Question

Q1. a) Name the stock exchange market in Riyadh , KSA and explain its operating activities. (2Marks) b) Read the figure below and answer the

Q1. a) Name the stock exchange market in Riyadh, KSA and explain its operating activities. (2Marks)

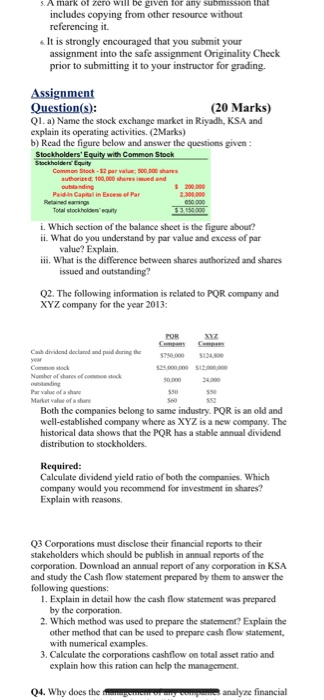

b) Read the figure below and answer the questions given :

Q2. The following information is related to PQR company and XYZ company for the year 2013:

| PQR Company | XYZ Company |

Cash dividend declared and paid during the year | $750,000 | $124,800 |

Common stock | $25,000,000 | $12,000,000 |

Number of shares of common stock outstanding | 50,000 | 24,000 |

Par value of a share | $50 | $50 |

Market value of a share | $60 | $52 |

Both the companies belong to same industry. PQR is an old and well-established company where as XYZ is a new company. The historical data shows that the PQR has a stable annual dividend distribution to stockholders.

Required:

Calculate dividend yield ratio of both the companies. Which company would you recommend for investment in shares? Explain with reasons.

Q3 Corporations must disclose their financial reports to their stakeholders which should be publish in annual reports of the corporation. Download an annual report of any corporation in KSA and study the Cash flow statement prepared by them to answer the following questions:

Q4. Why does the management of any companies analyze financial statements? Explain by using the different tools in analyzing financial statement with proper numerical example.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started