Question

Q1 a. ABC Ltd manufactures two products, the Simplex and the Complex. The Simplex has been produced and sold for some years, and although it

Q1 a.

ABC Ltd manufactures two products, the Simplex and the Complex. The Simplex has been produced and sold for some years, and although it is a well-established brand it has been losing market share in recent years to cheaper products from competitors. The Complex, on the other hand, is a new product that was introduced about six months ago. ABC Ltd is excited about the Complex, as it has been well received by the market and sales have increased steadily since its launch. In fact, the company is thinking of phasing out production of the Simplex and putting all of its efforts behind the Complex.

Monthly cost, production and sales data relating to the products are as follows:

Complex Simplex Direct material cost per unit 150.00 55.00 Direct labour cost per unit 30.00 20.00 Total direct costs per unit 180 75.00

Direct labour hours per unit 1.5 hours 1.0 hour Selling price per unit 913.50 546.00 Monthly sales units 100 units 900 units

At present the company uses a traditional method of overhead absorption. Manufacturing overheads amount to 330,750 per month, and are absorbed by the two products on the basis of direct labour hours. The company uses a cost-plus method of pricing, with prices for both products being based on the full production cost per unit, plus 40%. The company also employs a just-in-time inventory policy, so that there are no monthly opening or closing inventories of WIP or finished goods.

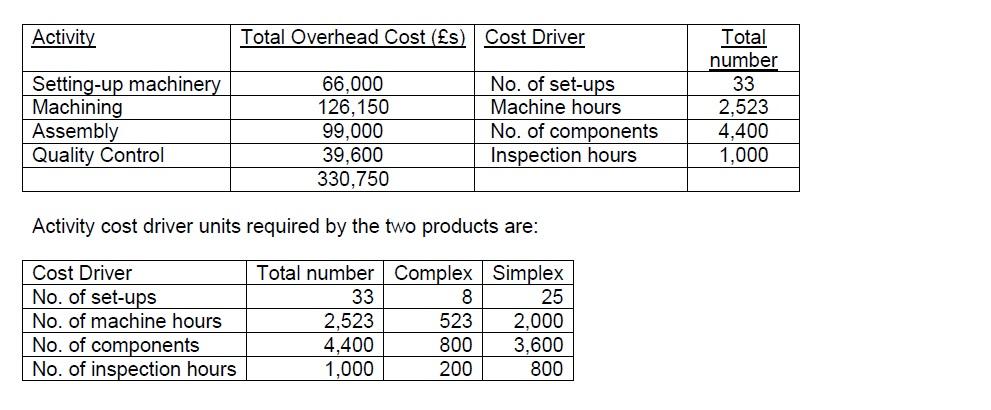

ABC Ltd is planning to introduce an activity-based costing (ABC) system. The company has identified the activities which are required each month to produce the sales volumes of the two products, as indicated above, and has also determined the overhead activity cost pools and activity cost drivers for each cost pool. The results of this analysis are presented below:

Required

1) Using the same mark-up as before, re-calculate the selling price of each product if ABC was used to determine product costs.

2) Why might the Simplex be losing market share, and why might sales of the Complex be growing? Explain briefly, using insights gained from your ABC analysis.

3) Would it be wise for ABC Ltd to start phasing out production of the Simplex so as to concentrate on the Complex? Briefly advise the company, with reasons, why this might or might not be a good idea.

Please provide working.

Activity Total Overhead Cost (s) Cost Driver Setting-up machinery Machining Assembly Quality Control 66,000 126,150 99,000 39.600 330,750 No. of set-ups Machine hours No. of components Inspection hours Total number 33 2,523 4,400 1,000 Activity cost driver units required by the two products are: Cost Driver No. of set-ups No. of machine hours No. of components No. of inspection hours Total number Complex Simplex 33 8 25 2,523 523 2,000 4,400 800 3,600 1,000 200 800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started