Answered step by step

Verified Expert Solution

Question

1 Approved Answer

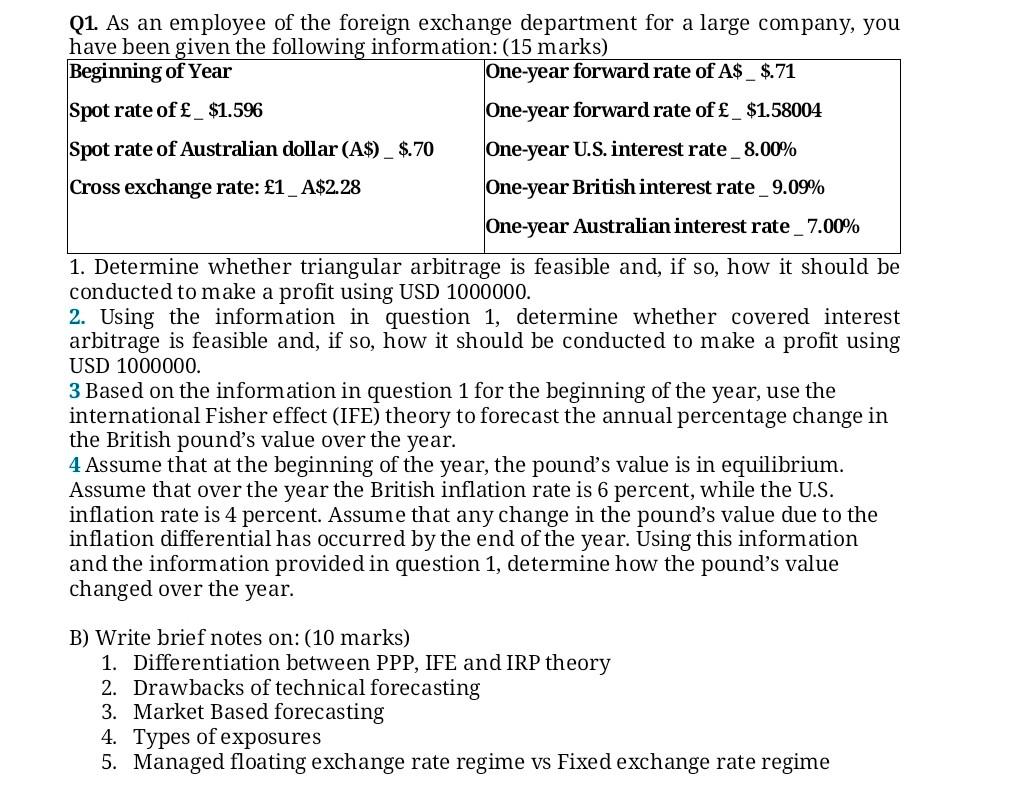

Q1. As an employee of the foreign exchange department for a large company, you have been given the following information: (15 marks) Beginning of Year

Q1. As an employee of the foreign exchange department for a large company, you have been given the following information: (15 marks) Beginning of Year One-year forward rate of A$_$.71 Spot rate of _$1.596 One-year forward rate of _$1.58004 Spot rate of Australian dollar (A$)_ $.70 One-year U.S. interest rate_8.00% Cross exchange rate: 1_A$2.28 One-year British interest rate_9.09% One-year Australian interest rate_ 7.00% 1. Determine whether triangular arbitrage is feasible and, if so, how it should be conducted to make a profit using USD 1000000. 2. Using the information in question 1, determine whether covered interest arbitrage is feasible and, if so, how it should be conducted to make a profit using USD 1000000. 3 Based on the information in question 1 for the beginning of the year, use the international Fisher effect (IFE) theory to forecast the annual percentage change in the British pound's value over the year. 4 Assume that at the beginning of the year, the pound's value is in equilibrium. Assume that over the year the British inflation rate is 6 percent, while the U.S. inflation rate is 4 percent. Assume that any change in the pound's value due to the inflation differential has occurred by the end of the year. Using this information and the information provided in question 1, determine how the pound's value changed over the year. B) Write brief notes on: (10 marks) 1. Differentiation between PPP, IFE and IRP theory 2. Drawbacks of technical forecasting 3. Market Based forecasting 4. Types of exposures 5. Managed floating exchange rate regime vs Fixed exchange rate regime Q1. As an employee of the foreign exchange department for a large company, you have been given the following information: (15 marks) Beginning of Year One-year forward rate of A$_$.71 Spot rate of _$1.596 One-year forward rate of _$1.58004 Spot rate of Australian dollar (A$)_ $.70 One-year U.S. interest rate_8.00% Cross exchange rate: 1_A$2.28 One-year British interest rate_9.09% One-year Australian interest rate_ 7.00% 1. Determine whether triangular arbitrage is feasible and, if so, how it should be conducted to make a profit using USD 1000000. 2. Using the information in question 1, determine whether covered interest arbitrage is feasible and, if so, how it should be conducted to make a profit using USD 1000000. 3 Based on the information in question 1 for the beginning of the year, use the international Fisher effect (IFE) theory to forecast the annual percentage change in the British pound's value over the year. 4 Assume that at the beginning of the year, the pound's value is in equilibrium. Assume that over the year the British inflation rate is 6 percent, while the U.S. inflation rate is 4 percent. Assume that any change in the pound's value due to the inflation differential has occurred by the end of the year. Using this information and the information provided in question 1, determine how the pound's value changed over the year. B) Write brief notes on: (10 marks) 1. Differentiation between PPP, IFE and IRP theory 2. Drawbacks of technical forecasting 3. Market Based forecasting 4. Types of exposures 5. Managed floating exchange rate regime vs Fixed exchange rate regime

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started