Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q. Jasmine Inc., a software vendor, delivers its product to a customer on Jan 30, 2001 pursuant to a licensing arrangement that permits the

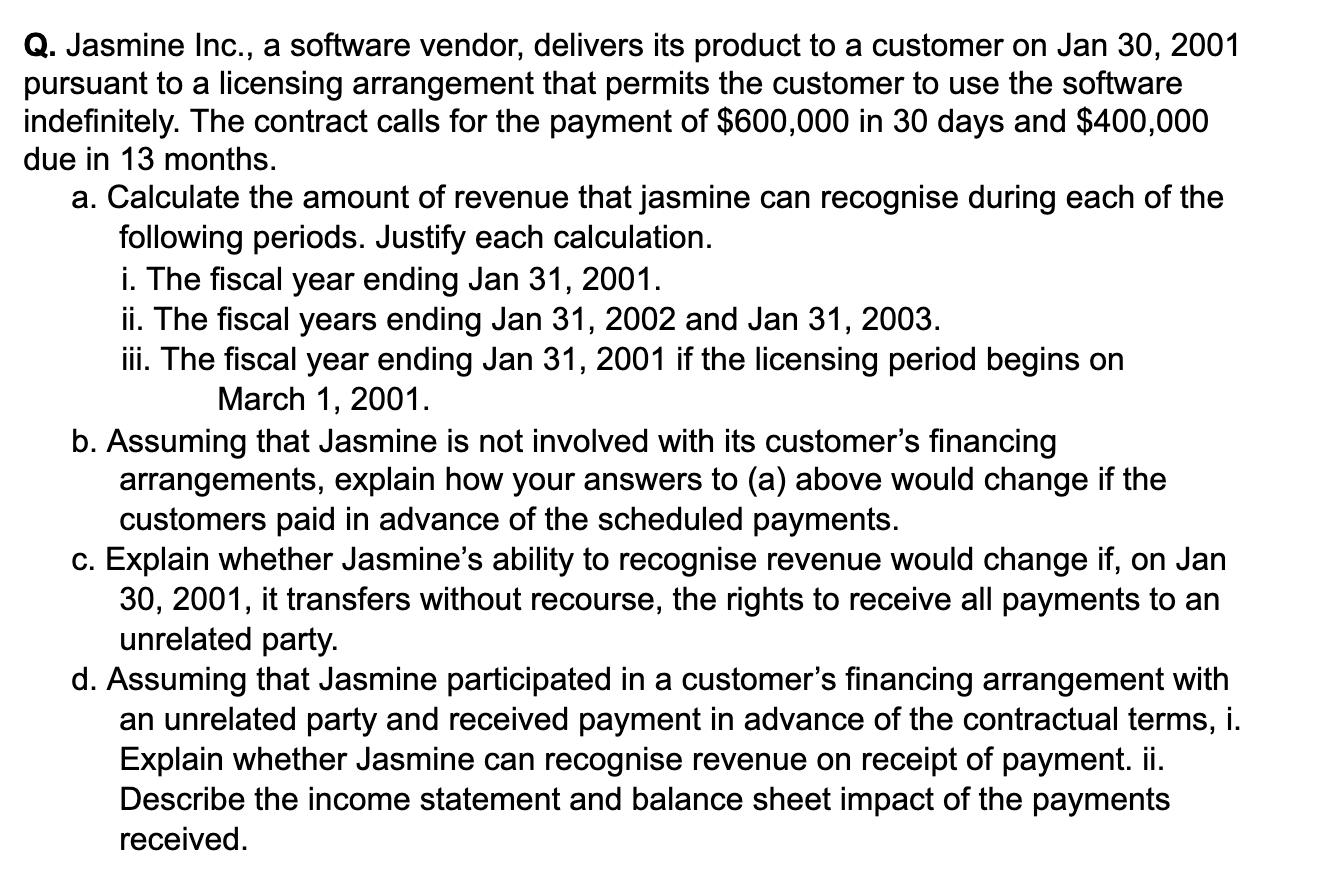

Q. Jasmine Inc., a software vendor, delivers its product to a customer on Jan 30, 2001 pursuant to a licensing arrangement that permits the customer to use the software indefinitely. The contract calls for the payment of $600,000 in 30 days and $400,000 due in 13 months. a. Calculate the amount of revenue that jasmine can recognise during each of the following periods. Justify each calculation. i. The fiscal year ending Jan 31, 2001. ii. The fiscal years ending Jan 31, 2002 and Jan 31, 2003. iii. The fiscal year ending Jan 31, 2001 if the licensing period begins on March 1, 2001. b. Assuming that Jasmine is not involved with its customer's financing arrangements, explain how your answers to (a) above would change if the customers paid in advance of the scheduled payments. c. Explain whether Jasmine's ability to recognise revenue would change if, on Jan 30, 2001, it transfers without recourse, the rights to receive all payments to an unrelated party. d. Assuming that Jasmine participated in a customer's financing arrangement with an unrelated party and received payment in advance of the contractual terms, i. Explain whether Jasmine can recognise revenue on receipt of payment. ii. Describe the income statement and balance sheet impact of the payments received.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In the present case the software is delivered to the client on Jan 30 2001 and the payment is expected to be received in two installments 1 600000 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started