Answered step by step

Verified Expert Solution

Question

1 Approved Answer

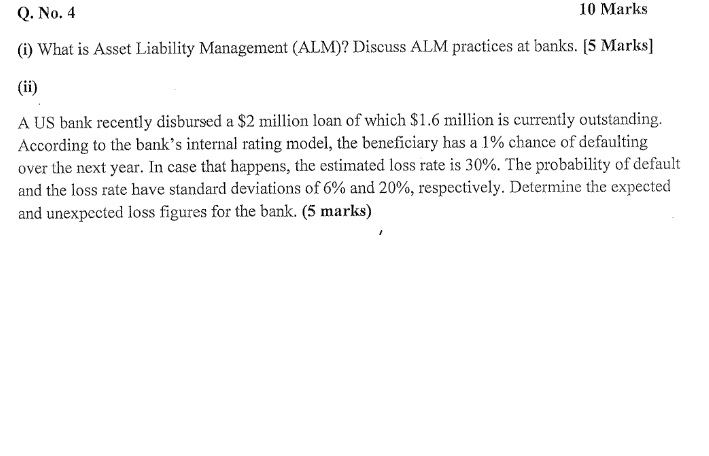

Q . No . 4 ( i ) What is Asset Liability Management ( ALM ) ? Discuss ALM practices at banks. ( ii )

Q No

i What is Asset Liability Management ALM Discuss ALM practices at banks.

ii

A US bank recently disbursed a $ million loan of which $ million is currently outstanding.

According to the bank's internal rating model, the beneficiary has a chance of defaulting

over the next year. In case that happens, the estimated loss rate is The probability of default

and the loss rate have standard deviations of and respectively. Determine the expected

and unexpected loss figures for the bank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started