Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q:. _ You are conducting the audit of slam company for 2008, and you discover the following errors:. a- Because of an errors in the

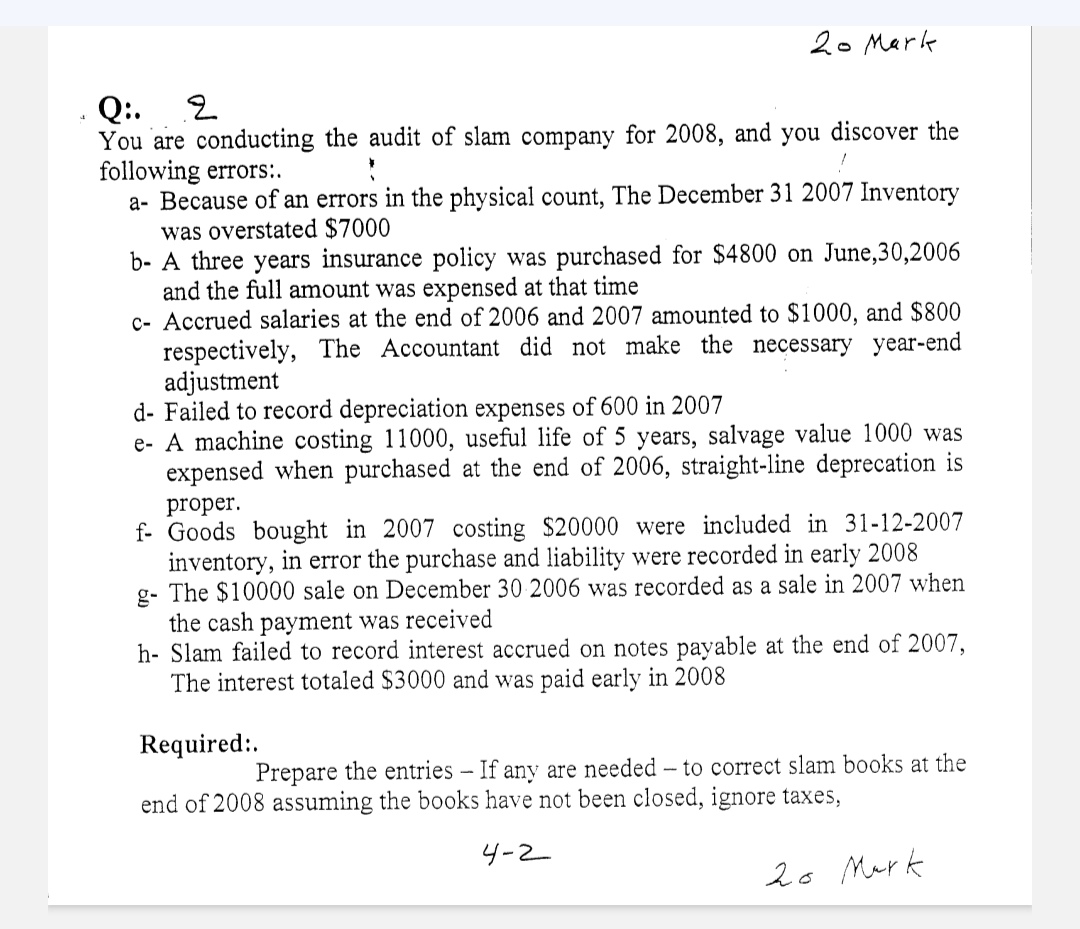

Q:. _ You are conducting the audit of slam company for 2008, and you discover the following errors:. a- Because of an errors in the physical count, The December 312007 Inventory was overstated $7000 b- A three years insurance policy was purchased for $4800 on June,30,2006 and the full amount was expensed at that time c- Accrued salaries at the end of 2006 and 2007 amounted to $1000, and $800 respectively, The Accountant did not make the necessary year-end adjustment d- Failed to record depreciation expenses of 600 in 2007 e- A machine costing 11000 , useful life of 5 years, salvage value 1000 was expensed when purchased at the end of 2006 , straight-line deprecation is proper. f- Goods bought in 2007 costing \$20000 were included in 31-12-2007 inventory, in error the purchase and liability were recorded in early 2008 g- The $10000 sale on December 30 2006 was recorded as a sale in 2007 when the cash payment was received h- Slam failed to record interest accrued on notes payable at the end of 2007 , The interest totaled $3000 and was paid early in 2008 Required:: Prepare the entries - If any are needed - to correct slam books at the end of 2008 assuming the books have not been closed, ignore taxes, 42

Q:. _ You are conducting the audit of slam company for 2008, and you discover the following errors:. a- Because of an errors in the physical count, The December 312007 Inventory was overstated $7000 b- A three years insurance policy was purchased for $4800 on June,30,2006 and the full amount was expensed at that time c- Accrued salaries at the end of 2006 and 2007 amounted to $1000, and $800 respectively, The Accountant did not make the necessary year-end adjustment d- Failed to record depreciation expenses of 600 in 2007 e- A machine costing 11000 , useful life of 5 years, salvage value 1000 was expensed when purchased at the end of 2006 , straight-line deprecation is proper. f- Goods bought in 2007 costing \$20000 were included in 31-12-2007 inventory, in error the purchase and liability were recorded in early 2008 g- The $10000 sale on December 30 2006 was recorded as a sale in 2007 when the cash payment was received h- Slam failed to record interest accrued on notes payable at the end of 2007 , The interest totaled $3000 and was paid early in 2008 Required:: Prepare the entries - If any are needed - to correct slam books at the end of 2008 assuming the books have not been closed, ignore taxes, 42 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started