Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 b Risk-free Rate Portfolio Expected Return Portfolio Variance Portfolio Standard Deviation Portfolio Sharpe Ratio Covariance matrix Portfolio Expected Return Portfolio Variance Asset 1 Asset

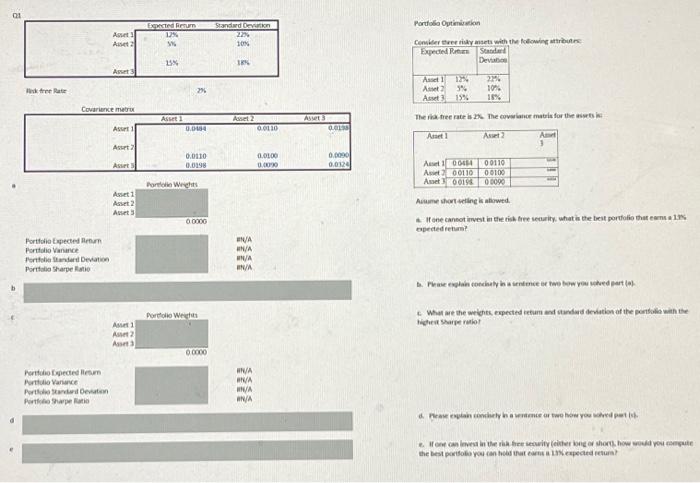

Q1 b Risk-free Rate Portfolio Expected Return Portfolio Variance Portfolio Standard Deviation Portfolio Sharpe Ratio Covariance matrix Portfolio Expected Return Portfolio Variance Asset 1 Asset 2 Portfolio Standard Deviation Portfolio Sharpe Ratio Asset 3 Asset 1 Asset 2 Asset 3 Asset 1 Asset 2 Asset 3 Asset 1 Asset 2 Asset 3 Expected Return 12% 5% 15% Asset 1 2% 0.0484 0.0110 0.0198 Portfolio Weights 0.0000 Portfolio Weights 0.0000 Standard Deviation 22% 10% 18% Asset 2 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A 0.0110 0.0100 0.0090 Asset 3 0.0198 0.0090 0.0324 Portfolio Optimization Consider three risky assets with the following attributes: Expected Return Asset 1 Asset 2 Asset 3 12% 5% 15% Asset 1 Standard Deviation 22% 10% 18% The risk-free rate is 2%. The covariance matrix for the assets is: Asset 2 Asset 1 0.0484 0.0110 0.0100 Asset 2 0.0110 Asset 3 0.0198 0.0090 Asset 3 Sam BALD Assume short-selling is allowed. a. If one cannot invest in the risk-free security, what is the best portfolio that earns a 13% expected return? b. Please explain concisely in a sentence or two how you solved part (a). c. What are the weights, expected return and standard deviation of the portfolio with the highest Sharpe ratio? d. Please explain concisely in a sentence or two how you solved part (c). e. If one can invest in the risk-free security (either long or short), how would you compute the best portfolio you can hold that earns a 13% expected return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started