Q*/*

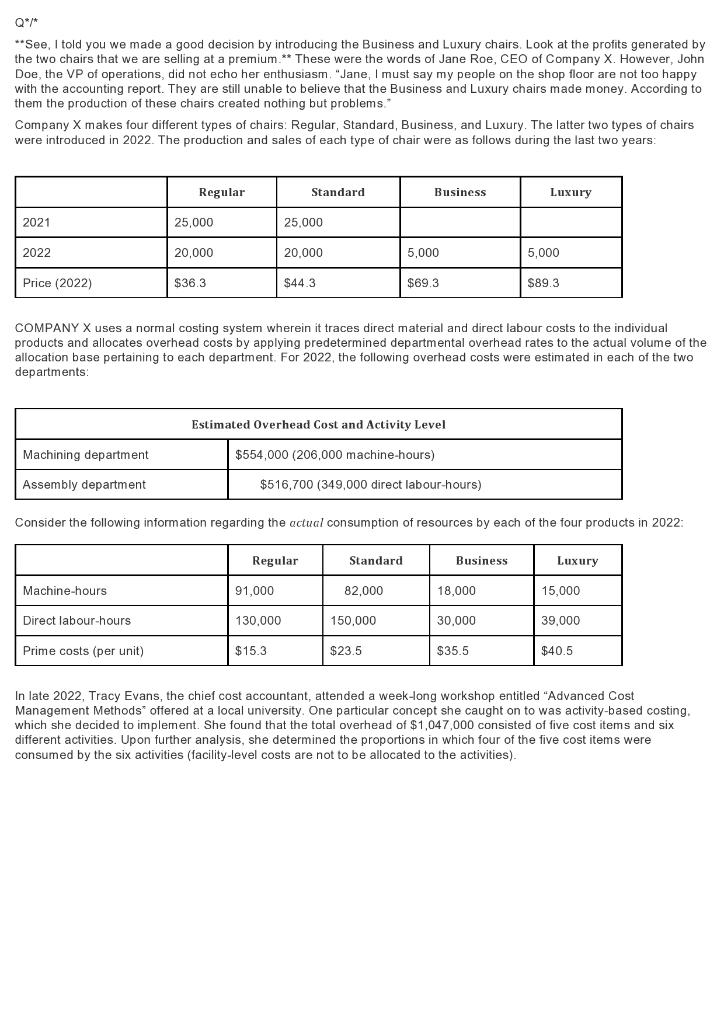

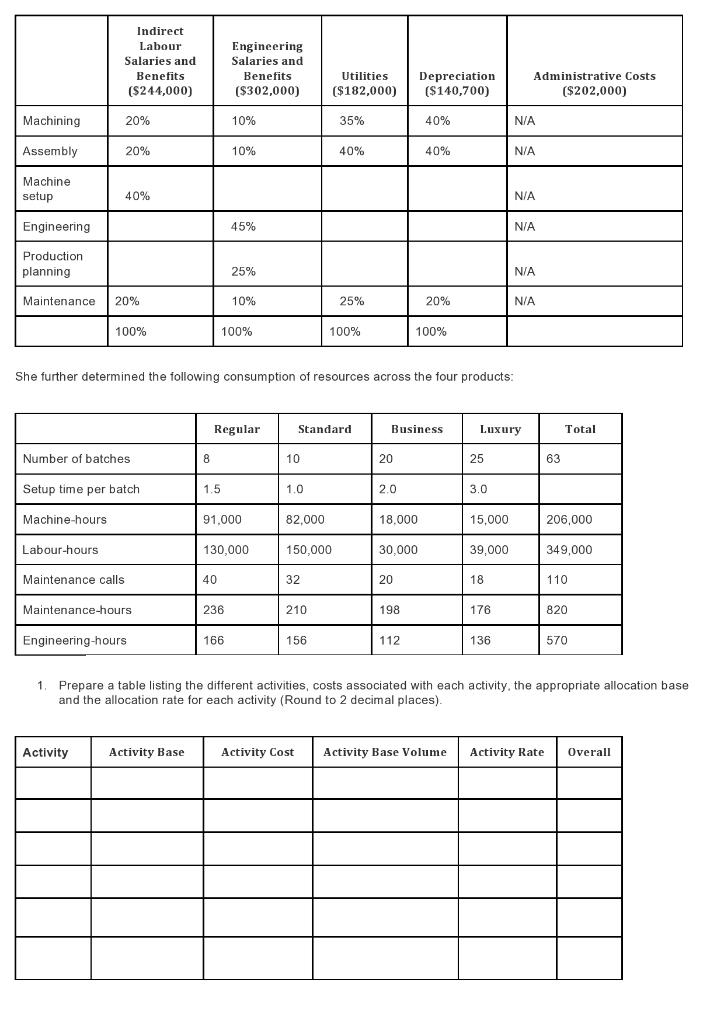

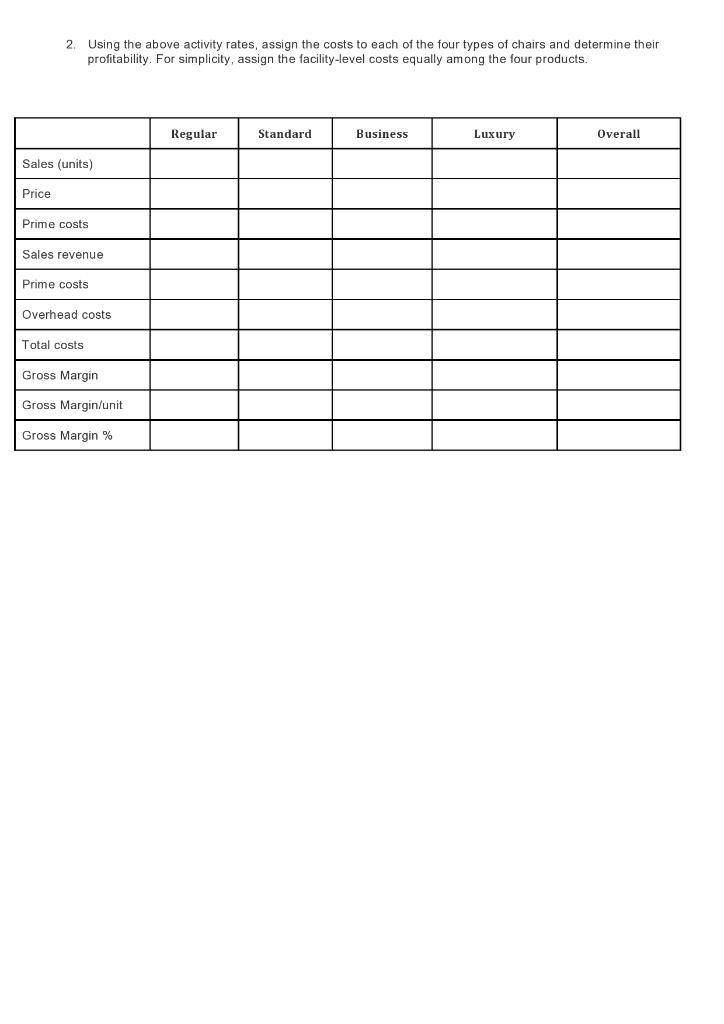

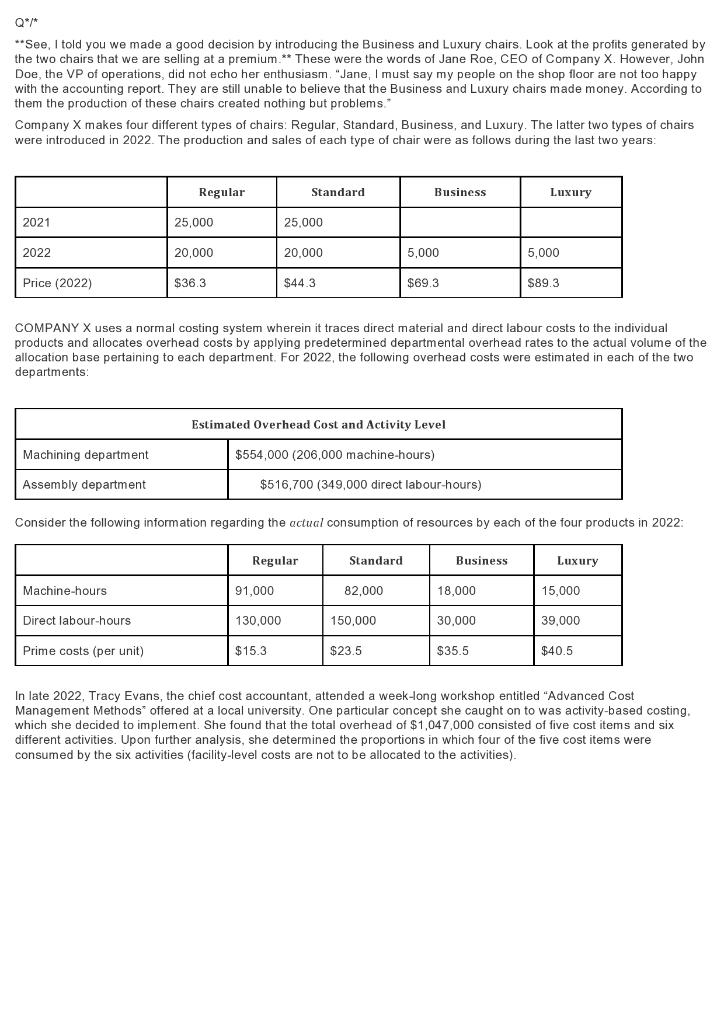

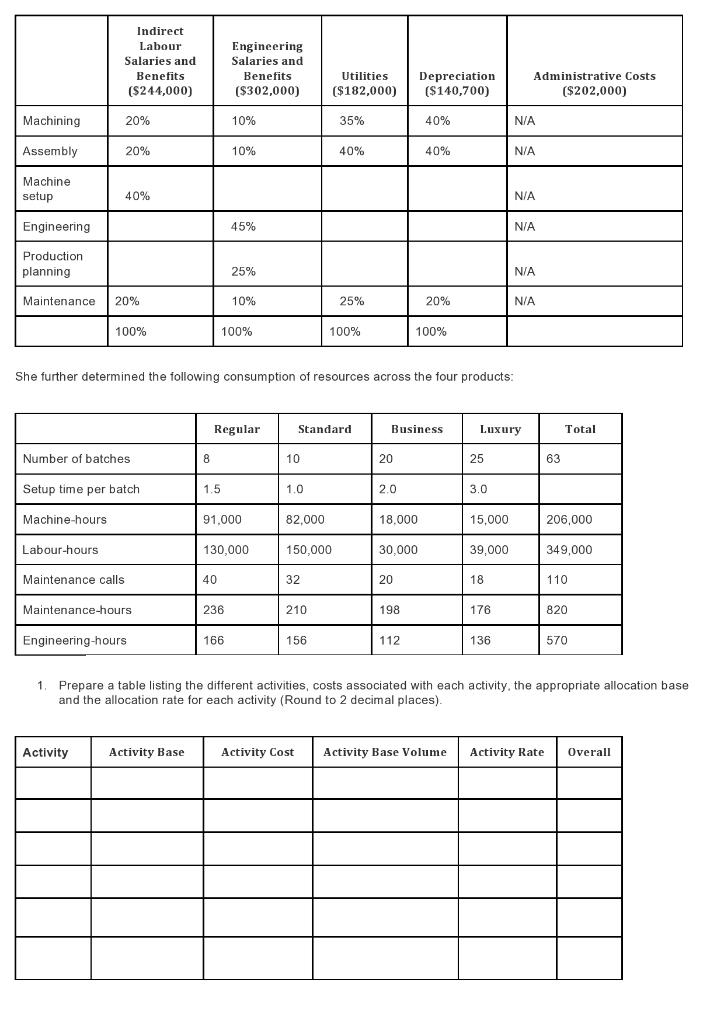

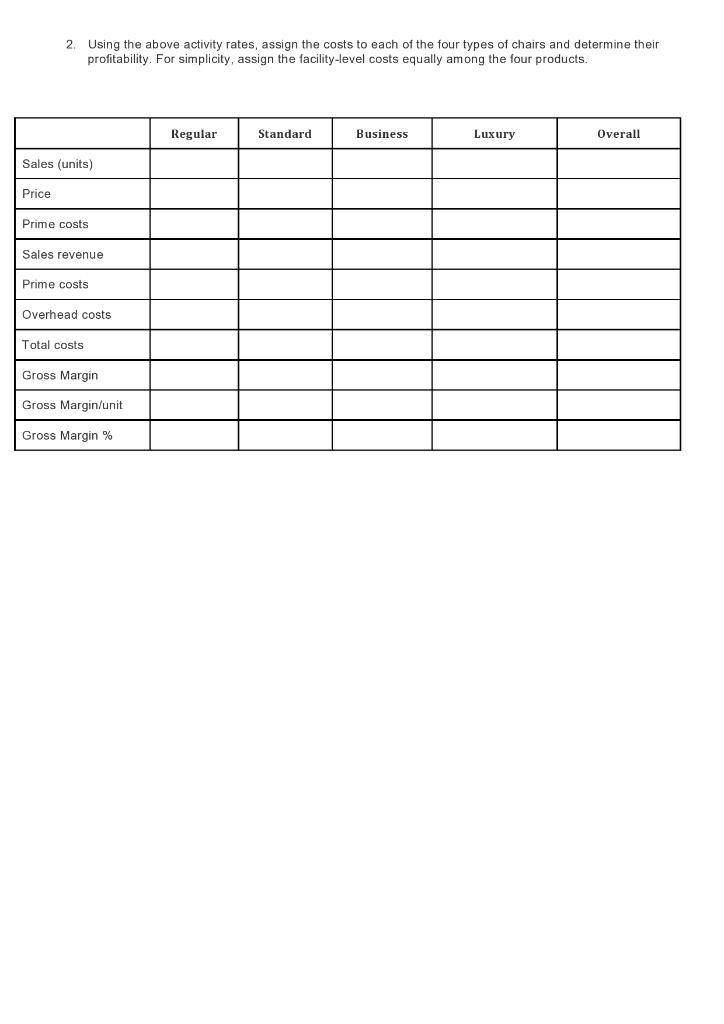

Q7 **See, I told you we made a good decision by introducing the Business and Luxury chairs. Look at the profits generated by the two chairs that we are selling at a premium.** These were the words of Jane Roe, CEO of Company X. However, John Doe, the VP of operations, did not echo her enthusiasm. "Jane, I must say my people on the shop floor are not too happy with the accounting report. They are still unable believe that the Business and Luxury chairs made money. According to them the production of these chairs created nothing but problems Company X makes four different types of chairs. Regular, Standard, Business, and Luxury. The latter two types of chairs were introduced in 2022. The production and sales of each type of chair were follows during the last two years: Regular Standard Business Luxury 2021 25,000 25,000 2022 20,000 20.000 5,000 5,000 Price (2022) $36.3 $44.3 $69.3 $89.3 COMPANY X uses normal costing system wherein it traces direct material and direct labour costs to the individual products and allocates overhead costs by applying predetermined departmental overhead rates to the actual volume of the allocation base pertaining to each department. For 2022, the following overhead costs were estimated in each of the two departments Estimated Overhead Cost and Activity Level Machining department $554,000 (206,000 machine-hours) Assembly department $516,700 (349,000 direct labour-hours) Consider the following information regarding the actual consumption of resources by each of the four products in 2022: Regular Standard Business Luxury Machine-hours 91,000 82,000 18,000 15,000 Direct labour-hours 130,000 150,000 30,000 39,000 Prime costs (per unit) $15.3 $23.5 $35.5 $40.5 In late 2022, Tracy Evans, the chief cost accountant, attended a week-long workshop entitled "Advanced Cost Management Methods offered at a local university. One particular concept she caught on to was activity-based costing, which she decided to implement. She found that the total overhead of $1,047,000 consisted of five cost items and six different activities. Upon further analysis, she determined the proportions in which four of the five cost items were consumed by the six activities (facility-level costs are not to be allocated to the activities). Indirect Labour Salaries and Benefits ($244,000) Engineering Salaries and Benefits ($302,000) Utilities ($182,000) Depreciation ($140,700) Administrative Costs ($202,000) Machining 20% 10% 35% 40% N/A Assembly 20% 10% 40% 40% N/A Machine setup 40% N/A Engineering 45% N/A Production planning 25% N/A Maintenance 20% 10% 25% 20% N/A 100% 100% 100% 100% She further determined the following consumption of resources across the four products: Regular Standard Business Luxury Total Number of batches 8 10 20 25 63 Setup time per batch 1.5 1.0 2.0 3.0 Machine-hours 91.000 82,000 18.000 15.000 206,000 Labour-hours - 130,000 150,000 30,000 39,000 349,000 Maintenance calls 40 32 20 18 110 Maintenance-hours 236 210 198 176 820 Engineering-hours 166 156 112 136 570 1. Prepare a table listing the different activities, costs associated with each activity, the appropriate allocation base and the allocation rate for each activity (Round to 2 decimal places). Activity Activity Base Activity Cost Activity Base Volume Activity Rate Overall 2. Using the above activity rates, assign the costs to each of the four types of chairs and determine their profitability. For simplicity, assign the facility-level costs equally among the four products. Regular Standard Business Luxury Overall Sales (units) Price Prime costs Sales revenue Prime costs Overhead costs Total costs Gross Margin Gross Margin/unit Gross Margin % Q7 **See, I told you we made a good decision by introducing the Business and Luxury chairs. Look at the profits generated by the two chairs that we are selling at a premium.** These were the words of Jane Roe, CEO of Company X. However, John Doe, the VP of operations, did not echo her enthusiasm. "Jane, I must say my people on the shop floor are not too happy with the accounting report. They are still unable believe that the Business and Luxury chairs made money. According to them the production of these chairs created nothing but problems Company X makes four different types of chairs. Regular, Standard, Business, and Luxury. The latter two types of chairs were introduced in 2022. The production and sales of each type of chair were follows during the last two years: Regular Standard Business Luxury 2021 25,000 25,000 2022 20,000 20.000 5,000 5,000 Price (2022) $36.3 $44.3 $69.3 $89.3 COMPANY X uses normal costing system wherein it traces direct material and direct labour costs to the individual products and allocates overhead costs by applying predetermined departmental overhead rates to the actual volume of the allocation base pertaining to each department. For 2022, the following overhead costs were estimated in each of the two departments Estimated Overhead Cost and Activity Level Machining department $554,000 (206,000 machine-hours) Assembly department $516,700 (349,000 direct labour-hours) Consider the following information regarding the actual consumption of resources by each of the four products in 2022: Regular Standard Business Luxury Machine-hours 91,000 82,000 18,000 15,000 Direct labour-hours 130,000 150,000 30,000 39,000 Prime costs (per unit) $15.3 $23.5 $35.5 $40.5 In late 2022, Tracy Evans, the chief cost accountant, attended a week-long workshop entitled "Advanced Cost Management Methods offered at a local university. One particular concept she caught on to was activity-based costing, which she decided to implement. She found that the total overhead of $1,047,000 consisted of five cost items and six different activities. Upon further analysis, she determined the proportions in which four of the five cost items were consumed by the six activities (facility-level costs are not to be allocated to the activities). Indirect Labour Salaries and Benefits ($244,000) Engineering Salaries and Benefits ($302,000) Utilities ($182,000) Depreciation ($140,700) Administrative Costs ($202,000) Machining 20% 10% 35% 40% N/A Assembly 20% 10% 40% 40% N/A Machine setup 40% N/A Engineering 45% N/A Production planning 25% N/A Maintenance 20% 10% 25% 20% N/A 100% 100% 100% 100% She further determined the following consumption of resources across the four products: Regular Standard Business Luxury Total Number of batches 8 10 20 25 63 Setup time per batch 1.5 1.0 2.0 3.0 Machine-hours 91.000 82,000 18.000 15.000 206,000 Labour-hours - 130,000 150,000 30,000 39,000 349,000 Maintenance calls 40 32 20 18 110 Maintenance-hours 236 210 198 176 820 Engineering-hours 166 156 112 136 570 1. Prepare a table listing the different activities, costs associated with each activity, the appropriate allocation base and the allocation rate for each activity (Round to 2 decimal places). Activity Activity Base Activity Cost Activity Base Volume Activity Rate Overall 2. Using the above activity rates, assign the costs to each of the four types of chairs and determine their profitability. For simplicity, assign the facility-level costs equally among the four products. Regular Standard Business Luxury Overall Sales (units) Price Prime costs Sales revenue Prime costs Overhead costs Total costs Gross Margin Gross Margin/unit Gross Margin %