Question

Q1 answer is dr prepaid ins 175 and cr insurance exp 175. Can u explain to me why the prepaid ins is debit side and

Q1 answer is dr prepaid ins 175 and cr insurance exp 175. Can u explain to me why the prepaid ins is debit side and ins exp is credit side? (why the prepaid ins is not cr side etc)

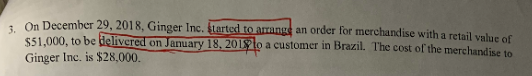

Q3 answer is no entry. How do you tell this is no entry?

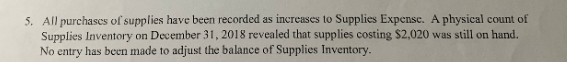

Q5 answer is dr supplies exp 700 and cr supplies 700. Can u tell me in what condition the supplies exp will be in cr side and supplies in dr side?

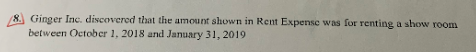

Q8 answer is dr prepaid rent 3200 and cr rent exp 3200. Can u explain to me why the prepaid rent is debit side and rent exp is credit side?

Be specific, I will give you a thumb!

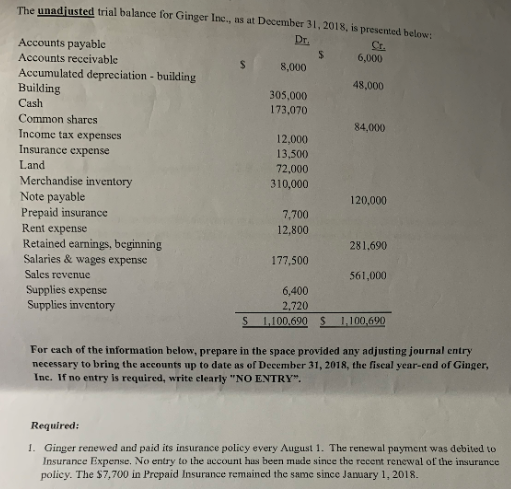

The unadjusted trial balance for Ginger Inc., as at December 31, 2018, is presented hele Dr. Accounts payable $ Accounts receivable 6,000 8,000 Accumulated depreciation - building Building 48,000 305,000 Cash 173,070 Common shares 84.000 Income tax expenses 12.000 Insurance expense 13,500 Land 72,000 Merchandise inventory 310,000 Note payable 120,000 Prepaid insurance 7.700 Rent expense 12,800 Retained earnings, beginning 281.690 Salaries & wages expense 177,500 Sales revenue 561,000 Supplies expense 6,400 Supplies inventory 2.720 S 1,100.690 $ 1,100,690 For each of the information below, prepare in the space provided any adjusting journal entry necessary to bring the accounts up to date as of December 31, 2018, the fiscal year-end of Ginger, Inc. If no entry is required, write clearly "NO ENTRY". Required: I. Ginger renewed and paid its insurance policy every August 1. The renewal payment was debited to Insurance Expense, No entry to the account has been made since the recent renewal of the insurance policy. The $7.700 in Prepaid Insurance remained the same since January 1, 2018. On December 29, 2018. Ginger Inc. Started to arrange an order for merchandise with a retail value of $51.000, to be delivered on January 18, 2018 lo a customer in Brazil. The cost of the merchandise Ginger Inc. is $28,000. 5. All purchases of supplies have been recorded as increases to Supplies Expense. A physical count of Supplies Inventory on December 31, 2018 revealed that supplies costing $2,020 was still on hand. No entry has been made to adjust the balance of Supplies Inventory. 8. Ginger Inc, discovered that the amount shown in Rent Expense was for renting a show room between October 1, 2018 and January 31, 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started