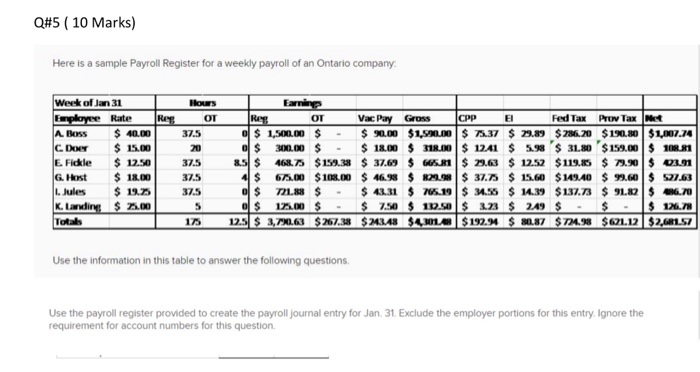

Q#1 (10 Marks) Fred Vedaro is paid bi-weekly and earns $15 per hour with overtime paid after 44 hours in one week. Fred works 48 hours in the first week and 39 in the second Vacation pay at 4% will be paid on each pay cycle. Calculate Fred's gross wages for this two week period. Q#2 ( 5 Marks) Explain the purpose of the Canada Pension Plan. Q#3 ( 6 Marks) Name the 3 Statutory Deductions in Canada. Q#4 ( 20 Marks) An employee earns $55,000 per year and is paid on a semi-monthly pay schedule. The employee enjoys the benefit of a company paid cell phone for personal use (cost is $150 per month) and receives 6% vacation pay on each payment. This pay cycle included 15 hours of approved overtime worked over the normal 40 hour work week and a reimbursement for travel expenses in the amount of $434.20. The employee contributes 5% of their regular wages to a Registered Retirement Savings Plan each pay cycle. Calculate the net pay for this employee. Be sure to list all of the deductions from the employee's pay for this pay cycle. (Note: if you do not have access to the PDOC assume Federal Tax deduction = $394.90 and Provincial Tax deduction = $191.45) Based on 2019 rates and T4032 tables Q#5 ( 10 Marks) Here is a sample Payroll Register for a weekly payroll of an Ontario company Week of Jan 31 Explore Rate Reg A Boss $ 40.00 C. Does $ 15.00 E. Fickle $ 12.50 G. Horst $ 18.00 LJules $ 19.75 K. Landing $ 25.00 Totals Hours OT 37.5 20 37.5 37.5 37.5 5 175 Earning Reg OT Vac Pay Gross CPP EI Fed Tax Pruw Tax Net $ 1,500.00 $ $ 90.00 $1,590.00 $ 15.37 $ 79.89 $286.20 $190.80 $1,007.74 o $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 '$ 31.80 $ 159.00 $ 108,91 8.5$ 468.73 $159.38 $ 37.69 $ 665.81 $ 29.63 $ 12.52 $119.85 $ 19.90 $ 03.91 4 $ 675.00 $ 108.00 $ 46,98 $ $29.98 $ 37.5 $ 15.60 $149.40 $ 99.60 $ 527.63 o $ 721.88 $ $ 43.31 $ 765.19 $ 32.55 $ 14.39 $137.73 $ 91.82 $ 46.70 o $ 125.00 $ $ 7.50 $ 102.50 $ 3.73 $ 249 $ $ $ 126.78 125 $ 3,720.63 $267.38 $243.43 $4,301.18 $ 192.94 $ 80.87 $72.98 $671.12 $2,681.57 Use the information in this table to answer the following questions. Use the payroll register provided to create the payroll journal entry for Jan. 31. Exclude the employer portions for this entry. Ignore the requirement for account numbers for this question Q#6 ( 5 Marks) Explain the value an out-sourced payroll service provider can offer to an employer. Q#7 ( 1 Mark) All payroll remittance payments made to the Canada Revenue Agency must have attached A blank void cheque The employer's payroll business number Employee Social Insurance Numbers A T4A Summary form The employer's HST filing number Q#8 (3 Marks) The Record of Employment is an extremely important document. Explain who it is used by and what for Q#1 (10 Marks) Fred Vedaro is paid bi-weekly and earns $15 per hour with overtime paid after 44 hours in one week. Fred works 48 hours in the first week and 39 in the second Vacation pay at 4% will be paid on each pay cycle Calculate Fred's gross wages for this two week period. Q#2 ( 5 Marks) Explain the purpose of the Canada Pension Plan. Q#3 ( 6 Marks) Name the 3 Statutory Deductions in Canada