Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Dominion Tool Company is expected to have earnings of $3 per share and pay 2/3 of it as dividend in the upcoming

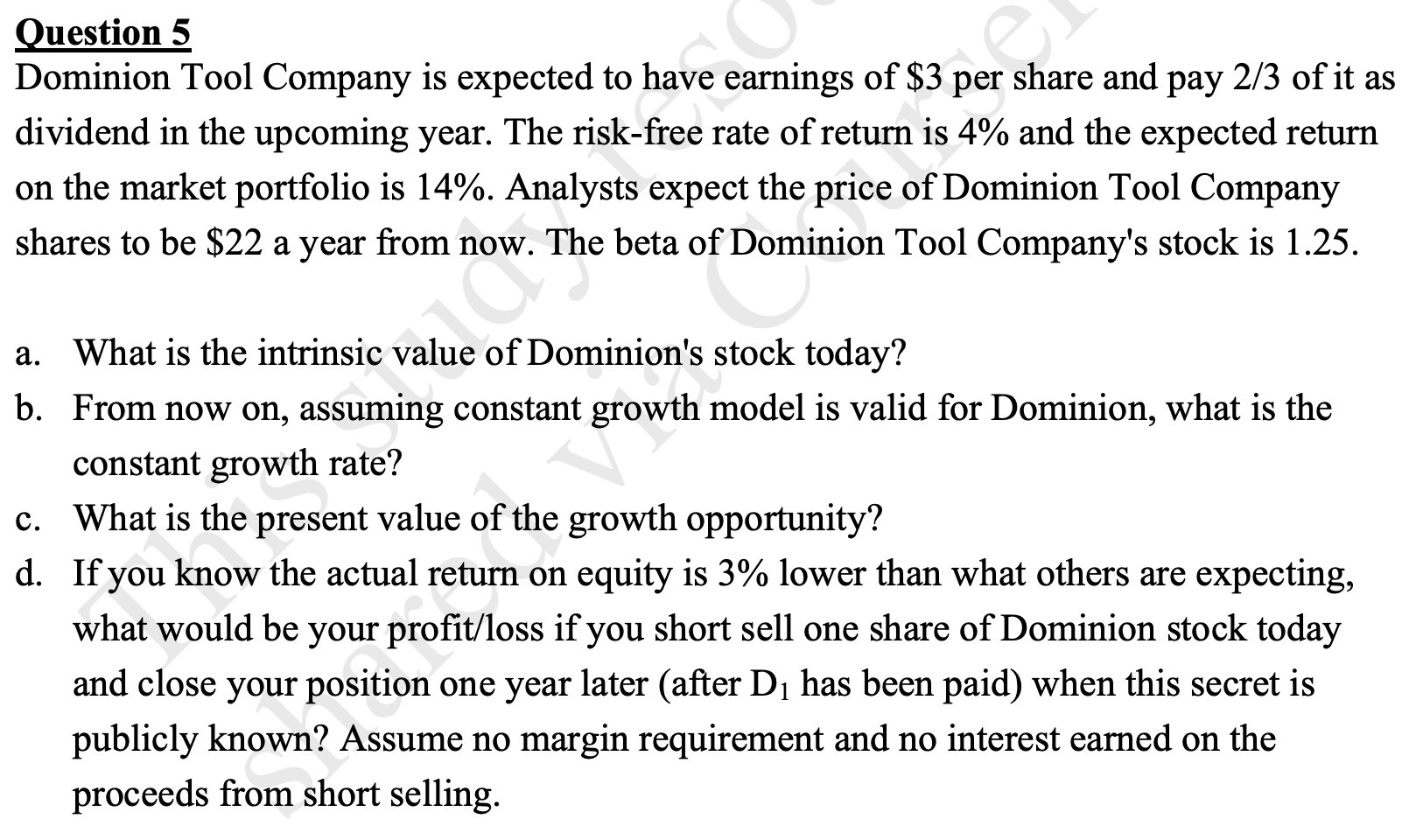

Question 5 Dominion Tool Company is expected to have earnings of $3 per share and pay 2/3 of it as dividend in the upcoming year. The risk-free rate of return is 4% and the expected return on the market portfolio is 14%. Analysts expect the price of Dominion Tool Company shares to be $22 a year from now. The beta of Dominion Tool Company's stock is 1.25. ave eam *$3 per she a. What is the intrinsic value of Dominion's stock today? b. From now on, assuming constant growth model is valid for Dominion, what is the constant growth rate? c. What is the present value of the growth opportunity? d. If you know the actual return on equity is 3% lower than what others are expecting, what would be your profit/loss if you short sell one share of Dominion stock today and close your position one year later (after D has been paid) when this secret is publicly known? Assume no margin requirement and no interest earned on the proceeds from short selling.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the intrinsic value of Dominions stock today we can use the dividend discount model DDM under the assumption of constant growth Intrins...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started