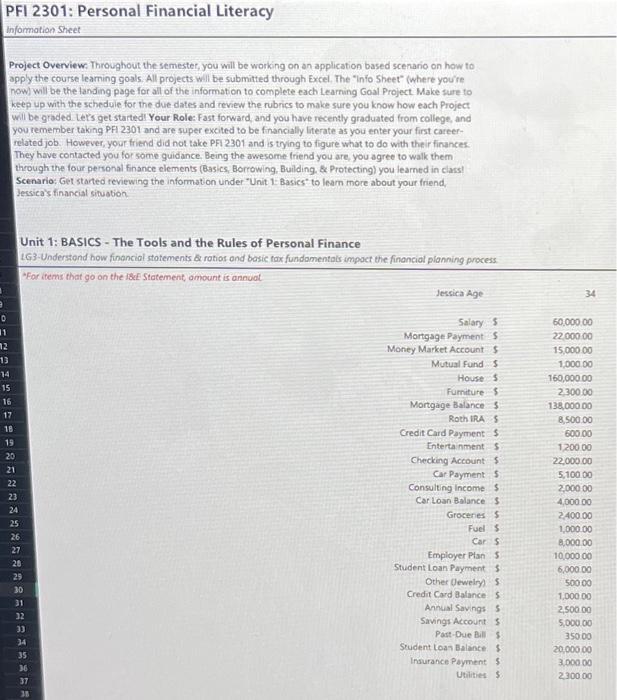

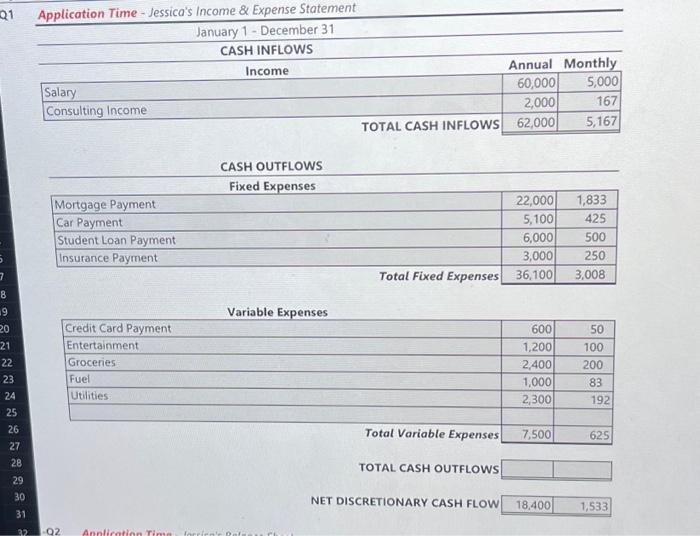

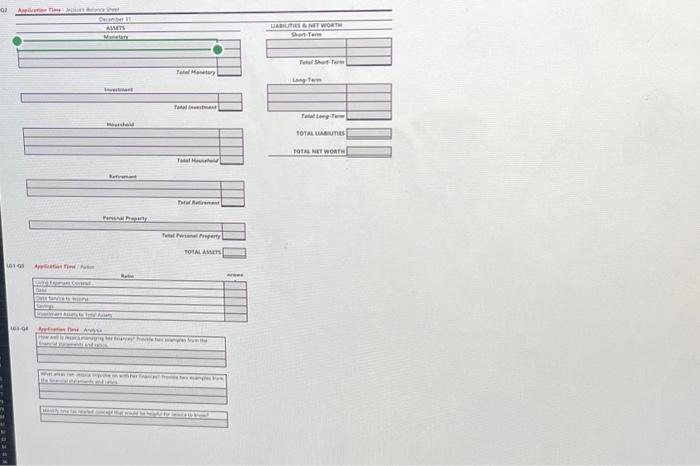

Q1 Application Time - Jessica's Income \& Expense Statement January 1 - December 31 CASH INFLOWS \begin{tabular}{|lr|r|r|} \hline \multicolumn{1}{c}{ Income } & Annual & Monthly \\ \hline Salary & & 60,000 & 5,000 \\ \hline Consulting Income & & 2,000 & 167 \\ \hline \end{tabular} CASH OUTFLOWS Fixed Expenses \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{l|}{ Fortgage Payment } & 22,000 & 1,833 \\ \hline Car Payment & 5,100 & 425 \\ \hline Student Loan Payment & 6,000 & 500 \\ \hline Insurance Payment & 3,000 & 250 \\ \hline \end{tabular} Variable Expenses TOTAL CASH OUTFLOWS NET DISCRETIONARY CASH FLOW 18,400 1,533 Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course leaming goals. All projects will be submitted through Excel, The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project Make sure to keep up with the scheduie for the due dates and review the rubrics to make sure you know how each Project Will be graded. Lets get startedi Your Role: Fast forward, and you have recently graduated from college, and you remember taking PF 2301 and are super excited to be financially literate as you enter your first careerrelated job. However, your friend did not take PFI2301 and is trying to figure what to do with their finances: They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance clements (Basics, Borrowing, Building. \& Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 1: Basics" to learn more about your friend, Jessica's financial situstion. Q1 Application Time - Jessica's Income \& Expense Statement January 1 - December 31 CASH INFLOWS \begin{tabular}{|lr|r|r|} \hline \multicolumn{1}{c}{ Income } & Annual & Monthly \\ \hline Salary & & 60,000 & 5,000 \\ \hline Consulting Income & & 2,000 & 167 \\ \hline \end{tabular} CASH OUTFLOWS Fixed Expenses \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{l|}{ Fortgage Payment } & 22,000 & 1,833 \\ \hline Car Payment & 5,100 & 425 \\ \hline Student Loan Payment & 6,000 & 500 \\ \hline Insurance Payment & 3,000 & 250 \\ \hline \end{tabular} Variable Expenses TOTAL CASH OUTFLOWS NET DISCRETIONARY CASH FLOW 18,400 1,533 Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course leaming goals. All projects will be submitted through Excel, The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project Make sure to keep up with the scheduie for the due dates and review the rubrics to make sure you know how each Project Will be graded. Lets get startedi Your Role: Fast forward, and you have recently graduated from college, and you remember taking PF 2301 and are super excited to be financially literate as you enter your first careerrelated job. However, your friend did not take PFI2301 and is trying to figure what to do with their finances: They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance clements (Basics, Borrowing, Building. \& Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 1: Basics" to learn more about your friend, Jessica's financial situstion