Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. (a) Glassdoor Inc., has 15,00,000 equity shares outstanding. The stock sells for Rs 45 per share and has a beta of 0.90. The face

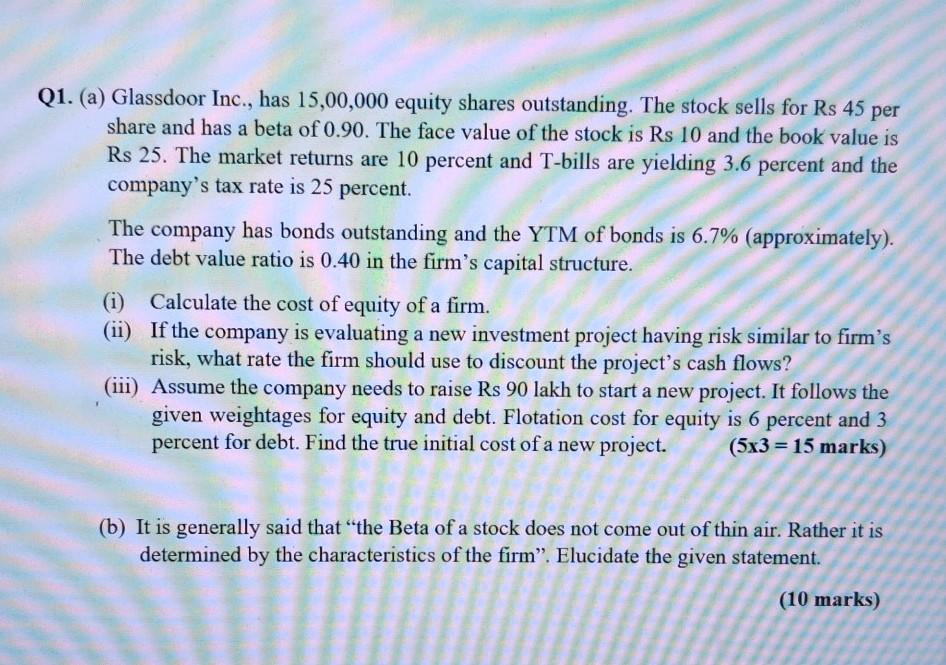

Q1. (a) Glassdoor Inc., has 15,00,000 equity shares outstanding. The stock sells for Rs 45 per share and has a beta of 0.90. The face value of the stock is Rs 10 and the book value is Rs 25. The market returns are 10 percent and T-bills are yielding 3.6 percent and the company's tax rate is 25 percent. The company has bonds outstanding and the YTM of bonds is 6.7% (approximately). The debt value ratio is 0.40 in the firm's capital structure. Calculate the cost of equity of a firm. (i) If the company is evaluating a new investment project having risk similar to firm's risk, what rate the firm should use to discount the project's cash flows? (iii) Assume the company needs to raise Rs 90 lakh to start a new project. It follows the given weightages for equity and debt. Flotation cost for equity is 6 percent and 3 percent for debt. Find the true initial cost of a new project. (5x3 = 15 marks) (b) It is generally said that "the Beta of a stock does not come out of thin air. Rather it is determined by the characteristics of the firm". Elucidate the given statement. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started