipment during 2020 The company did not purchase any land during 2020 Vespa Company Income Statement For the Year Ended December 31, 2020 Sales 5426.000 Cost of Goods Sold $276.900 Gros Drofit $149.100 Operating Expenses Depreciation Expense $6.000 Other Operating Expenses 527400 Total Operating Expenses 533400 Income from Operations $115.700 Other income and Expenses interest Expense 5-6.000 Lots on sale of Egy lomant 5-6.500 Gain on Sale of Land | 56.300 Operating income before Tax $109.500 Income Tax $32.95 Net Income Los) 576,650 Prepare the cash flow statement for December 31, 2020 using the indirect method. Do not enter dollar intercommas in the input boxes Use the negative sig for a decrease in cash. Vespa Company Cash Flow Statement For the Year Ended December 31, 2020 Cash Flow from Operating Activities Net income Adjustments to Reconcile Net Income to Cash Depreciation Expense Loss On Sale of Equipment Gain on Sale of Land Changes in Operating Assets and Liabilities increase in Accounts Receivable increase in Merchandise Inventory | Decrease in Accounts Payable Change in Cash Due to Operating Activities Cash Flow from investing Activities Sale of Equipment Sale of Land Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities Proceeds from issuance of Common Shares Proceeds from Bonds Payable Payment of Dividends Net Cash Provided Used by Financing Activities PORTAL Net increase (decrease in cash Paththe Beginning of the Year c Cash at the End of the Year hat the end of Take me to the text A simplified balance sheet for Planet Inc. contain the following amounts at the end of 2019 and 2020. Planet Inc. Balance Sheet As at November 30 2020 2019 Assets Current Assets Cash $100 $9,000 Accounts Receivable $18,100 $12.000 Prepaid Expenses $3.000 $1,100 Merchandise Inventory $29,900 $11,700 Total Current Assets $51,100 $33,800 Long-Term Assets Equipment $184.000 $174.000 Less: Accumulated Depreciation 5-28,400 5-19,100 Total Long-Term Assets 5155.600 $154.900 Total Assets 5206,700 5188,700 Liabilities Current Liabilities $19,700 $19,700 Long-Term Liabilities 521,000 $43,000 Total Liabilities $40.700 $62,700 Shareholders' Equity Contributed Capital Preferred Shares $51,000 $51,000 Common Shares $28,000 $8.000 Total Contributed Capital 579,000 559,000 Retained Earnings $87,000 $67,000 Total Shareholders' Equity 5166,000 $126,000 Total Liabilities and Equity $206,700 5188,700 Assume current liabilities include only items from operations (e.g. accounts payable, taxes payable). Long-term liabilities include items from financing (e.g. bonds and other long-term liabilities). Note that the company did not sell any equipment and did not borrow any additional long-term liabilities throughout the year. Prepare the cash flow statement for 2020 using the indirect method. Assume no dividends were declared or paid in 2020. Do not ecrease in cash Planet Inc Cash Flow Statement For the Year Ended November 30, 2020 Cash Flow from Operations Net Income Adjustments to reconcile Net Income to Cash Depreciation Expense Change in Operating Assets and Liabilities Increase in Accounts Receivable Increase in Prepaid Expenses increase in Merchandise inventory Net Cash Provided (Used) by Operating Activities Cash Flow from Investing Activities Purchase of Equipment Net Cash Provided (Used) by investing Activities Cash Flow from Financing Activities Issuance of Common Shares Repayment of Long-Term Liabilities Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash Cash at the Beginning of the Year Cash at the End of the Yea