Answered step by step

Verified Expert Solution

Question

1 Approved Answer

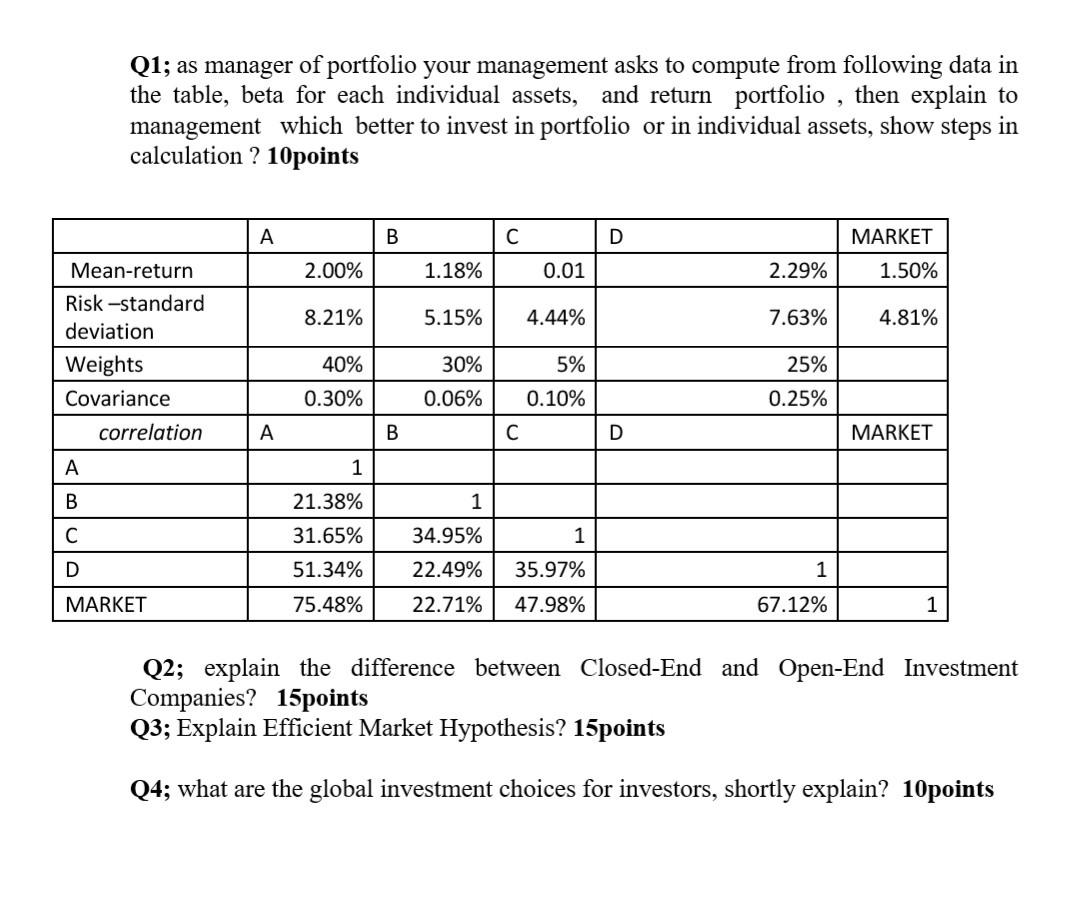

Q1; as manager of portfolio your management asks to compute from following data in the table, beta for each individual assets, and return portfolio ,

Q1; as manager of portfolio your management asks to compute from following data in the table, beta for each individual assets, and return portfolio , then explain to management which better to invest in portfolio or in individual assets, show steps in calculation ? 10points B D MARKET 1.50% 2.00% 1.18% 0.01 2.29% 8.21% 5.15% 4.44% 7.63% 4.81% Mean-return Risk-standard deviation Weights Covariance correlation 40% 25% 30% 0.06% 5% 0.10% 0.30% 0.25% A B C D MARKET A 1 B 21.38% 1 C 31.65% 1 D 34.95% 22.49% 22.71% 51.34% 75.48% 35.97% 1 67.12% MARKET 47.98% 1 Q2; explain the difference between Closed-End and Open-End Investment Companies? 15 points Q3; Explain Efficient Market Hypothesis? 15 points Q4; what are the global investment choices for investors, shortly explain? 10points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started