Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q: Regarding Chapter 28, compare and contrast Chapters 7, 11, 13, and 12 bankruptcies, including in your answer an analysis of the workings of each.

Q: Regarding Chapter 28, compare and contrast Chapters 7, 11, 13, and 12 bankruptcies, including in your answer an analysis of the workings of each. Look at the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) and explain its goals. Do you think BAPCPA has been successful in accomplishing its stated purpose?

Q: Regarding Chapter 28, compare and contrast Chapters 7, 11, 13, and 12 bankruptcies, including in your answer an analysis of the workings of each. Look at the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) and explain its goals. Do you think BAPCPA has been successful in accomplishing its stated purpose?

The book is "Business Law" (Edition 10) by Cheeseman

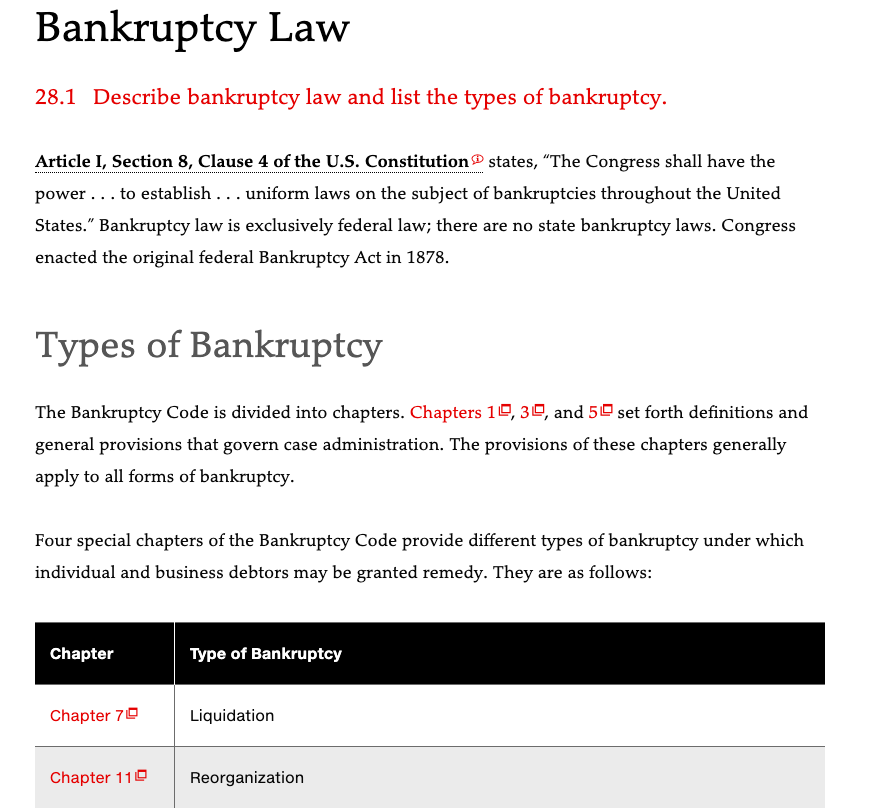

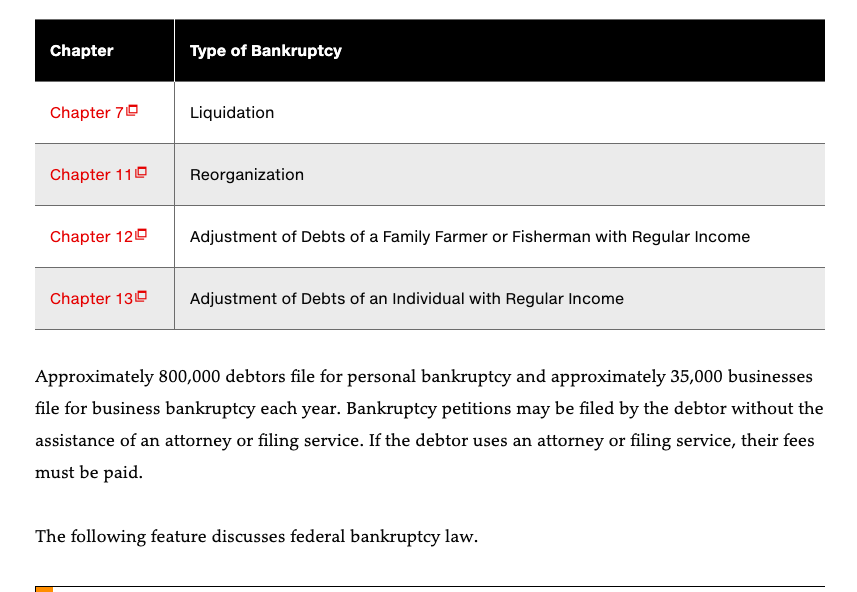

Bankruptcy Law 28.1 Describe bankruptcy law and list the types of bankruptcy. Article 1, Section 8, Clause 4 of the U.S. Constitution states, The Congress shall have the power ... to establish ... uniform laws on the subject of bankruptcies throughout the United States." Bankruptcy law is exclusively federal law; there are no state bankruptcy laws. Congress enacted the original federal Bankruptcy Act in 1878. Types of Bankruptcy The Bankruptcy Code is divided into chapters. Chapters 10,30, and 50 set forth definitions and general provisions that govern case administration. The provisions of these chapters generally apply to all forms of bankruptcy. Four special chapters of the Bankruptcy Code provide different types of bankruptcy under which individual and business debtors may be granted remedy. They are as follows: Chapter Type of Bankruptcy Chapter 70 Liquidation Chapter 110 Reorganization Chapter Type of Bankruptcy Chapter 70 Liquidation Chapter 110 Reorganization Chapter 120 Adjustment of Debts of a Family Farmer or Fisherman with Regular Income Chapter 130 Adjustment of Debts of an Individual with Regular Income Approximately 800,000 debtors file for personal bankruptcy and approximately 35,000 businesses file for business bankruptcy each year. Bankruptcy petitions may be filed by the debtor without the assistance of an attorney or filing service. If the debtor uses an attorney or filing service, their fees must be paid. The following feature discusses federal bankruptcy law. Landmark Law Bankruptcy Code Over the years, Congress has adopted various bankruptcy laws. Federal bankruptcy law was completely revised by the Bankruptcy Reform Act of 19780.1 The 1978 act made it easier for debtors to rid themselves of unsecured debt, primarily by filing for Chapter 7 liquidation bankruptcy. Subsequently, credit card companies, commercial banks, and other businesses lobbied Congress to pass a new bankruptcy act that would reduce the ability of some debtors to relieve themselves of unwanted debt through bankruptcy. In response, Congress enacted the Bankruptcy Abuse Prevention and Consumer Protection Act of 20050.20 The 2005 act substantially amended federal bankruptcy law, making it much more difficult for debtors to escape unwanted debt through bankruptcy. Federal bankruptcy law, as amended, is called the Bankruptcy Code, which is contained in Title 11 of the U.S. Code. The Bankruptcy Code establishes procedures for filing for bankruptcy, resolving creditors' claims, and protecting debtors' rightsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started