Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Answer Options: $190,000 $150,000 $125,000 $40,000 Q2 Answer Options: 10% 12% 22% 24% Q3 Answer Options: 12% 22% 10% 24% Q4 Answer Options: 22%

Q1 Answer Options:

$190,000

$150,000

$125,000

$40,000

Q2 Answer Options:

10%

12%

22%

24%

Q3 Answer Options:

12%

22%

10%

24%

Q4 Answer Options:

22%

32%

12%

24%

Q5 Answer Options:

$19,124

$20,000

$7,760

$1,975

$9,889

Q6 Answer Options:

15%

13%

12%

18%

Q7 Answer Options:

32%

24%

22%

12%

The "Questions" are each of the drop down menu options.

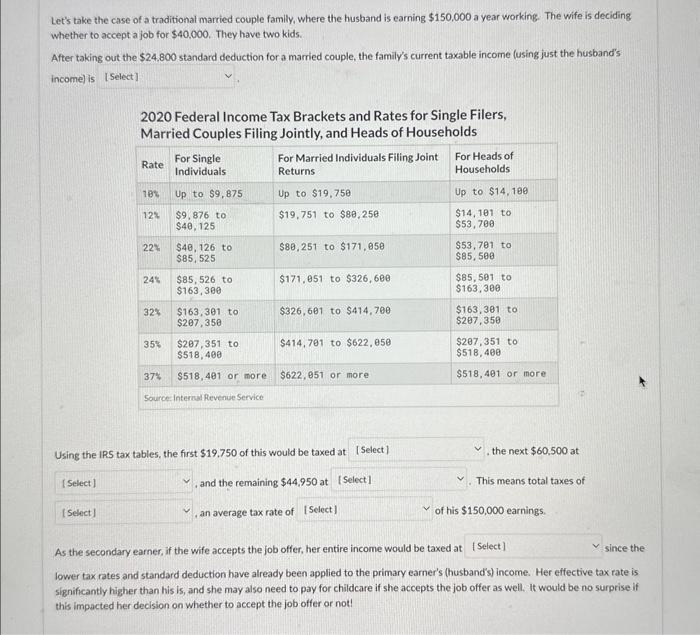

Let's take the case of a traditional married couple family, where the husband is earning $150,000 a year working. The wife is deciding whether to accept a job for $40,000. They have two kids. After takins out the $24.800 standard deduction for a married couple, the family's current taxable income (using just the husband's income) is 2020 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households Using the IRS tax tables, the first $19.750 of this would be taxed at , the next $60,500 at , and the remaining $44,950 at This means total taxes of an average tax rate of of his $150,000 earnings. As the secondary earner, if the wife accepts the job offer, her entire income would be taxed at since the lower tax rates and standard deduction have already been applied to the primary earner's (husband's) income. Her effective tax rate is significantly higher than his is, and she may also need to pay for childcare if she accepts the job offer as well. It would be no surprise if this impacted her decision on whether to accept the job offer or not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started