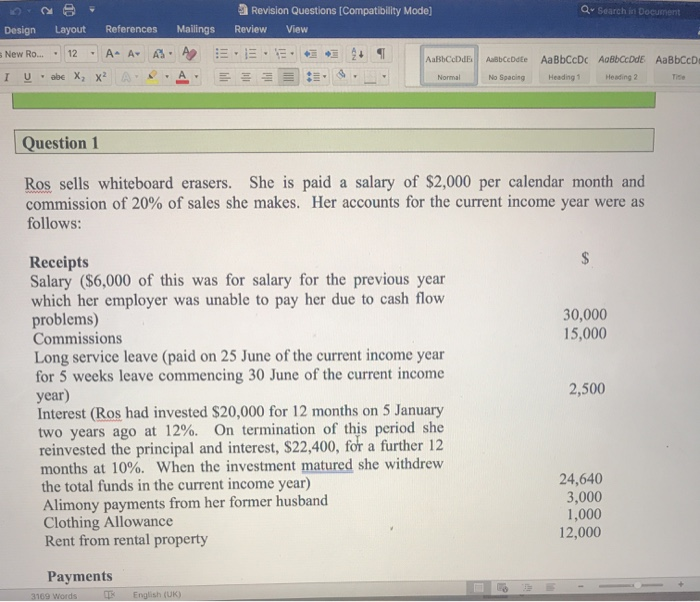

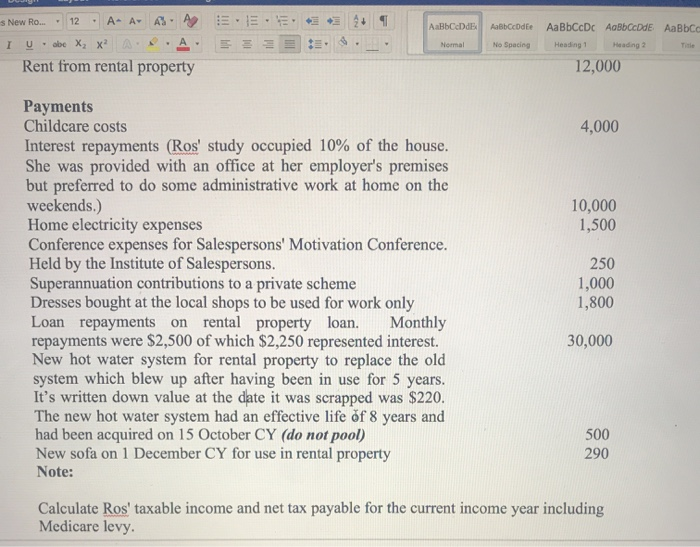

Q- Search in Document Design Layout References New Ro... 12 . A- A A IV.abe X, X A A a Revision Questions [Compatibility Mode] Mailings Review View A E.E.. + AaBbcd E = = = Ausbccdte No Spacing AaBbCcDc AoBbCcDdE AaBbcc Heading 1 Heading 2 T. Question 1 Ros sells whiteboard erasers. She is paid a salary of $2,000 per calendar month and commission of 20% of sales she makes. Her accounts for the current income year were as follows: 30,000 15,000 2,500 Receipts Salary ($6,000 of this was for salary for the previous year which her employer was unable to pay her due to cash flow problems) Commissions Long service leave (paid on 25 June of the current income year for 5 weeks leave commencing 30 June of the current income year) Interest (Ros had invested $20,000 for 12 months on 5 January two years ago at 12%. On termination of this period she reinvested the principal and interest, $22,400, for a further 12 months at 10%. When the investment matured she withdrew the total funds in the current income year) Alimony payments from her former husband Clothing Allowance Rent from rental property 24,640 3,000 1,000 12,000 Payments 3169 Words English (UK) AaBbCdDdE s New Ro.. . 12 - A- A A A IU.abe Xz x A A Rent from rental property . E . 3 3 + 1 EEEEE: $._. Normal AaBbcode AaBbCcDc AaBbcode AaBbcc No Spacing Heading 1 Heading 2 12,000 4,000 10,000 1,500 Payments Childcare costs Interest repayments (Ros' study occupied 10% of the house. She was provided with an office at her employer's premises but preferred to do some administrative work at home on the weekends.) Home electricity expenses Conference expenses for Salespersons' Motivation Conference. Held by the Institute of Salespersons. Superannuation contributions to a private scheme Dresses bought at the local shops to be used for work only Loan repayments on rental property loan. Monthly repayments were $2,500 of which $2,250 represented interest. New hot water system for rental property to replace the old system which blew up after having been in use for 5 years. It's written down value at the date it was scrapped was $220. The new hot water system had an effective life of 8 years and had been acquired on 15 October CY (do not pool) New sofa on 1 December CY for use in rental property Note: 250 1,000 1,800 30,000 500 290 Calculate Ros' taxable income and net tax payable for the current income year including Medicare levy. Q- Search in Document Design Layout References New Ro... 12 . A- A A IV.abe X, X A A a Revision Questions [Compatibility Mode] Mailings Review View A E.E.. + AaBbcd E = = = Ausbccdte No Spacing AaBbCcDc AoBbCcDdE AaBbcc Heading 1 Heading 2 T. Question 1 Ros sells whiteboard erasers. She is paid a salary of $2,000 per calendar month and commission of 20% of sales she makes. Her accounts for the current income year were as follows: 30,000 15,000 2,500 Receipts Salary ($6,000 of this was for salary for the previous year which her employer was unable to pay her due to cash flow problems) Commissions Long service leave (paid on 25 June of the current income year for 5 weeks leave commencing 30 June of the current income year) Interest (Ros had invested $20,000 for 12 months on 5 January two years ago at 12%. On termination of this period she reinvested the principal and interest, $22,400, for a further 12 months at 10%. When the investment matured she withdrew the total funds in the current income year) Alimony payments from her former husband Clothing Allowance Rent from rental property 24,640 3,000 1,000 12,000 Payments 3169 Words English (UK) AaBbCdDdE s New Ro.. . 12 - A- A A A IU.abe Xz x A A Rent from rental property . E . 3 3 + 1 EEEEE: $._. Normal AaBbcode AaBbCcDc AaBbcode AaBbcc No Spacing Heading 1 Heading 2 12,000 4,000 10,000 1,500 Payments Childcare costs Interest repayments (Ros' study occupied 10% of the house. She was provided with an office at her employer's premises but preferred to do some administrative work at home on the weekends.) Home electricity expenses Conference expenses for Salespersons' Motivation Conference. Held by the Institute of Salespersons. Superannuation contributions to a private scheme Dresses bought at the local shops to be used for work only Loan repayments on rental property loan. Monthly repayments were $2,500 of which $2,250 represented interest. New hot water system for rental property to replace the old system which blew up after having been in use for 5 years. It's written down value at the date it was scrapped was $220. The new hot water system had an effective life of 8 years and had been acquired on 15 October CY (do not pool) New sofa on 1 December CY for use in rental property Note: 250 1,000 1,800 30,000 500 290 Calculate Ros' taxable income and net tax payable for the current income year including Medicare levy