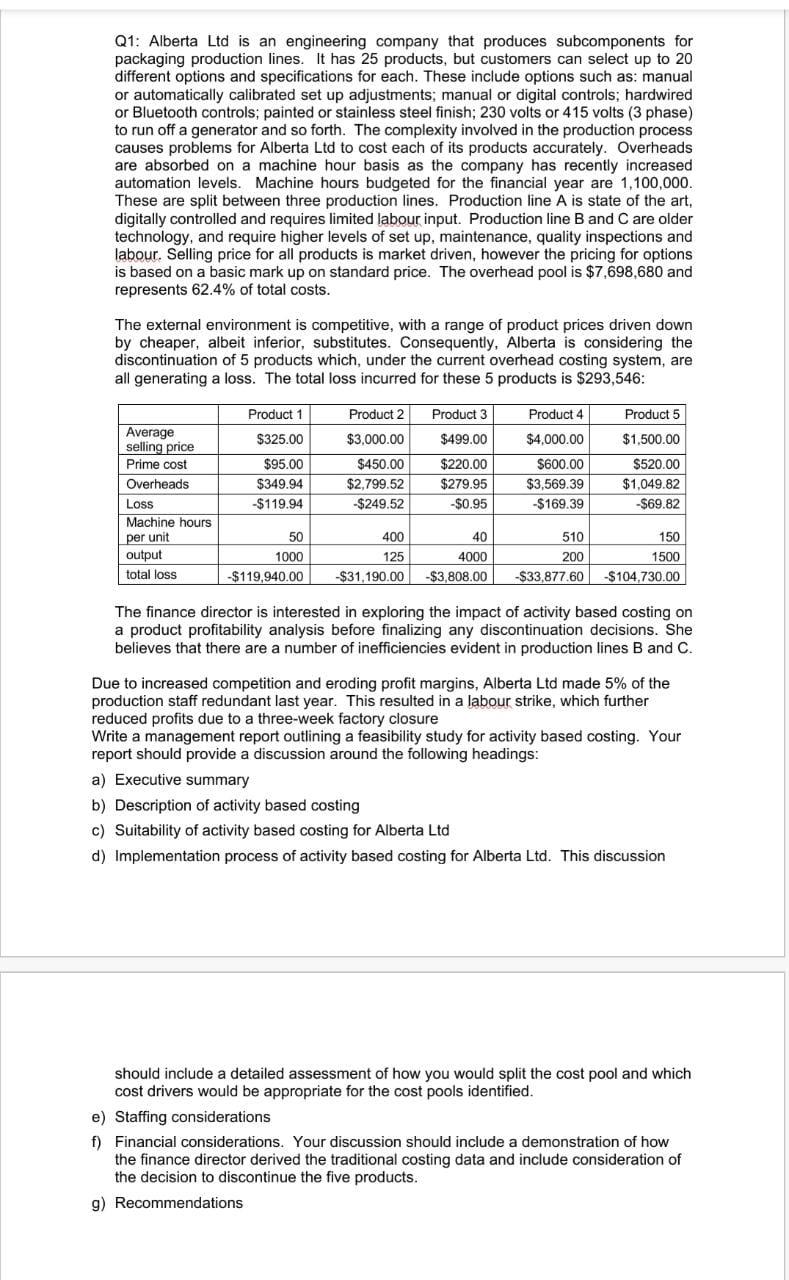

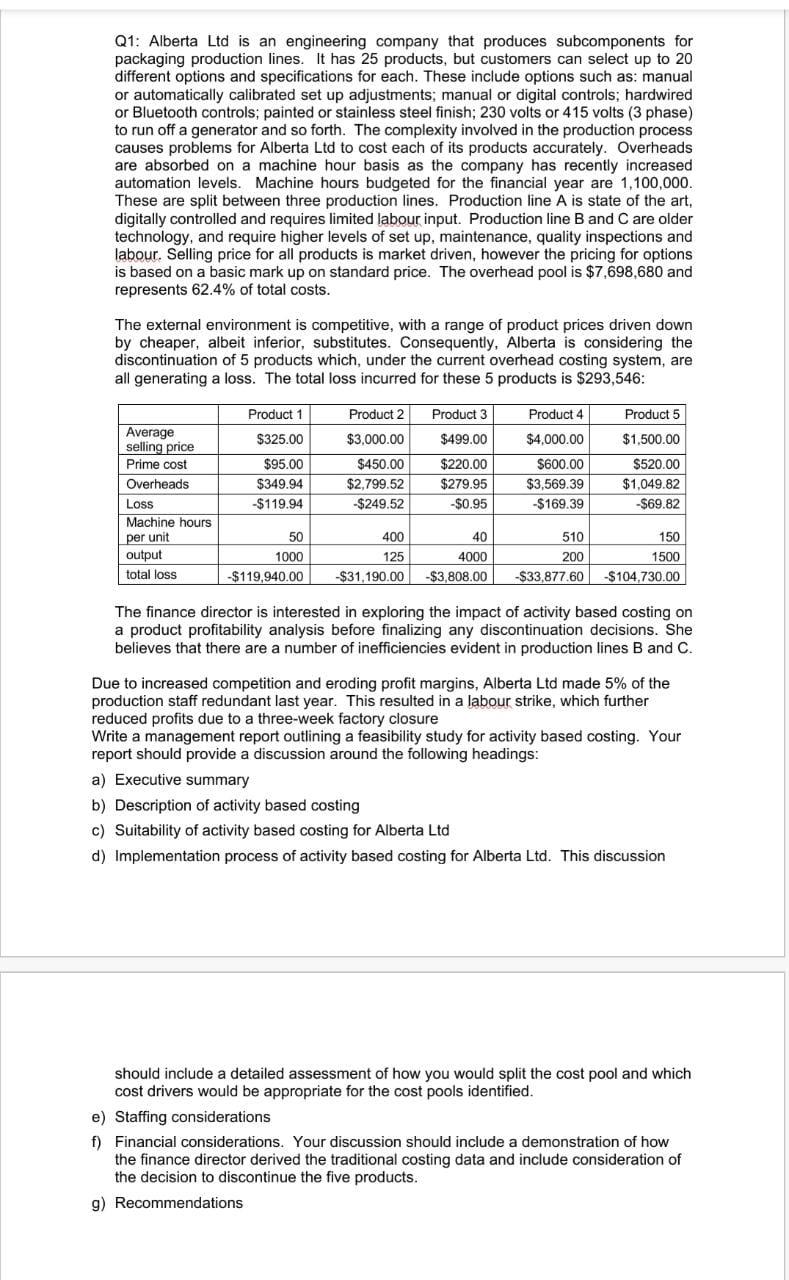

Q1: Alberta Ltd is an engineering company that produces subcomponents for packaging production lines. It has 25 products, but customers can select up to 20 different options and specifications for each. These include options such as: manual or automatically calibrated set up adjustments; manual or digital controls; hardwired or Bluetooth controls, painted or stainless steel finish; 230 volts or 415 volts (3 phase) to run off a generator and so forth. The complexity involved in the production process causes problems for Alberta Ltd to cost each of its products accurately. Overheads are absorbed on a machine hour basis as the company has recently increased automation levels. Machine hours budgeted for the financial year are 1,100,000. These are split between three production lines. Production line A is state of the art, digitally controlled and requires limited labour input. Production line B and C are older technology, and require higher levels of set up, maintenance, quality inspections and labour. Selling price for all products is market driven, however the pricing for options is based on a basic mark up on standard price. The overhead pool is $7,698,680 and represents 62.4% of total costs. The external environment is competitive, with a range of product prices driven down by cheaper, albeit inferior, substitutes. Consequently, Alberta is considering the discontinuation of 5 products which, under the current overhead costing system, are all generating a loss. The total loss incurred for these 5 products is $293,546: Product 1 Product 3 Product 4 Product 5 Product 2 $3,000.00 $499.00 $1,500.00 Average selling price Prime cost Overheads Loss Machine hours per unit output total loss $325.00 $95.00 $349.94 $119.94 $450.00 $2,799.52 $249.52 $220.00 $279.95 -$0.95 $4,000.00 $600.00 $3,569.39 -$169.39 $520.00 $1,049.82 $69.82 40 50 1000 -$119,940.00 400 125 $31.190.00 4000 -$3,808.00 510 200 -$33,877.60 150 1500 -$104,730.00 The finance director is interested in exploring the impact of activity based costing on a product profitability analysis before finalizing any discontinuation decisions. She believes that there are a number of inefficiencies evident in production lines B and C. Due to increased competition and eroding profit margins, Alberta Ltd made 5% of the production staff redundant last year. This resulted in a labour strike, which further reduced profits due to a three-week factory closure Write a management report outlining a feasibility study for activity based costing. Your report should provide a discussion around the following headings: a) Executive summary b) Description of activity based costing c) Suitability of activity based costing for Alberta Ltd d) Implementation process of activity based costing for Alberta Ltd. This discussion should include a detailed assessment of how you would split the cost pool and which cost drivers would be appropriate for the cost pools identified. e) Staffing considerations f) Financial considerations. Your discussion should include a demonstration of how the finance director derived the traditional costing data and include consideration of the decision to discontinue the five products. g) Recommendations Q1: Alberta Ltd is an engineering company that produces subcomponents for packaging production lines. It has 25 products, but customers can select up to 20 different options and specifications for each. These include options such as: manual or automatically calibrated set up adjustments; manual or digital controls; hardwired or Bluetooth controls, painted or stainless steel finish; 230 volts or 415 volts (3 phase) to run off a generator and so forth. The complexity involved in the production process causes problems for Alberta Ltd to cost each of its products accurately. Overheads are absorbed on a machine hour basis as the company has recently increased automation levels. Machine hours budgeted for the financial year are 1,100,000. These are split between three production lines. Production line A is state of the art, digitally controlled and requires limited labour input. Production line B and C are older technology, and require higher levels of set up, maintenance, quality inspections and labour. Selling price for all products is market driven, however the pricing for options is based on a basic mark up on standard price. The overhead pool is $7,698,680 and represents 62.4% of total costs. The external environment is competitive, with a range of product prices driven down by cheaper, albeit inferior, substitutes. Consequently, Alberta is considering the discontinuation of 5 products which, under the current overhead costing system, are all generating a loss. The total loss incurred for these 5 products is $293,546: Product 1 Product 3 Product 4 Product 5 Product 2 $3,000.00 $499.00 $1,500.00 Average selling price Prime cost Overheads Loss Machine hours per unit output total loss $325.00 $95.00 $349.94 $119.94 $450.00 $2,799.52 $249.52 $220.00 $279.95 -$0.95 $4,000.00 $600.00 $3,569.39 -$169.39 $520.00 $1,049.82 $69.82 40 50 1000 -$119,940.00 400 125 $31.190.00 4000 -$3,808.00 510 200 -$33,877.60 150 1500 -$104,730.00 The finance director is interested in exploring the impact of activity based costing on a product profitability analysis before finalizing any discontinuation decisions. She believes that there are a number of inefficiencies evident in production lines B and C. Due to increased competition and eroding profit margins, Alberta Ltd made 5% of the production staff redundant last year. This resulted in a labour strike, which further reduced profits due to a three-week factory closure Write a management report outlining a feasibility study for activity based costing. Your report should provide a discussion around the following headings: a) Executive summary b) Description of activity based costing c) Suitability of activity based costing for Alberta Ltd d) Implementation process of activity based costing for Alberta Ltd. This discussion should include a detailed assessment of how you would split the cost pool and which cost drivers would be appropriate for the cost pools identified. e) Staffing considerations f) Financial considerations. Your discussion should include a demonstration of how the finance director derived the traditional costing data and include consideration of the decision to discontinue the five products. g) Recommendations