Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1) A company paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 2% over the next 4

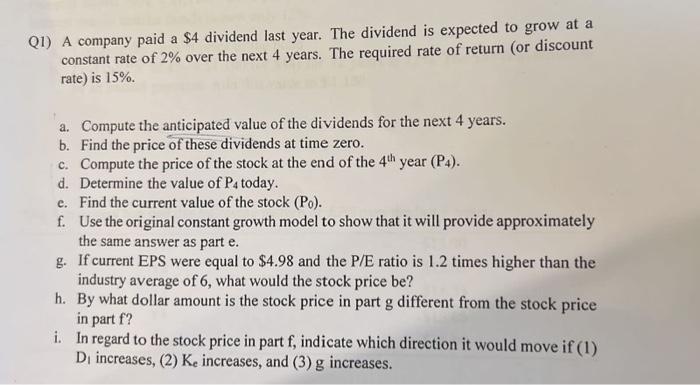

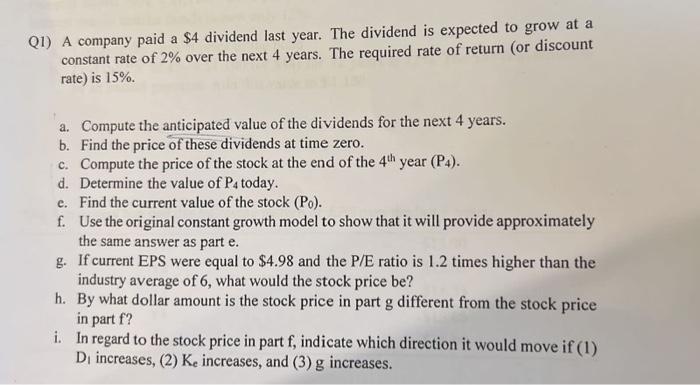

Q1) A company paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 2% over the next 4 years. The required rate of return (or discount rate) is 15% a. Compute the anticipated value of the dividends for the next 4 years. b. Find the price of these dividends at time zero. c. Compute the price of the stock at the end of the 4th year (P4). d. Determine the value of P4 today. e. Find the current value of the stock (P0). f. Use the original constant growth model to show that it will provide approximately the same answer as part e. g. If current EPS were equal to $4.98 and the P/E ratio is 1.2 times higher than the industry average of 6 , what would the stock price be? h. By what dollar amount is the stock price in part g different from the stock price in part f ? i. In regard to the stock price in part f, indicate which direction it would move if (1) D1 increases, (2) Ke increases, and (3) g increases

Q1) A company paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 2% over the next 4 years. The required rate of return (or discount rate) is 15% a. Compute the anticipated value of the dividends for the next 4 years. b. Find the price of these dividends at time zero. c. Compute the price of the stock at the end of the 4th year (P4). d. Determine the value of P4 today. e. Find the current value of the stock (P0). f. Use the original constant growth model to show that it will provide approximately the same answer as part e. g. If current EPS were equal to $4.98 and the P/E ratio is 1.2 times higher than the industry average of 6 , what would the stock price be? h. By what dollar amount is the stock price in part g different from the stock price in part f ? i. In regard to the stock price in part f, indicate which direction it would move if (1) D1 increases, (2) Ke increases, and (3) g increases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started