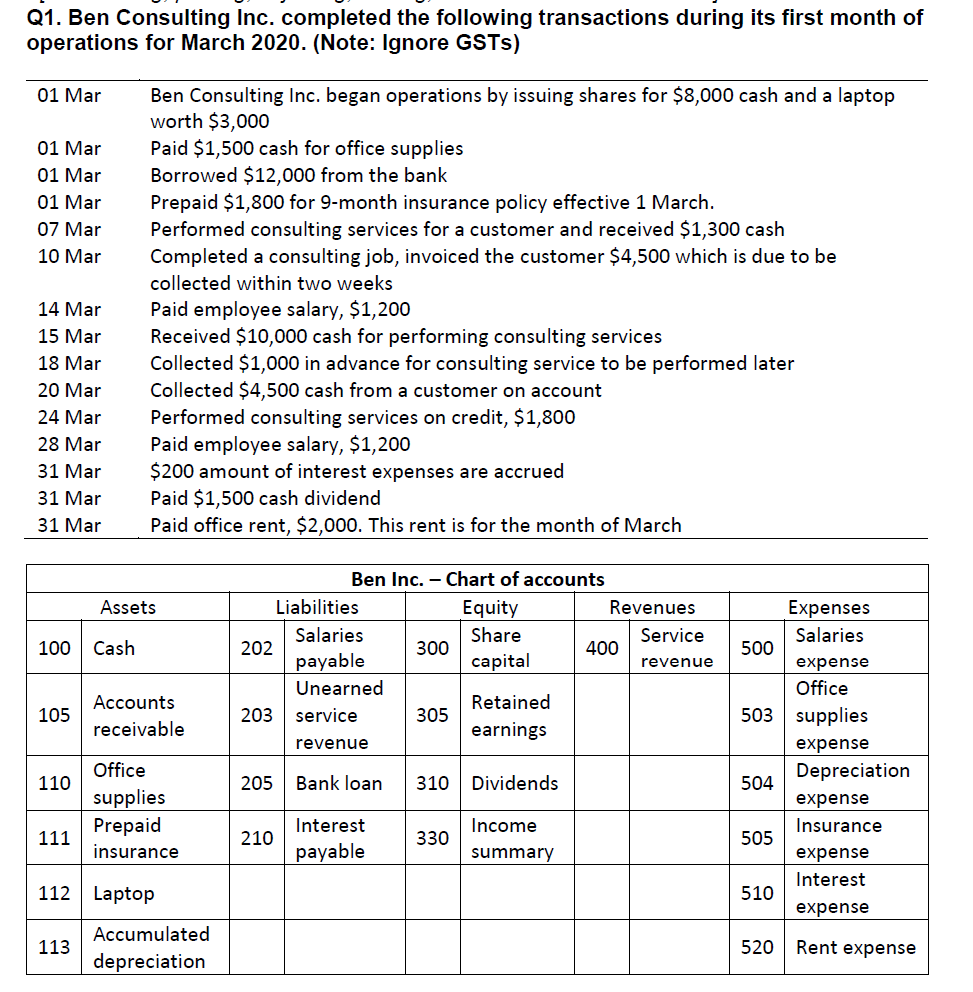

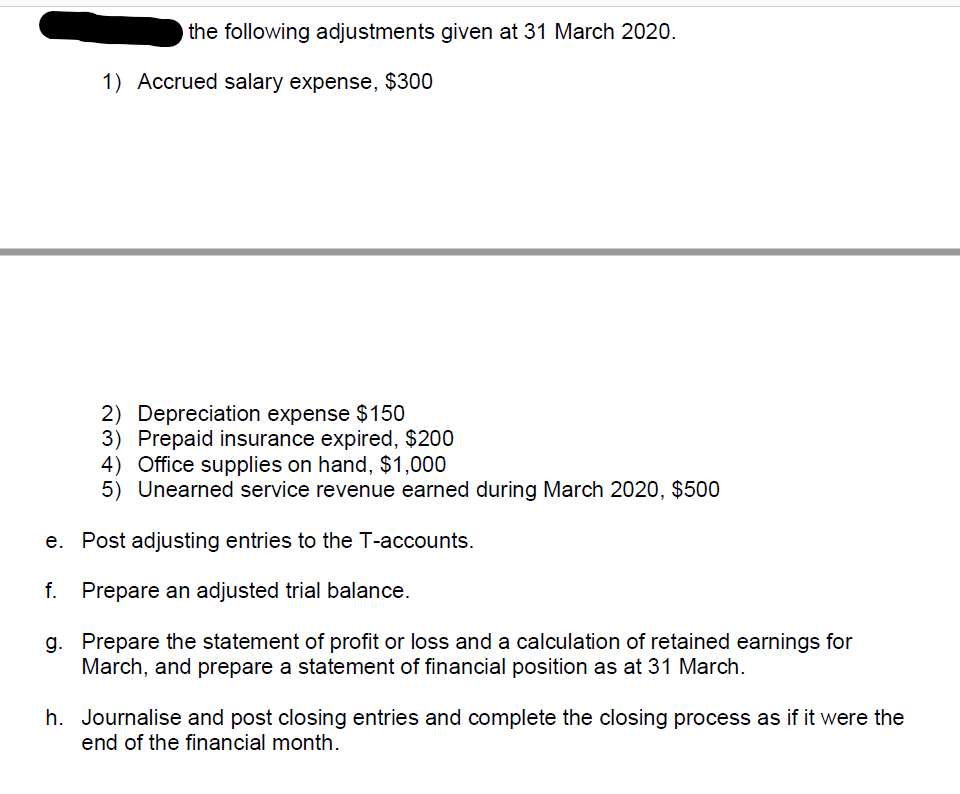

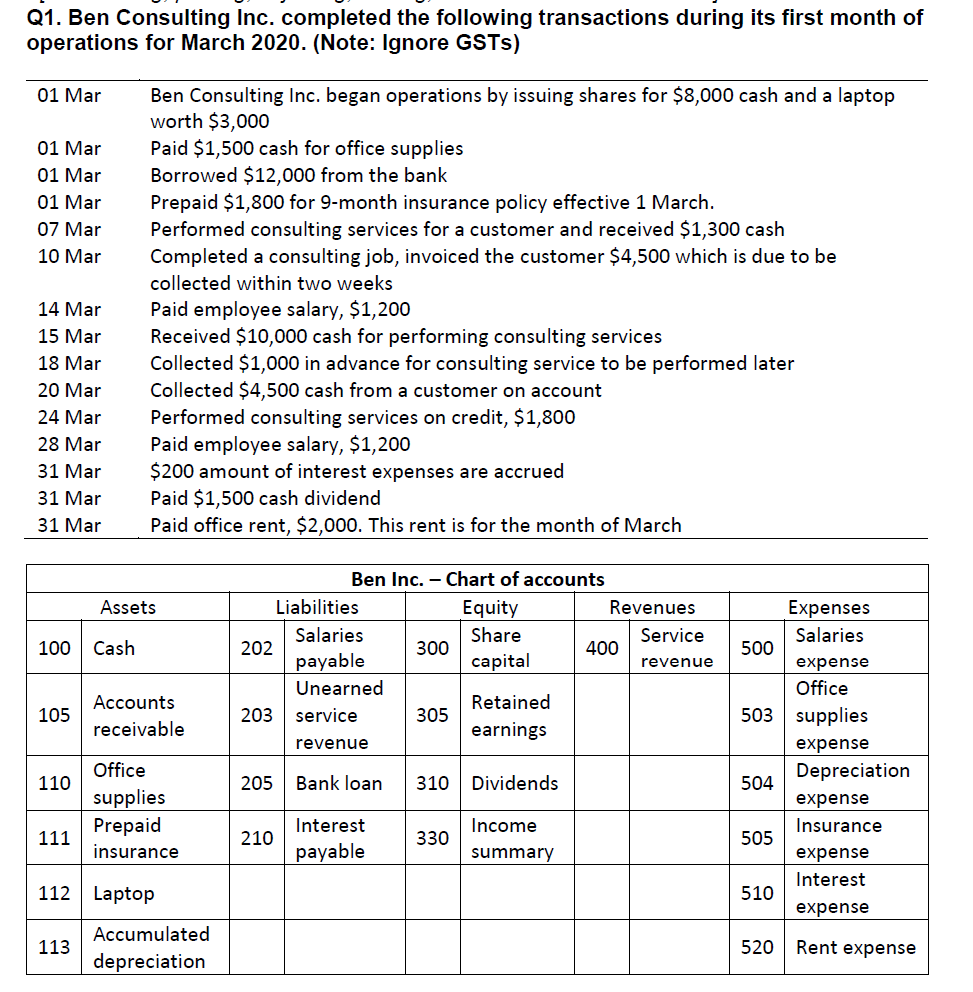

Q1. Ben Consulting Inc. completed the following transactions during its first month of operations for March 2020. (Note: Ignore GSTs) 01 Mar 01 Mar 01 Mar 01 Mar 07 Mar 10 Mar 14 Mar 15 Mar 18 Mar 20 Mar 24 Mar 28 Mar 31 Mar 31 Mar 31 Mar Ben Consulting Inc. began operations by issuing shares for $8,000 cash and a laptop worth $3,000 Paid $1,500 cash for office supplies Borrowed $12,000 from the bank Prepaid $1,800 for 9-month insurance policy effective 1 March. Performed consulting services for a customer and received $1,300 cash Completed a consulting job, invoiced the customer $4,500 which is due to be collected within two weeks Paid employee salary, $1,200 Received $10,000 cash for performing consulting services Collected $1,000 in advance for consulting service to be performed later Collected $4,500 cash from a customer on account Performed consulting services on credit, $1,800 Paid employee salary, $1,200 $200 amount of interest expenses are accrued Paid $1,500 cash dividend Paid office rent, $2,000. This rent is for the month of March Assets 100 Cash 202 500 Ben Inc. - Chart of accounts Liabilities Equity Revenues Salaries Share Service 400 300 payable capital revenue Unearned Retained 203 service 305 earnings revenue 105 Accounts receivable Expenses Salaries expense Office supplies expense Depreciation expense Insurance expense Interest expense 110 205 Bank loan 310 Dividends Office supplies Prepaid insurance 111 210 Interest payable 330 Income summary 112 Laptop 113 Accumulated depreciation Rent expense the following adjustments given at 31 March 2020. 1) Accrued salary expense, $300 2) Depreciation expense $150 3) Prepaid insurance expired, $200 4) Office supplies on hand, $1,000 5) Unearned service revenue earned during March 2020, $500 e. Post adjusting entries to the T-accounts. f. Prepare an adjusted trial balance. g. Prepare the statement of profit or loss and a calculation of retained earnings for March, and prepare a statement of financial position as at 31 March. h. Journalise and post closing entries and complete the closing process as if it were the end of the financial month