Q. Were there other elements of customer value beyond a better

product and lower pricing? Who was the right customer for Exterior Inc., and what would

satisfy the needs of the target segment?

Q. Identify Exterior Inc.'s total addressable

market, target segment, and non-target segment.

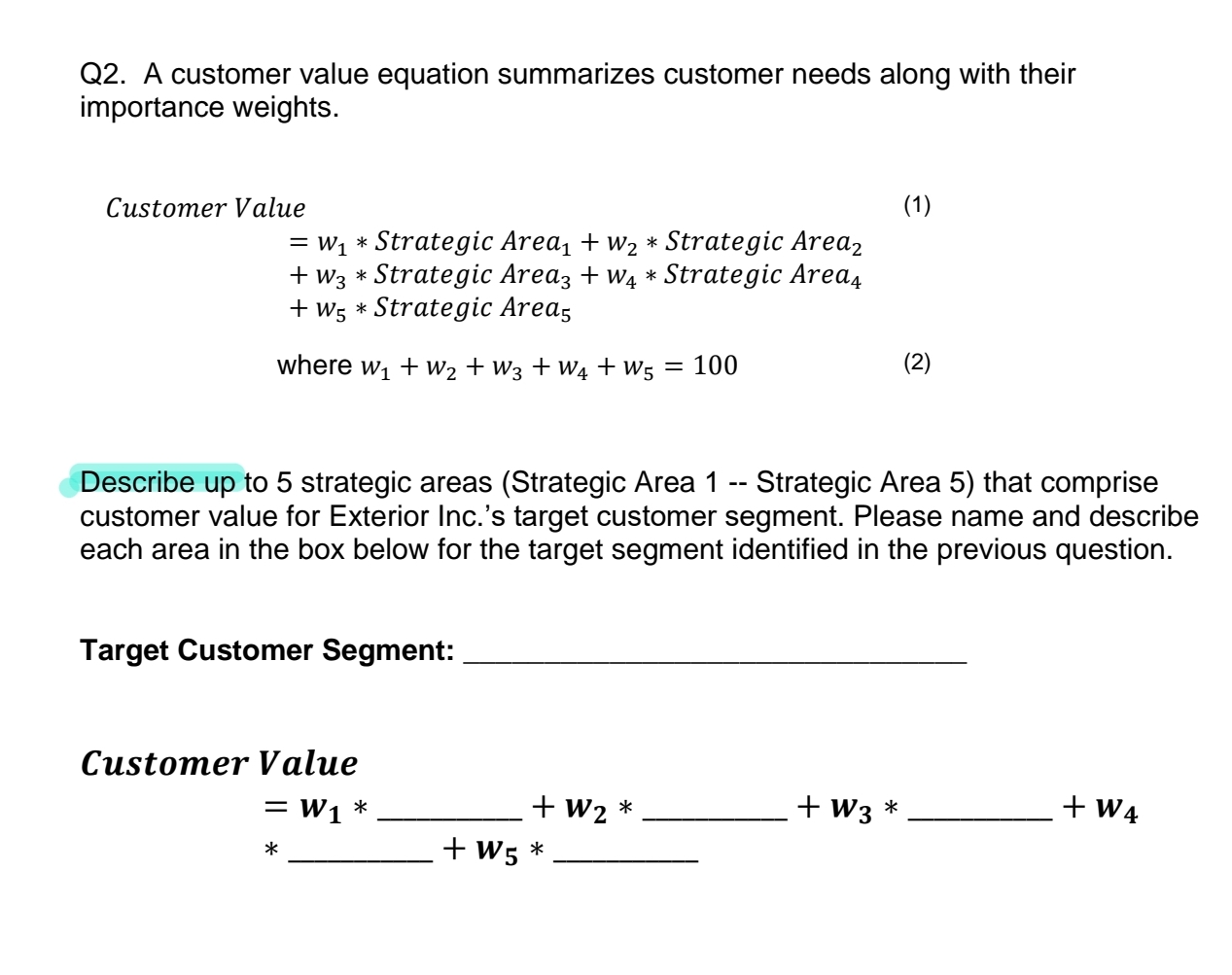

Q.Describe up to 5 strategic areas (Strategic Area 1 -- Strategic Area 5) that comprise

customer value for Exterior Inc.'s target customer segment. Please name and describe

each area in the box below for the target segment identified in the previous question.

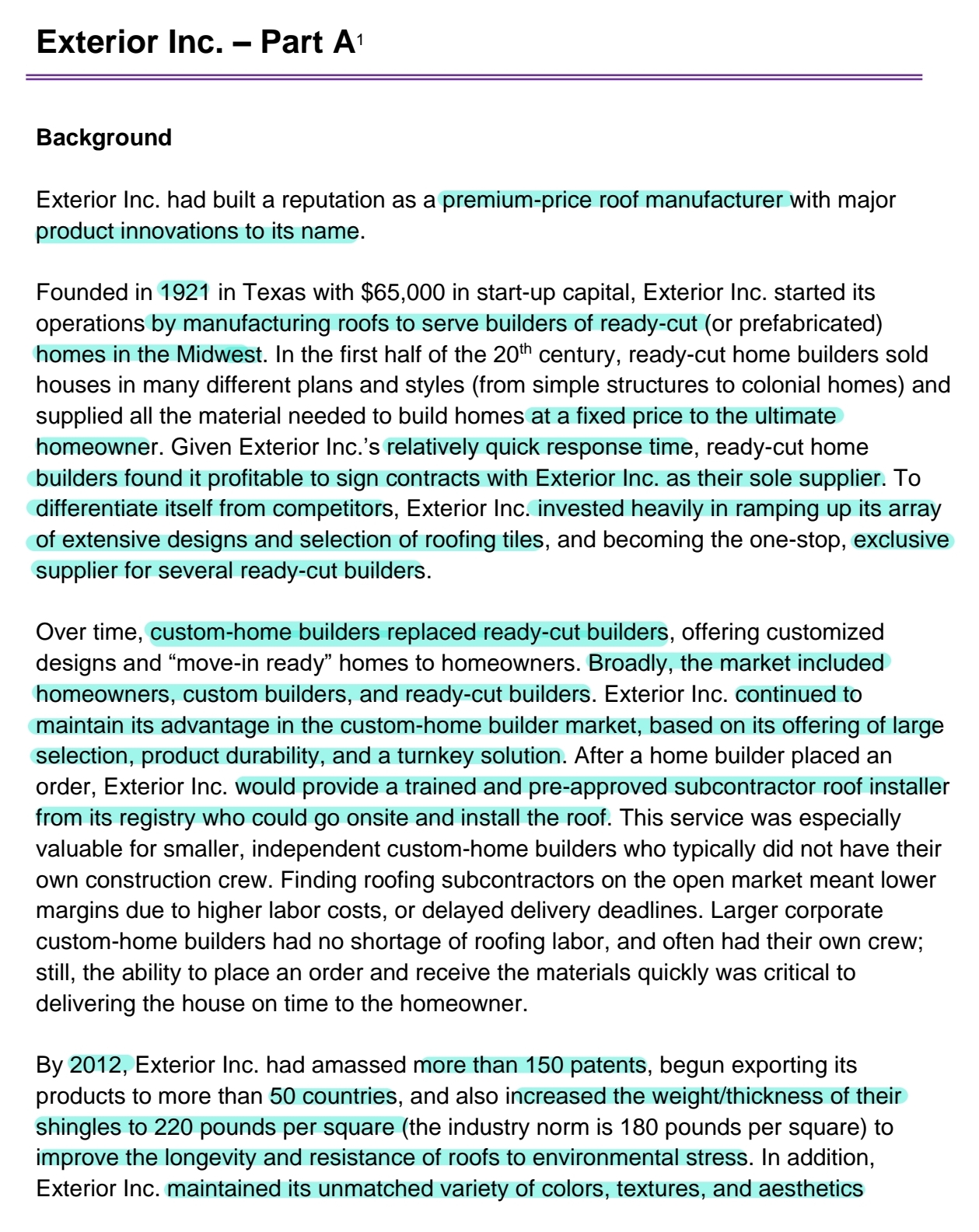

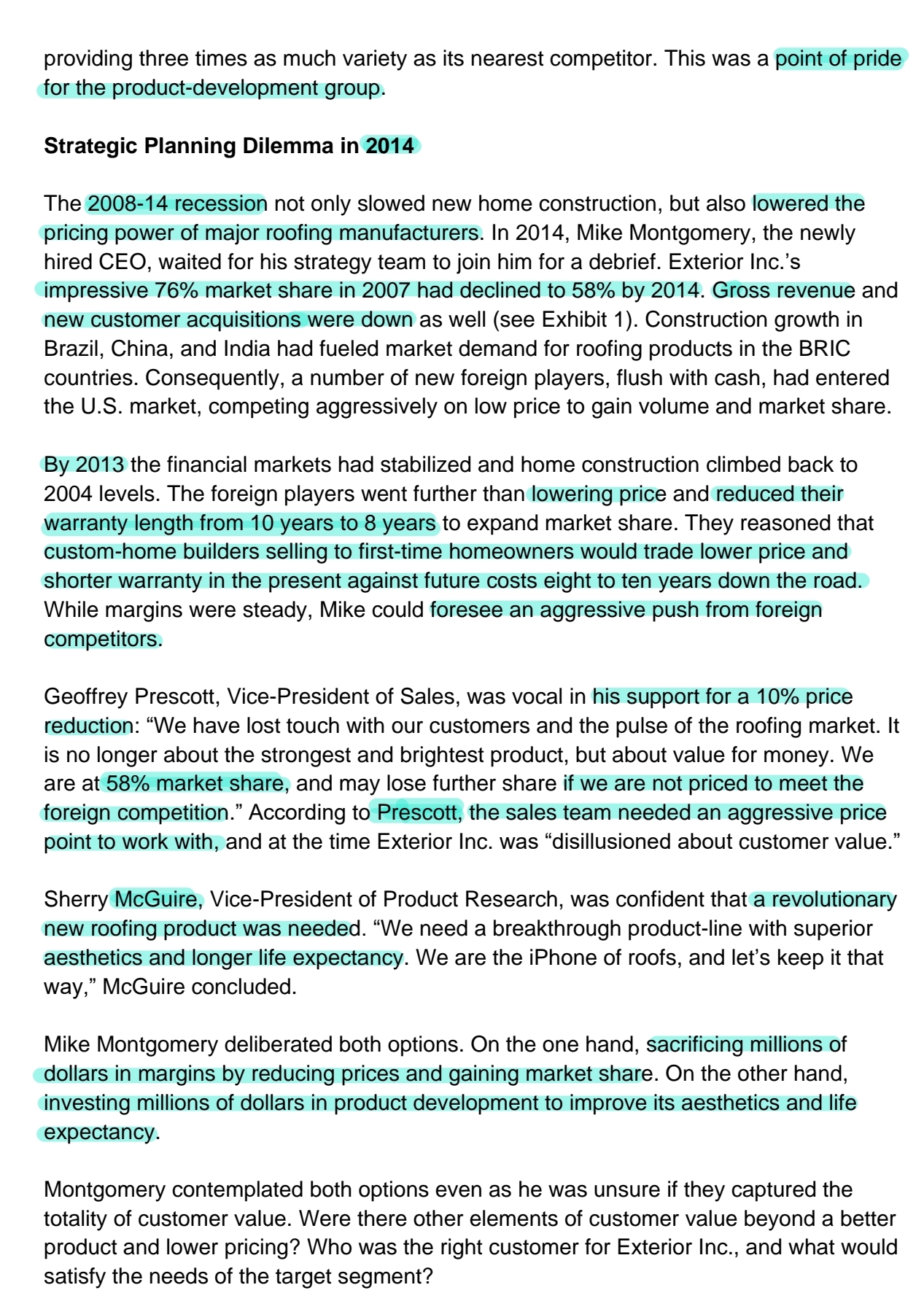

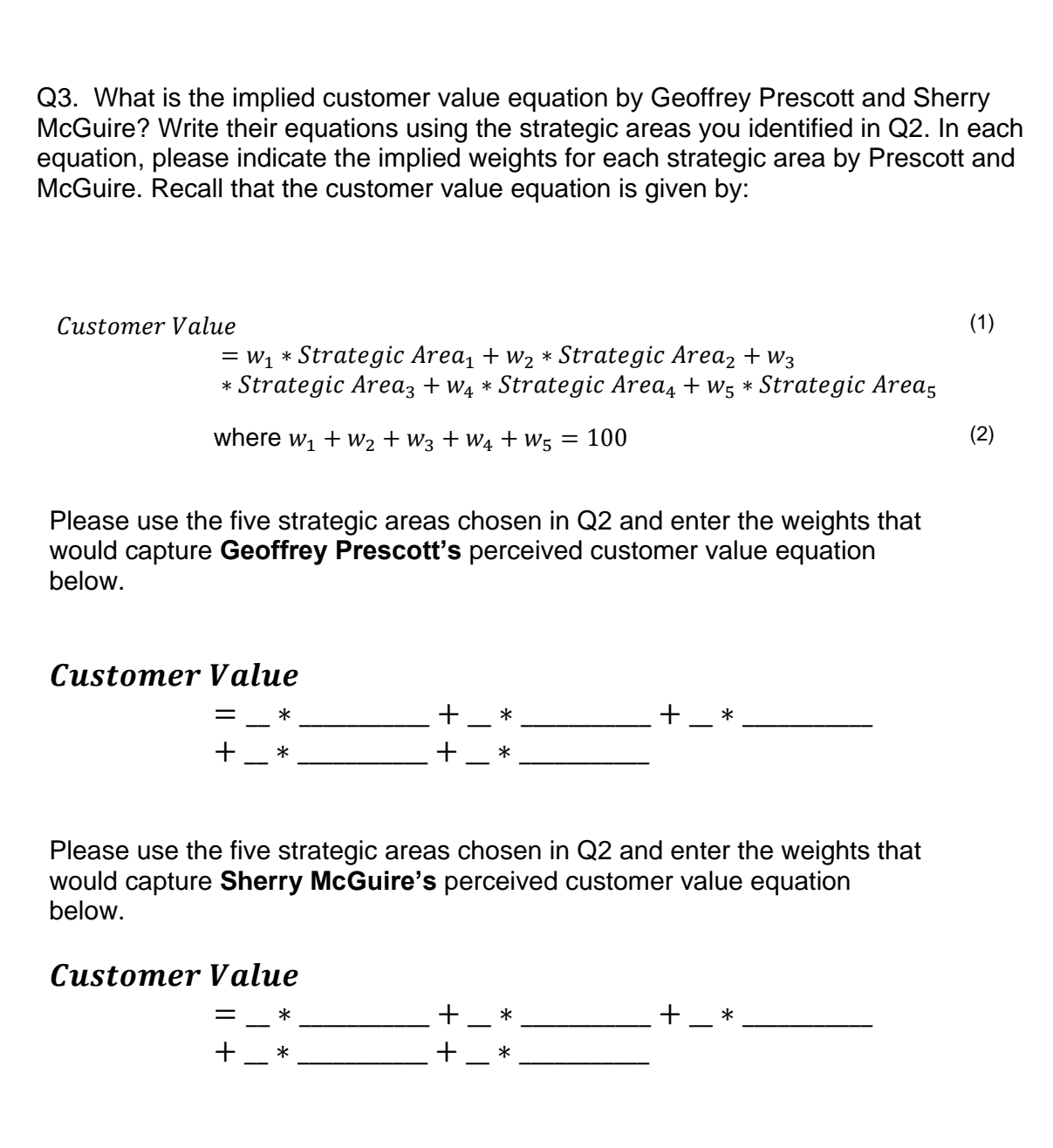

Exterior Inc. - Part A1 Background Exterior Inc. had built a reputation as a premiumprice roof manufacturer with major product innovations to its name. Founded in 1921 in Texas with $65,000 in start-up capital, Exterior Inc. started its operations by manufacturing roofs to serve builders of ready-cut (or prefabricated) homes in the Midwest. In the first half of the 20lh century, ready-cut home builders sold houses in many different plans and styles (from simple structures to colonial homes) and supplied all the material needed to build homes at a fixed price to the ultimate homeowner. Given Exterior |nc.'s relatively quick response time, ready-cut home builders found it profitable to sign contracts with Exterior Inc. as their sole supplier. To differentiate itself from competitors, Exterior Inc. invested heavily in ramping up its array of extensive designs and selection of roofing tiles, and becoming the one-stop, exclusive supplier for several ready-cut builders. Over time, custom-home builders replaced ready-cut builders, offering customized designs and \"move-in ready" homes to homeowners. Broadly, the market included homeowners, custom builders, and ready-cut builders. Exterior Inc. continued to maintain its advantage in the custom-home builder market, based on its offering of large selection, product durability, and a turnkey solution. After a home builder placed an order, Exterior Inc. would provide a trained and pre-approved subcontractor roof installer from its registry who could go onsite and install the roof. This service was especially valuable for smaller, independent custom-home builders who typically did not have their own construction crew. Finding roofing subcontractors on the open market meant lower margins due to higher labor costs, or delayed delivery deadlines. Larger corporate custom-home builders had no shortage of roofing labor, and often had their own crew; still, the ability to place an order and receive the materials quickly was critical to delivering the house on time to the homeowner. By 2012, Exterior Inc. had amassed more than 150 patents, begun exporting its products to more than 50 countries, and also increased the weight/thickness of their shingles to 220 pounds per square (the industry norm is 180 pounds per square) to improve the longevity and resistance of roofs to environmental stress. In addition, Exterior Inc. maintained its unmatched variety of colors, textures, and aesthetics providing three times as much variety as its nearest competitor. This was a point of pride for the product-development group. Strategic Planning Dilemma in 2014 The 2008-14 recession not only slowed new home construction, but also lowered the pricing power of major roofing manufacturers. In 2014, Mike Montgomery, the newly hired CEO, waited for his strategy team to join him for a debrief. Exterior |nc.'s impressive 76% market share in 2007 had declined to 58% by 2014. Gross revenue and new customer acquisitions were down as well (see Exhibit 1). Construction growth in Brazil, China, and India had fueled market demand for roofing products in the BRIC countries. Consequently, a number of new foreign players, flush with cash, had entered the U.S. market, competing aggressively on low price to gain volume and market share. By 2013 the financial markets had stabilized and home construction climbed back to 2004 levels. The foreign players went further than lowering price and reduced their warranty length from 10 years to 8 years to expand market share. They reasoned that custom-home builders selling to first-time homeowners would trade lower price and shorter warranty in the present against future costs eight to ten years down the road. While margins were steady, Mike could foresee an aggressive push from foreign competitors. Geoffrey Prescott, Vice-President of Sales, was vocal in his support for a 10% price reduction: \"We have lost touch with our customers and the pulse of the roofing market. It is no longer about the strongest and brightest product, but about value for money. We are at 58% market share, and may lose further share it we are not priced to meet the foreign competition." According to Prescott, the sales team needed an aggressive price point to work with, and at the time Exterior Inc. was "disillusioned about customer value." Sherry McGuire, Vice-President of Product Research, was confident that a revolutionary new roofing product was needed. "We need a breakthrough product-line with superior aesthetics and longer life expectancy. We are the iPhone of roofs, and let's keep it that way," McGuire concluded. Mike Montgomery deliberated both options. On the one hand, sacrificing millions of dollars in margins by reducing prices and gaining market share. On the other hand, investing millions of dollars in product development to improve its aesthetics and life expectancy. Montgomery contemplated both options even as he was unsure if they captured the totality of customer value. Were there other elements of customer value beyond a better product and lower pricing? Who was the right customer for Exterior |nc., and what would satisfy the needs of the target segment? Exhibit 1: Exterior Inc. (2007 vs. 2014) m Customer Metrics (Home builders) 2007 m New Customer Acquisition Rate Percentage increase in demand for 1% decrease 1.86% 2.12% in price Exercise Questions 01. Successful companies focus on satisfying the needs of a select group of target segment(s) with relatively similar preferences. Identify Exterior |nc.'s total addressable market, target segment, and non-target segment. Total addressable market Non-target segment Target segment - Q2. A customer value equation summarizes customer needs along with their importance weights. Customer Value (1) = W1 * Strategic Area, + W2 * Strategic Area2 + W3 * Strategic Area3 + W4 * Strategic Area4 + W5 * Strategic Areas where w1 + W2 + W3 + W4 + Ws= 100 (2) Describe up to 5 strategic areas (Strategic Area 1 -- Strategic Area 5) that comprise customer value for Exterior Inc.'s target customer segment. Please name and describe each area in the box below for the target segment identified in the previous question. Target Customer Segment: Customer Value = W1 * + W2 * + W3 * + W4 * + W5 *03. What is the implied customer value equation by Geoffrey Prescott and Sherry McGuire? Write their equations using the strategic areas you identified in 02. In each equation, please indicate the implied weights for each strategic area by Prescott and McGuire. Recall that the customer value equation is given by: Customer Value (1) = W1 * Strategic Areal + wz =I= Strategic Areaz + W3 * Strategic Area3 + W4 =I= Strategic Area4 + 1475 =I= Strategic Areas where W1 + wz + W3 + W4 + w5 = 100 (2) Please use the five strategic areas chosen in 02 and enter the weights that would capture Geoffrey Prescott's perceived customer value equation below. Customer Value +_*_+_* +_ >l