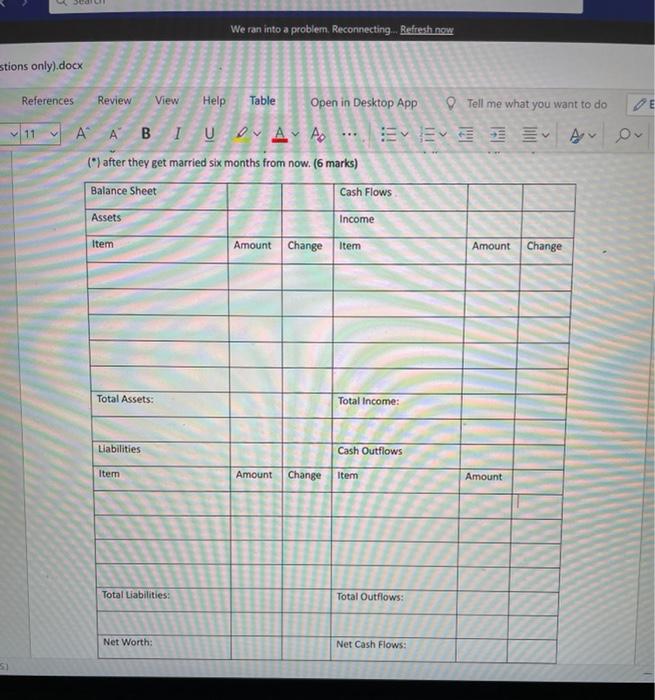

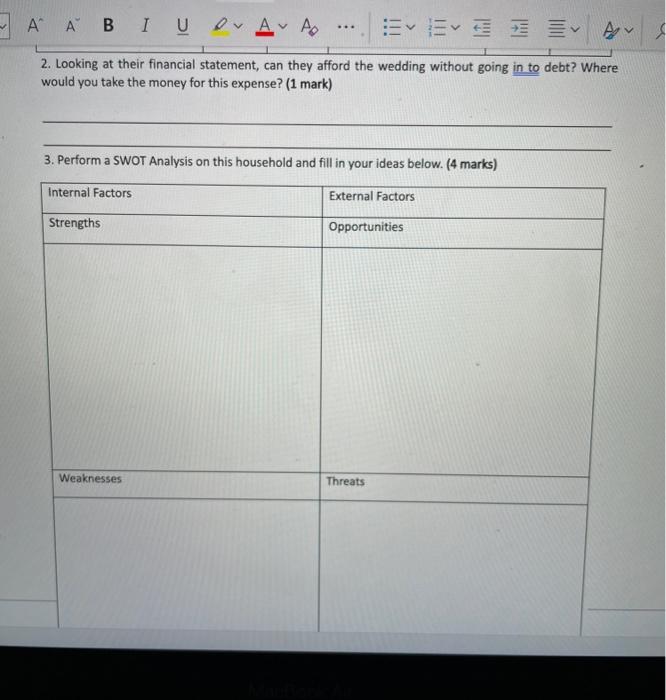

Q Search We ran into a problem. Reconnecting Refresh now s only).docx References Review View Help Table Open in Desktop App Tell me what you want to do 11 " A B I UDAYA 0 Emerson and Nevada are getting married. They have both sat down and written out a basic picture of their financial situation Emerson lives in an apartment with two roommates. They split their utilities ($150) and rent ($1,400) equally. He buys about $60 a week in groceries and eats out a lot ($120 per week). He has a brand-new car (valued at $18,000, with loan balance of $21,500, monthly payments of $415, maintenance and gas of $95; Insurance of $189) and a small boat (valued at $500). He spends about $50 a month on clothes, $100 per month on entertainment, and $200 per month on going out. He works full-time as a manager and makes around $2,605 per month after taxes. He has a poker habit, but limits himself to $50 per month. His phone costs $80 per month. He has $1,300 in savings and $800 in his checking account. His student loans amount to $35,000, with a monthly payment of $277. He has a credit card with $500 outstanding and a $25 minimum payment each month. Nevada lives with her parents. She is finishing school and is looking to get a job at a museum. She has a part-time job as an antique appraiser (10 hours per week at about $30 per hour after taxes). She does not buy groceries but anticipates that they will run $85 per week. She eats out occasionally ($30 per week). With her part-time work she has managed to pay off her truck. It is worth $2,300; gas and maintenance cost $200 per month due to work travel. She has amassed a sizeable coin collection that is valued at $4,600. She spends about $100 per month on clothes, $20 per week on entertainment, $30 per week on books, and gives about $200 per month to charity. She also has a checking account with $500 in it on average, a savings account with $3,000 in it, and $5,600 inwested in a bond mutual fund. Her mutual fund investments pay her $48 per month on average. They are planning to have a small wedding and have budgeted to spend $9,000. Their parents have offered to pay 50% of what they spend on the wedding. After the wedding. Emerson and Nevada plan to live in their own place that they have picked out. It costs $900, and utilities will run about $150. 1. Fill out Emerson and Nevada's combined personal financial statement in the space shown below. The average month has 4.34 weeks in it (365 days per year/12 months per year/7 days per month). In the change column write down whether you think each item will increase (+), decrease (-). or stay the same (") after they get married six months from now. (6 marks) Balance Sheet Cash Flows We ran into a problern. Reconnecting Refresh now stions only).docx Help Tell me what you want to do References Review View Table Open in Desktop App 11 AA BI U OVA A ... (*) after they get married six months from now. (6 marks) Balance Sheet Cash Flows Assets Income Item Amount Change Item Amount Change Total Assets: Total Income: Liabilities Cash Outflows Item Amount Change Item Amount Total Liabilities: Total Outflows: Net Worth: Net Cash Flows: 5 ' ' 2. Looking at their financial statement, can they afford the wedding without going in to debt? Where would you take the money for this expense? (1 mark) 3. Perform a SWOT Analysis on this household and fill in your ideas below. (4 marks) Internal factors External Factors Strengths Opportunities Weaknesses Threats 4. What advice would you give this household? (2 marks) 5. Suppose that the average cost of a child is around $13,000, how long do you think it will take for them to afford this expense? How many children do you think they could easily support? (2 marks) Q Search We ran into a problem. Reconnecting Refresh now s only).docx References Review View Help Table Open in Desktop App Tell me what you want to do 11 " A B I UDAYA 0 Emerson and Nevada are getting married. They have both sat down and written out a basic picture of their financial situation Emerson lives in an apartment with two roommates. They split their utilities ($150) and rent ($1,400) equally. He buys about $60 a week in groceries and eats out a lot ($120 per week). He has a brand-new car (valued at $18,000, with loan balance of $21,500, monthly payments of $415, maintenance and gas of $95; Insurance of $189) and a small boat (valued at $500). He spends about $50 a month on clothes, $100 per month on entertainment, and $200 per month on going out. He works full-time as a manager and makes around $2,605 per month after taxes. He has a poker habit, but limits himself to $50 per month. His phone costs $80 per month. He has $1,300 in savings and $800 in his checking account. His student loans amount to $35,000, with a monthly payment of $277. He has a credit card with $500 outstanding and a $25 minimum payment each month. Nevada lives with her parents. She is finishing school and is looking to get a job at a museum. She has a part-time job as an antique appraiser (10 hours per week at about $30 per hour after taxes). She does not buy groceries but anticipates that they will run $85 per week. She eats out occasionally ($30 per week). With her part-time work she has managed to pay off her truck. It is worth $2,300; gas and maintenance cost $200 per month due to work travel. She has amassed a sizeable coin collection that is valued at $4,600. She spends about $100 per month on clothes, $20 per week on entertainment, $30 per week on books, and gives about $200 per month to charity. She also has a checking account with $500 in it on average, a savings account with $3,000 in it, and $5,600 inwested in a bond mutual fund. Her mutual fund investments pay her $48 per month on average. They are planning to have a small wedding and have budgeted to spend $9,000. Their parents have offered to pay 50% of what they spend on the wedding. After the wedding. Emerson and Nevada plan to live in their own place that they have picked out. It costs $900, and utilities will run about $150. 1. Fill out Emerson and Nevada's combined personal financial statement in the space shown below. The average month has 4.34 weeks in it (365 days per year/12 months per year/7 days per month). In the change column write down whether you think each item will increase (+), decrease (-). or stay the same (") after they get married six months from now. (6 marks) Balance Sheet Cash Flows We ran into a problern. Reconnecting Refresh now stions only).docx Help Tell me what you want to do References Review View Table Open in Desktop App 11 AA BI U OVA A ... (*) after they get married six months from now. (6 marks) Balance Sheet Cash Flows Assets Income Item Amount Change Item Amount Change Total Assets: Total Income: Liabilities Cash Outflows Item Amount Change Item Amount Total Liabilities: Total Outflows: Net Worth: Net Cash Flows: 5 ' ' 2. Looking at their financial statement, can they afford the wedding without going in to debt? Where would you take the money for this expense? (1 mark) 3. Perform a SWOT Analysis on this household and fill in your ideas below. (4 marks) Internal factors External Factors Strengths Opportunities Weaknesses Threats 4. What advice would you give this household? (2 marks) 5. Suppose that the average cost of a child is around $13,000, how long do you think it will take for them to afford this expense? How many children do you think they could easily support? (2 marks)