Answered step by step

Verified Expert Solution

Question

1 Approved Answer

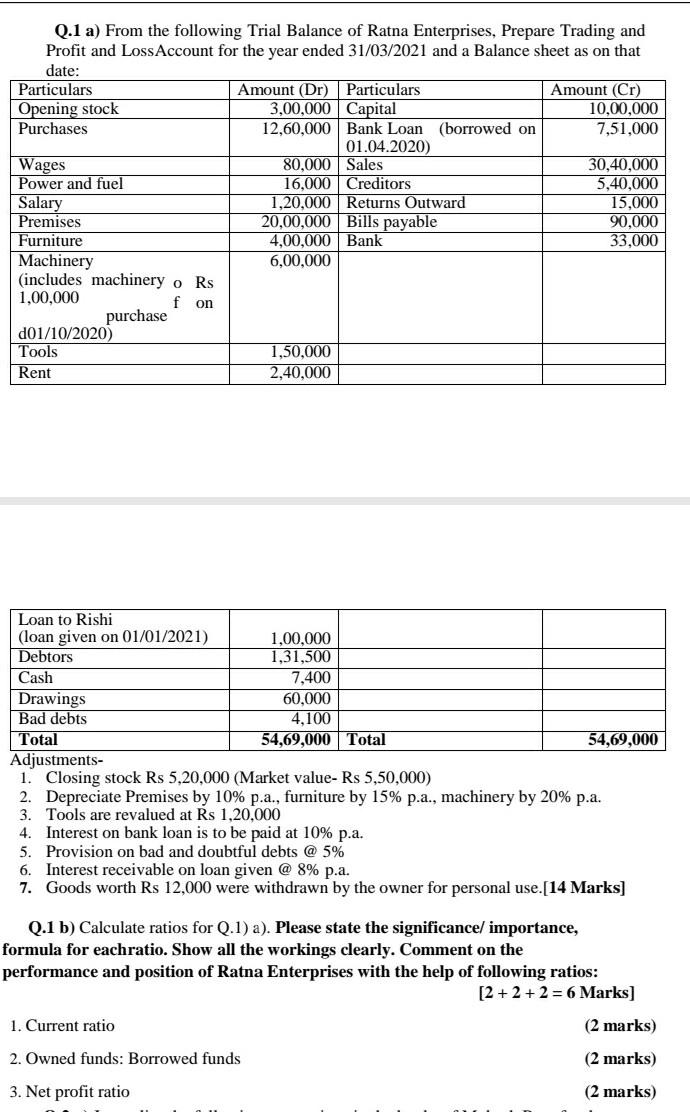

Q.1 a) From the following Trial Balance of Ratna Enterprises, Prepare Trading and Profit and Loss Account for the year ended 31/03/2021 and a Balance

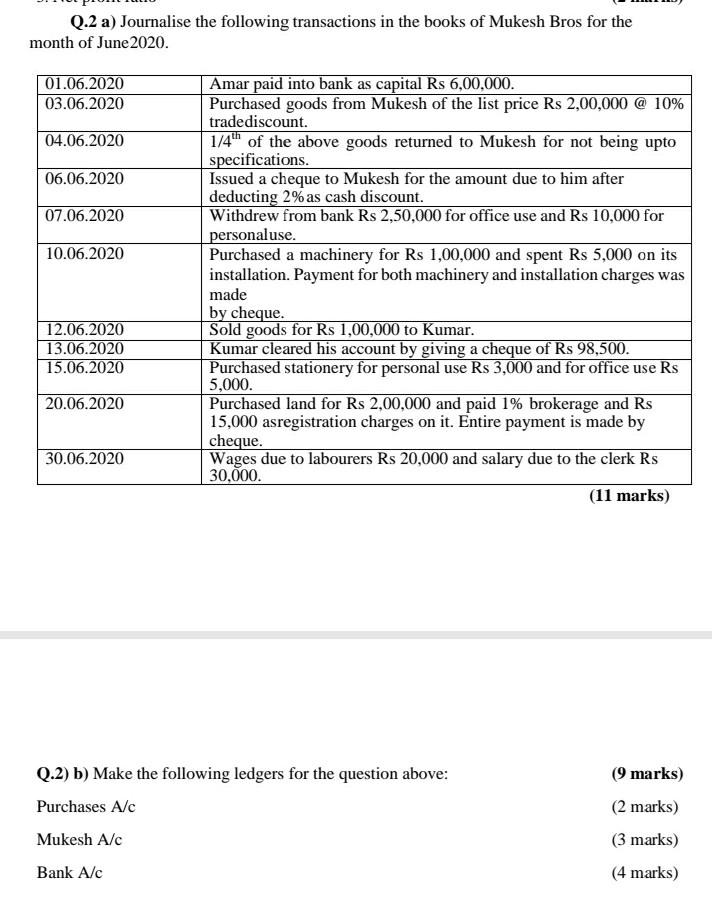

Q.1 a) From the following Trial Balance of Ratna Enterprises, Prepare Trading and Profit and Loss Account for the year ended 31/03/2021 and a Balance sheet as on that date: Particulars Amount (Dr) Particulars Amount (Cr) Opening stock 3,00,000 Capital 10,00,000 Purchases 12,60,000 Bank Loan (borrowed on 7,51,000 01.04.2020) Wages 80,000 Sales 30,40,000 Power and fuel 16,000 Creditors 5,40,000 Salary 1,20,000 Returns Outward 15.000 Premises 20,00,000 Bills payable 90,000 Furniture 4,00,000 Bank 33,000 Machinery 6,00,000 (includes machinery o Rs 1,00,000 fon purchase d01/10/2020) Tools 1,50.000 Rent 2,40,000 Loan to Rishi (loan given on 01/01/2021) 1,00,000 Debtors 1,31,500 Cash 7,400 Drawings 60,000 Bad debts 4,100 Total 54,69,000 Total 54,69,000 Adjustments- 1. Closing stock Rs 5,20,000 (Market value-Rs 5,50,000) 2. Depreciate Premises by 10% p.a., furniture by 15% p.a., machinery by 20% p.a. 3. Tools are revalued at Rs 1,20,000 4. Interest on bank loan is to be paid at 10% p.a. 5. Provision on bad and doubtful debts @ 5% 6. Interest receivable on loan given @ 8% p.a. 7. Goods worth Rs 12,000 were withdrawn by the owner for personal use.[14 Marks] Q.1 b) Calculate ratios for Q.1) a). Please state the significancel importance, formula for eachratio. Show all the workings clearly. Comment on the performance and position of Ratna Enterprises with the help of following ratios: [2 + 2 + 2 = 6 Marks] 1. Current ratio (2 marks) 2. Owned funds: Borrowed funds (2 marks) 3. Net profit ratio (2 marks) Q.2 a) Journalise the following transactions in the books of Mukesh Bros for the month of June 2020. 01.06.2020 03.06.2020 04.06.2020 06.06.2020 07.06.2020 10.06.2020 Amar paid into bank as capital Rs 6,00,000. Purchased goods from Mukesh of the list price Rs 2,00,000 @ 10% tradediscount. 1/4" of the above goods returned to Mukesh for not being upto specifications. Issued a cheque to Mukesh for the amount due to him after deducting 2% as cash discount. Withdrew from bank Rs 2,50,000 for office use and Rs 10,000 for personaluse. Purchased a machinery for Rs 1,00,000 and spent Rs 5,000 on its installation. Payment for both machinery and installation charges was made by cheque. Sold goods for Rs 1,00,000 to Kumar. Kumar cleared his account by giving a cheque of Rs 98,500. Purchased stationery for personal use Rs 3,000 and for office use Rs 5,000. Purchased land for Rs 2,00,000 and paid 1% brokerage and Rs 15,000 asregistration charges on it. Entire payment is made by cheque. Wages due to labourers Rs 20,000 and salary due to the clerk Rs 30,000. (11 marks) 12.06.2020 13.06.2020 15.06.2020 20.06.2020 30.06.2020 Q.2) b) Make the following ledgers for the question above: Purchases A/C (9 marks) (2 marks) (3 marks) Mukesh Alc Bank Alc (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started