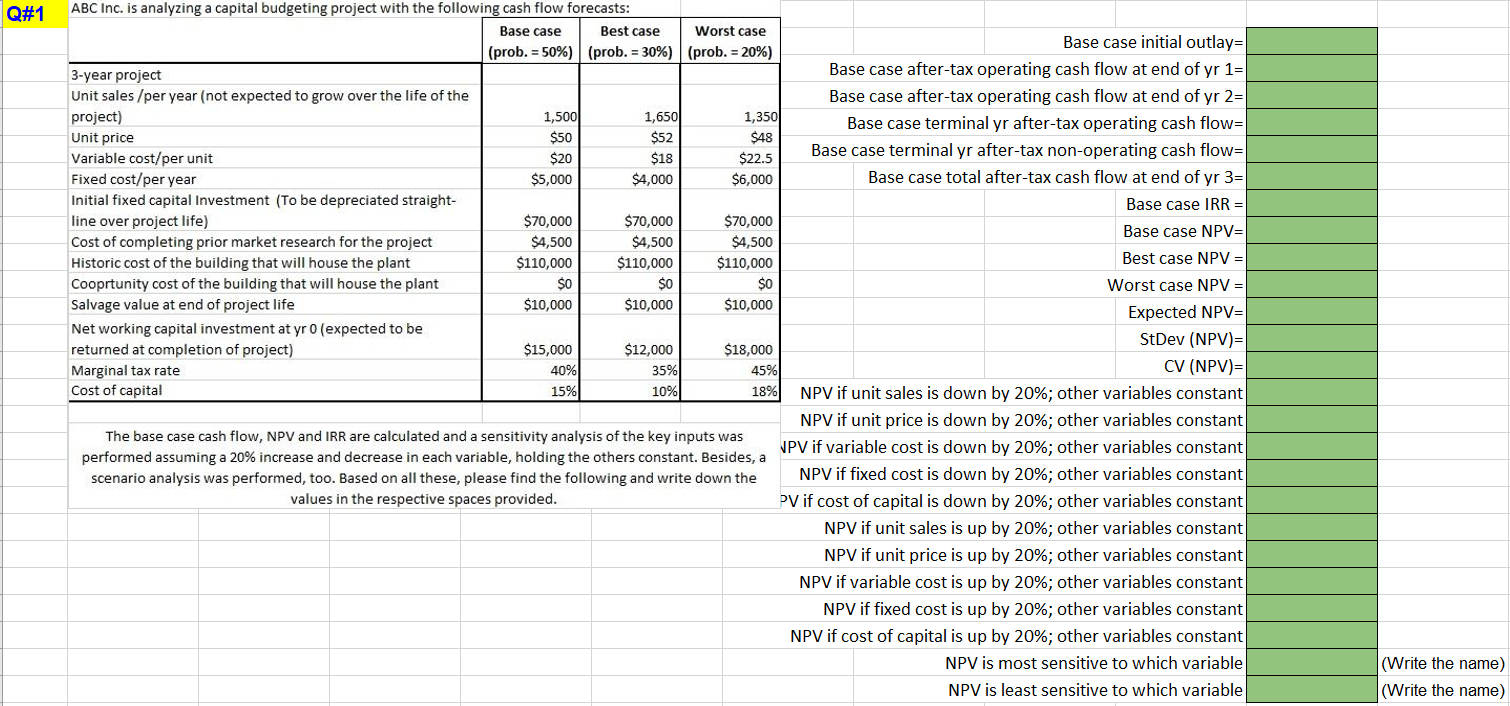

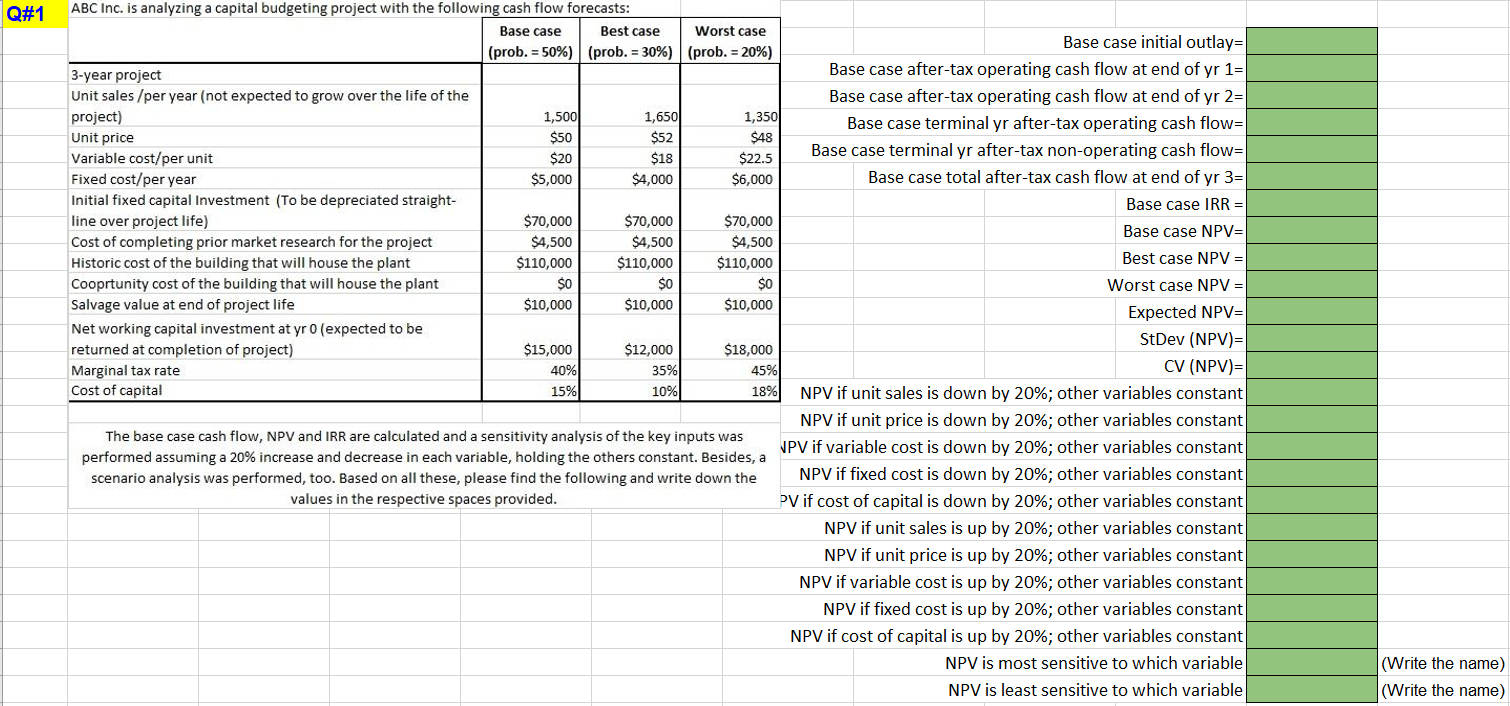

Q#1 ABC Inc. is analyzing a capital budgeting project with the following cash flow forecasts: Base case Best case Worst case Base case initial outlay= (prob. = 50%) (prob. = 30%) (prob. = 20%) Base case after-tax operating cash flow at end of yr 15 3-year project Unit sales /per year (not expected to grow over the life of the Base case after-tax operating cash flow at end of yr 2= project) 1,500 1,650 1,350 Base case terminal yr after-tax operating cash flow= Unit price $50 $52 $48 Variable cost/per unit $20 $18 $22.5 Base case terminal yr after-tax non-operating cash flow= Fixed cost/per year $5,000 $4,000 $6,000 Base case total after-tax cash flow at end of yr 3= Initial fixed capital Investment (To be depreciated straight- Base case IRR = line over project life) $70,000 $70,000 $70,000 Base case NPV= Cost of completing prior market research for the project $4,500 $4,500 $4,500 Historic cost of the building that will house the plant $110,000 $110,000 $110,000 Best case NPV = Cooprtunity cost of the building that will house the plant $0 $0 $0 Worst case NPV = Salvage value at end of project life $10,000 $10,000 $10,000 Expected NPV= Net working capital investment at yr 0 (expected to be StDev (NPV)= returned at completion of project) $15,000 $12,000 $18,000 Marginal tax rate 40% 35% 45% CV (NPV)= Cost of capital 15% 10% 18% NPV if unit sales is down by 20%; other variables constant NPV if unit price is down by 20%; other variables constant The base case cash flow, NPV and IRR are calculated and a sensitivity analysis of the key inputs was performed assuming a 20% increase and decrease in each variable, holding the others constant. Besides, a NPV if variable cost is down by 20%; other variables constant scenario analysis was performed, too. Based on all these, please find the following and write down the NPV if fixed cost is down by 20%; other variables constant values in the respective spaces provided. PV if cost of capital is down by 20%; other variables constant NPV if unit sales is up by 20%; other variables constant NPV if unit price is up by 20%; other variables constant NPV if variable cost is up by 20%; other variables constant NPV if fixed cost is up by 20%; other variables constant NPV if cost of capital is up by 20%; other variables constant NPV is most sensitive to which variable NPV is least sensitive to which variable (Write the name) (Write the name)