Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what are the solutions to all parts of the following 3 problems? Clarks Inc, a shoe retailer, sells boots in different styles. In early November

what are the solutions to all parts of the following 3 problems?

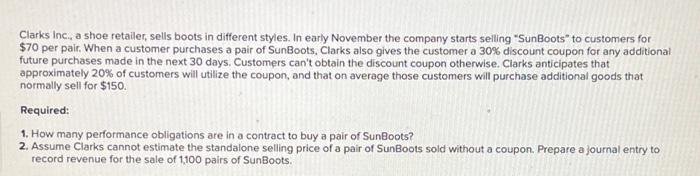

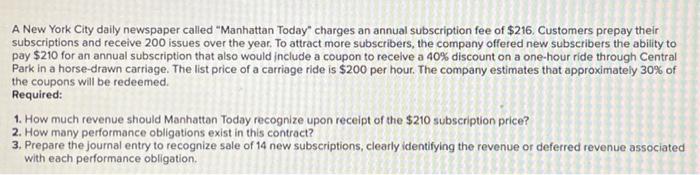

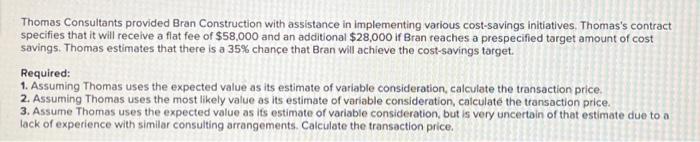

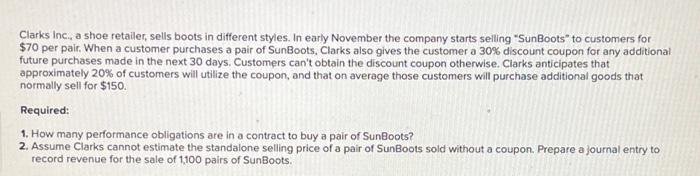

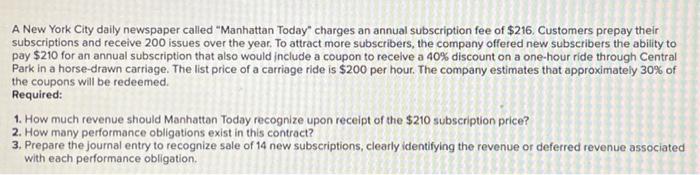

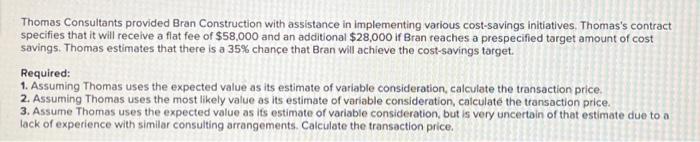

Clarks Inc, a shoe retailer, sells boots in different styles. In early November the company starts selling "SunBoots to customers for $70 per pair . When a customer purchases a pair of SunBoots, Clarks also gives the customer a 30% discount coupon for any additional future purchases made in the next 30 days. Customers can't obtain the discount coupon otherwise. Clarks anticipates that approximately 20% of customers will utilize the coupon, and that on average those customers will purchase additional goods that normally sell for $150. Required: 1. How many performance obligations are in a contract to buy a pair of SunBoots? 2. Assume Clarks cannot estimate the standalone selling price of a pair of SunBoots sold without a coupon. Prepare a journal entry to record revenue for the sale of 1100 pairs of SunBoots. A New York City daily newspaper called "Manhattan Today" charges an annual subscription fee of $216. Customers prepay their subscriptions and receive 200 issues over the year. To attract more subscribers, the company offered new subscribers the ability to pay $210 for an annual subscription that also would include a coupon to receive a 40% discount on a one-hour ride through Central Park in a horse-drawn carriage. The list price of a carriage ride is $200 per hour. The company estimates that approximately 30% of the coupons will be redeemed. Required: 1. How much revenue should Manhattan Today recognize upon receipt of the $210 subscription price? 2. How many performance obligations exist in this contract? 3. Prepare the journal entry to recognize sale of 14 new subscriptions, clearly identifying the revenue or deferred revenue associated with each performance obligation. Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas's contract specifies that it will receive a fiat fee of $58,000 and an additional $28,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 35% chance that Bran will achieve the cost savings target. Required: 1. Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price 2. Assuming Thomas uses the most likely value as its estimate of variable consideration calculate the transaction price. 3. Assume Thomas uses the expected value as its estimate of variable consideration, but is very uncertain of that estimate due to a lack of experience with similar consulting arrangements. Calculate the transaction price

Clarks Inc, a shoe retailer, sells boots in different styles. In early November the company starts selling "SunBoots to customers for $70 per pair . When a customer purchases a pair of SunBoots, Clarks also gives the customer a 30% discount coupon for any additional future purchases made in the next 30 days. Customers can't obtain the discount coupon otherwise. Clarks anticipates that approximately 20% of customers will utilize the coupon, and that on average those customers will purchase additional goods that normally sell for $150. Required: 1. How many performance obligations are in a contract to buy a pair of SunBoots? 2. Assume Clarks cannot estimate the standalone selling price of a pair of SunBoots sold without a coupon. Prepare a journal entry to record revenue for the sale of 1100 pairs of SunBoots. A New York City daily newspaper called "Manhattan Today" charges an annual subscription fee of $216. Customers prepay their subscriptions and receive 200 issues over the year. To attract more subscribers, the company offered new subscribers the ability to pay $210 for an annual subscription that also would include a coupon to receive a 40% discount on a one-hour ride through Central Park in a horse-drawn carriage. The list price of a carriage ride is $200 per hour. The company estimates that approximately 30% of the coupons will be redeemed. Required: 1. How much revenue should Manhattan Today recognize upon receipt of the $210 subscription price? 2. How many performance obligations exist in this contract? 3. Prepare the journal entry to recognize sale of 14 new subscriptions, clearly identifying the revenue or deferred revenue associated with each performance obligation. Thomas Consultants provided Bran Construction with assistance in implementing various cost-savings initiatives. Thomas's contract specifies that it will receive a fiat fee of $58,000 and an additional $28,000 if Bran reaches a prespecified target amount of cost savings. Thomas estimates that there is a 35% chance that Bran will achieve the cost savings target. Required: 1. Assuming Thomas uses the expected value as its estimate of variable consideration, calculate the transaction price 2. Assuming Thomas uses the most likely value as its estimate of variable consideration calculate the transaction price. 3. Assume Thomas uses the expected value as its estimate of variable consideration, but is very uncertain of that estimate due to a lack of experience with similar consulting arrangements. Calculate the transaction price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started