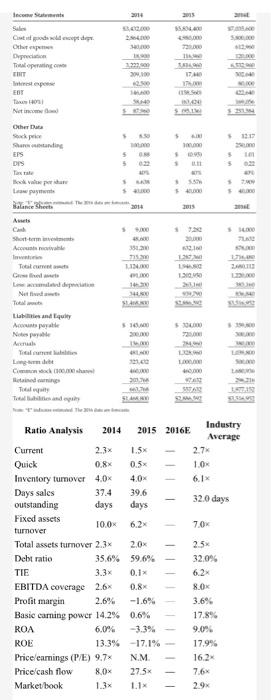

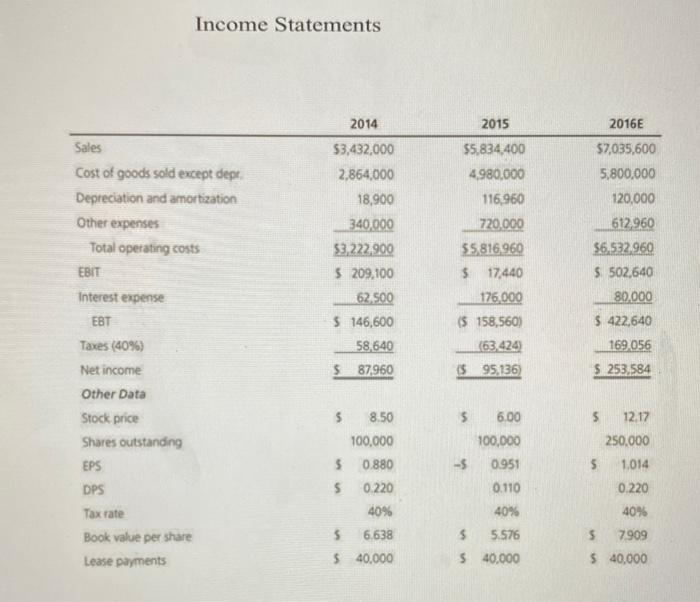

Q1: calculate the 2016 price/earnings ratio and market/ book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company?

Q2: use the DuPont equation yo provide a summary and overview of D'Leon's financial conditions as projected dor 2016. What are the firm's major strengths and weaknesses?

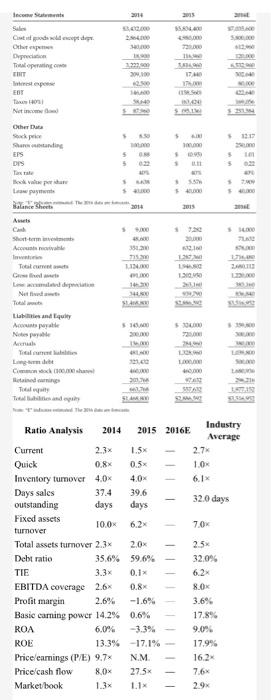

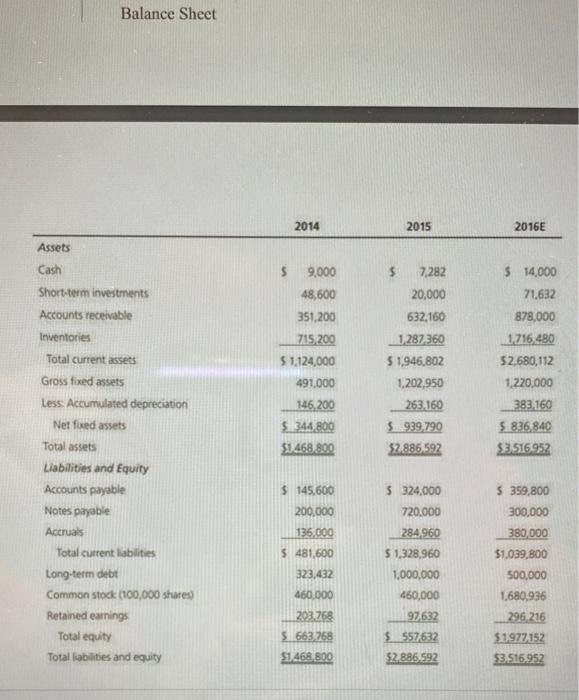

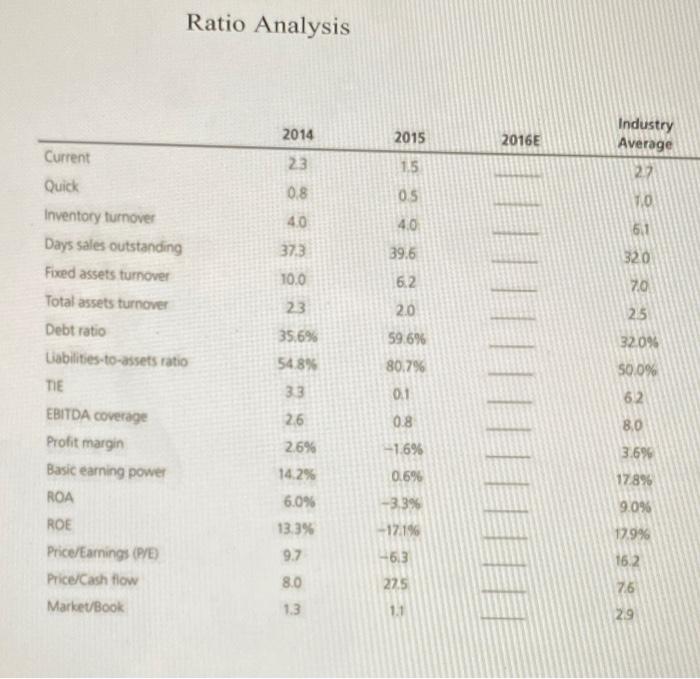

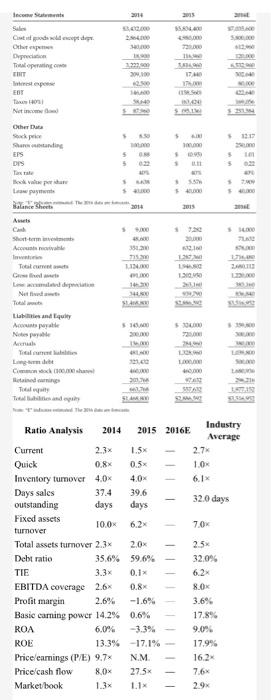

Incow State Se Copy 2014 3,000 Depec Talope 100 WE ENT Other EPS DIS Taxtale 5022 1 w punta 2015 17 A C Short-term Acom 350 12 Tot cum Celine LO MO 130 Netfm SA Labies and Equity Aconse Notes 50 LO Lange Chamel 1 00 30 Tite BATAN TOR 524 Ratio Analysis 2014 2015 2016 Industry Average 2.7% 1.0% 6.1% 32.0 days 7.0 2.5% 32.0% Current 2.3 1.5% Quick 0.8 0.5% Inventory turnover 4.0x 4.0% Days sales 37.4 39.6 outstanding days days Fixed assets 10.0 turnover Total assets turnover 2.3 2.0% Dehu ratio 35.6% 59.6% TIE 3.3% 0.1% EBITDA coverage 2.6% 0.8% Profit margin 2.6% -1.6% Basic caming power 14.2% 0.6% ROA 6.0% -3.3% ROE 13.3% -17.19 Priceleamings (PE) 9.7% N.M Price cash flow 8.0% 27.5 Market book 1.3 1.1 8.0 3.6% 17.8% 9.09 162 7.6% 2.9% Balance Sheet 2014 2015 2016E Assets $ 9,000 48,600 351,200 715,200 $1,124,000 491.000 5 7,282 20,000 632,160 1.287.360 5 1,946,802 1,202,950 263.160 $ 939,790 52.886,592 $ 14,000 71.632 878,000 1.716,480 52.680,112 1.220,000 383.160 5 836,840 $3516952 146,200 $ 344 800 $1468.800 Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net foed assets Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debit Common stock (100,000 shares) Retained earnings Total equity Total abilities and equity $145.600 5 324,000 $ 359,800 200,000 136,000 $ 481,600 720.000 284.960 $ 1,328,960 1,000,000 460,000 97632 $557632 $2.886.592 300,000 380,000 $1,039,800 500,000 1.680.936 323,432 296,216 460.000 203.758 5663.268 $1.468.800 51.977152 $3.516.952 Income Statements 2016E Sales Cost of goods sold except dept Depreciation and amortization Other expenses Total operating costs EBIT Interest expense EBT Taxes (40%) Net income Other Data Stock price Shares outstanding EPS DPS Tax rate Book value per share Lease payments 2014 $3,432,000 2,864,000 18,900 340,000 $3,222,900 $ 209,100 62,500 $ 146,600 58,640 S87960 2015 $5.834.400 4.980,000 116,960 720,000 55.816 960 $ 17,440 176,000 (5 158,560) (63,424 $ 95,136) $7,035,600 5,800,000 120,000 612,960 $6.532.960 $ 502,640 80,000 $ 422,640 169 056 $ 253,584 $ 8.50 5 12.17 250,000 1,014 $ 5 6.00 100,000 -5 0951 0.110 40% $ 5.576 $ 40.000 100,000 $ 0.880 $ 0.220 40% 5 6.638 $ 40,000 0.220 40% 5 7909 $ 40,000 Ratio Analysis 2014 2015 2016E Industry Average 23 1,5 22 08 05 1.0 40 4.0 6.1 37.3 39.6 320 10.0 62 2.0 23 70 25 59.6% 35,6% 54.8% 320% 50.0% 80.7% Current Quick Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Debt ratio Labilities-to-assets ratio TIE EBITDA coverage Profit margin Basic earning power ROA ROE Price/Earnings (P/E Price/Cash flow MarketBook 33 62 0.1 08 8.0 -1.6% 26 2.6% 14.2% 6.0% 13.3% 9.7 0.6% -33% -17.1% 3.6% 178% 9.096 12.9% -6.3 162 8.0 275 13 76 29 11