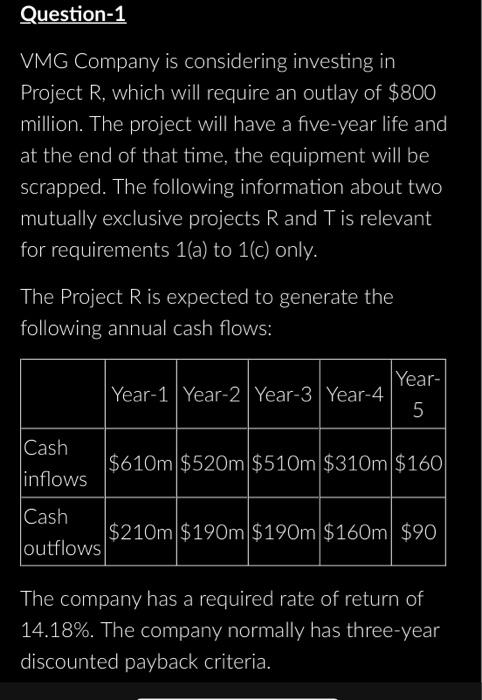

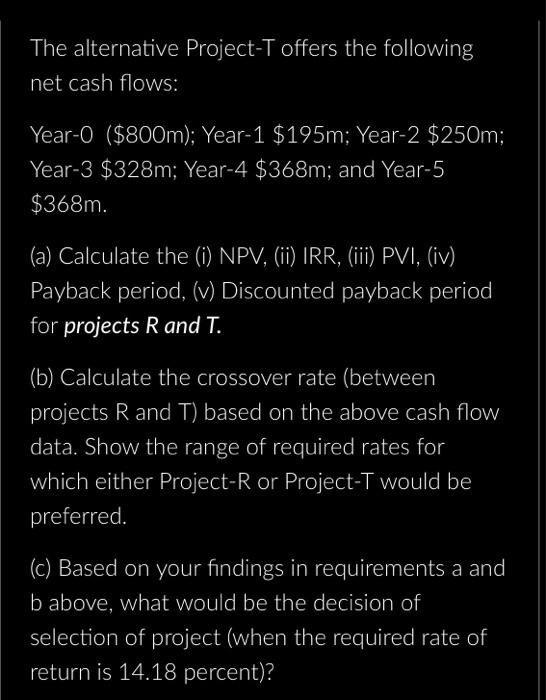

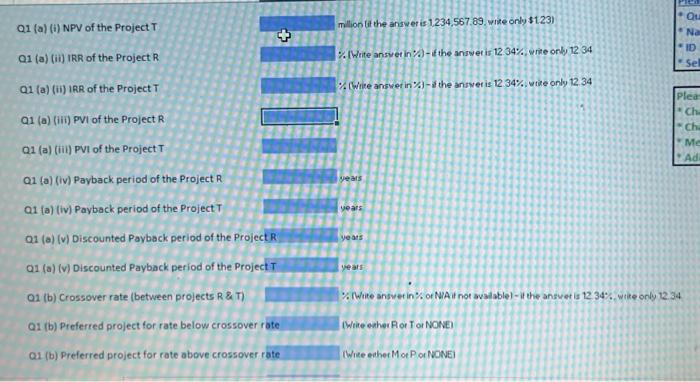

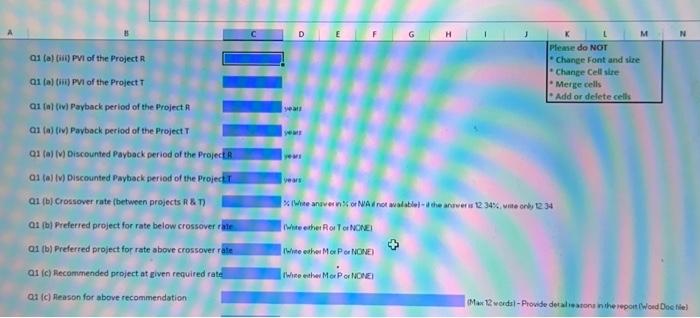

Q1 (a) (i) NPV of the Project T Q1 (a) (ii) IRR of the Project R Q1 (a) (ii) IRR of the Project T Q1 (a) (iii) PVI of the Project R Q1 (a) (iii) PVI of the Project T Q1 (a) (iv) Payback period of the Project R Q1 (a) (iv) Payback period of the Project T Q1 (a) (v) Discounted Payback period of the Proje Q1 (a) (v) Discounted Payback period of the Projec) O1 (b) Crossover rate (between projects R \& T) Q1 (b) Pieferred project for rate below crossover Q1 (b) Preferred project for rate above crossover ? million (it the answer is 1,234,567,89, wite only 5123 ) % (White answet in \%)-it the answer is 12.34%, whe only 1234 % (Wite answet in % )-it the answer is 12.34%, wite only 12.34 years years years yeats \% White answet in % or NVAit not sualsblel - it the answer is 1234%, wite only 12 White eaher Ror T or NONE) Write eaher Mor PorNONEI Q1 (a) (iii) PVI of the Project R Q1 (a) (tii) PVI of the Project T Q1 (a) (iv) Parback period of the Project A Q1 (a) (iv) Payback period of the Project T Q1 (a) (v) Discounted Paybock period of the Projec Os (a) (v) Discounted Payback period of the Projec Q1 (b) Crossover rate (between projects \& \&. T) at (b) Preferred project for rate below crossover ! OI (b) Preferfed project for rate above crossover - Q1 (c) Recommended project at given required rats Qu (c) Reason for above recommendation VMG Company is considering investing in Project R, which will require an outlay of $800 million. The project will have a five-year life and at the end of that time, the equipment will be scrapped. The following information about two mutually exclusive projects R and T is relevant for requirements 1 (a) to 1 (c) only. The Project R is expected to generate the following annual cash flows: The company has a required rate of return of 14.18%. The company normally has three-year discounted payback criteria. The alternative Project-T offers the following net cash flows: Year-0 (\$800m); Year-1 \$195m; Year-2 \$250m; Year-3 \$328m; Year-4 \$368m; and Year-5 $368m. (a) Calculate the (i) NPV, (ii) IRR, (iii) PVI, (iv) Payback period, (v) Discounted payback period for projects R and T. (b) Calculate the crossover rate (between projects R and T ) based on the above cash flow data. Show the range of required rates for which either Project-R or Project-T would be preferred. (c) Based on your findings in requirements a and b above, what would be the decision of selection of project (when the required rate of return is 14.18 percent)