Answered step by step

Verified Expert Solution

Question

1 Approved Answer

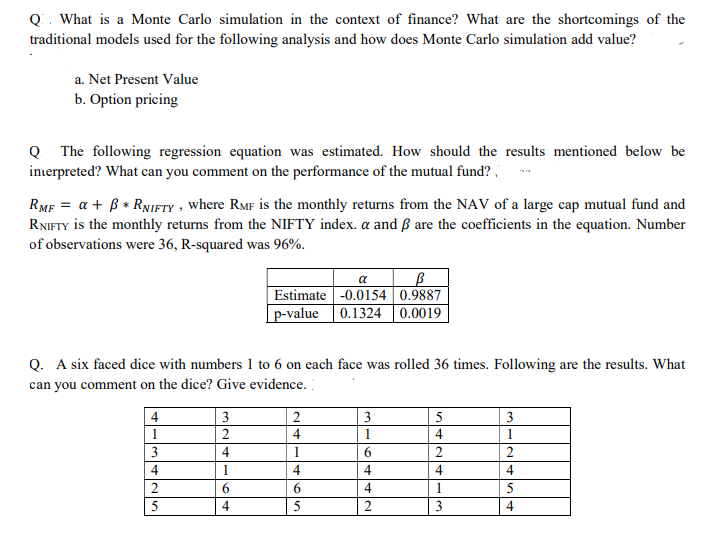

Q. What is a Monte Carlo simulation in the context of finance? What are the shortcomings of the traditional models used for the following

Q. What is a Monte Carlo simulation in the context of finance? What are the shortcomings of the traditional models used for the following analysis and how does Monte Carlo simulation add value? a. Net Present Value b. Option pricing QThe following regression equation was estimated. How should the results mentioned below be interpreted? What can you comment on the performance of the mutual fund? ** RMF = a + * RNIFTY, where RMF is the monthly returns from the NAV of a large cap mutual fund and RNIFTY is the monthly returns from the NIFTY index. a and 3 are the coefficients in the equation. Number of observations were 36, R-squared was 96%. 4 1 Q. A six faced dice with numbers 1 to 6 on each face was rolled 36 times. Following are the results. What can you comment on the dice? Give evidence. 3 4 2 5 3 2 4 1 6 Estimate p-value 4 a B -0.0154 0.9887 0.1324 0.0019 2 4 1 4 6 5 3 1 6 4 4 2 5 4 2 4 1 3 3 1 2 4 5 4

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Monte Carlo Simulation in Finance Monte Carlo simulation is a computational technique used in finance to model the probability of different outcomes in a process that cannot be easily predicted due ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started