Answered step by step

Verified Expert Solution

Question

1 Approved Answer

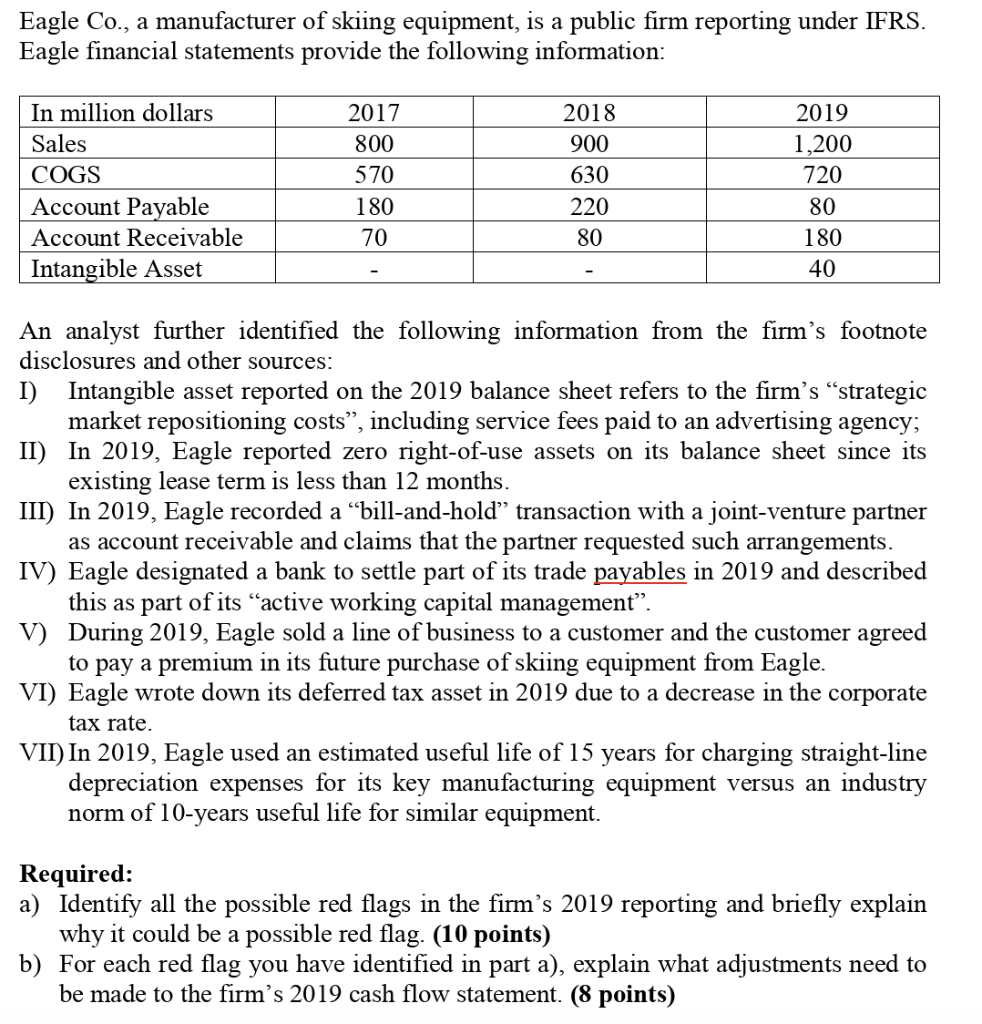

Q Eagle Co., a manufacturer of skiing equipment, is a public firm reporting under IFRS. Eagle financial statements provide the following information: In million dollars

Q

Eagle Co., a manufacturer of skiing equipment, is a public firm reporting under IFRS. Eagle financial statements provide the following information: In million dollars Sales COGS Account Payable Account Receivable Intangible Asset 2017 800 570 180 70 2018 900 630 220 80 2019 1,200 720 80 180 40 An analyst further identified the following information from the firm's footnote disclosures and other sources: I) Intangible asset reported on the 2019 balance sheet refers to the firm's strategic market repositioning costs, including service fees paid to an advertising agency; II) In 2019, Eagle reported zero right-of-use assets on its balance sheet since its existing lease term is less than 12 months. III) In 2019, Eagle recorded a bill-and-hold transaction with a joint-venture partner as account receivable and claims that the partner requested such arrangements. IV) Eagle designated a bank to settle part of its trade payables in 2019 and described this as part of its active working capital management. V) During 2019, Eagle sold a line of business to a customer and the customer agreed to pay a premium in its future purchase of skiing equipment from Eagle. VI) Eagle wrote down its deferred tax asset in 2019 due to a decrease in the corporate tax rate. VII) In 2019, Eagle used an estimated useful life of 15 years for charging straight-line depreciation expenses for its key manufacturing equipment versus an industry norm of 10-years useful life for similar equipment. Required: a) Identify all the possible red flags in the firm's 2019 reporting and briefly explain why it could be a possible red flag. (10 points) b) For each red flag you have identified in part a), explain what adjustments need to be made to the firm's 2019 cash flow statement. (8 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started