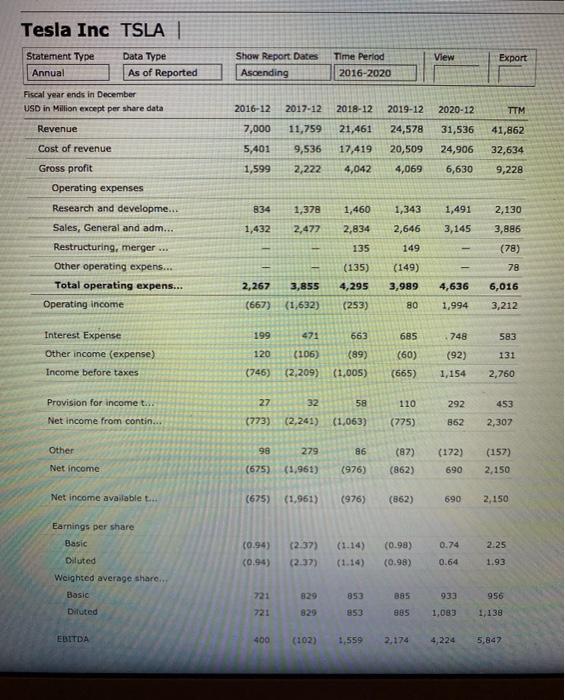

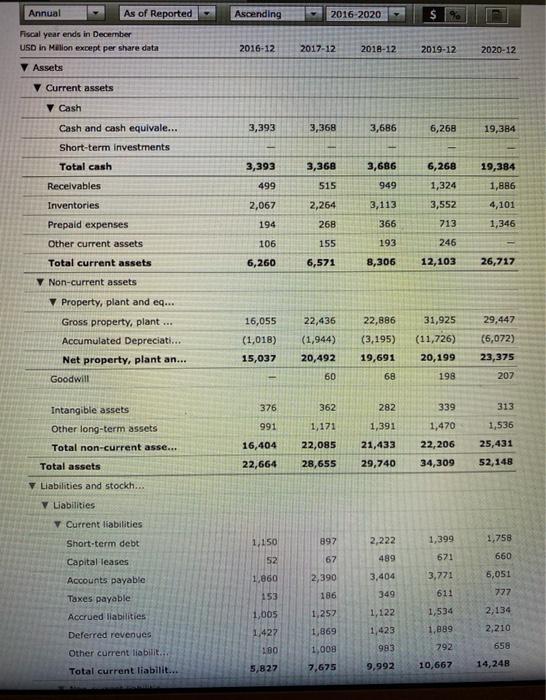

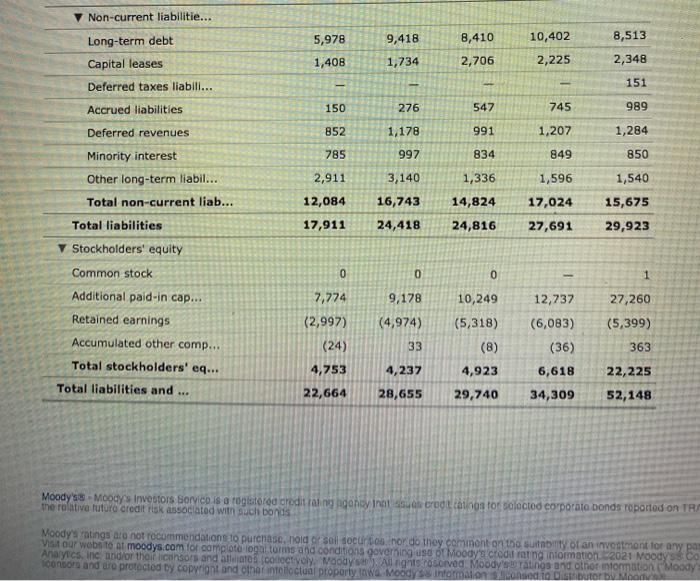

Q1. Calculate the three Dupont components and verify the Dupont identity for the years 2019 and 2020. (Profit margin, asset turnover, equity multiplier, and ROE). Q2. Discuss the change in each component and its impact on the overall profitability for the TSLA equityholders. Tesla Inc TSLA | View Export Statement Type Annual Data Type As of Reported Show Report Dates Ascending Time Period 2016-2020 Fiscal year ends in December USD in Million except per share data 2016-12 2017-12 2018-12 2019-12 2020-12 TTM Revenue 7,000 11,759 21,461 24,578 31,536 Cost of revenue 5,401 9,536 17,419 24,906 20,509 4,069 41,862 32,634 9,228 1,599 2,222 4,042 6,630 834 1,378 1,460 1,343 1,491 1,432 2,477 2,834 3,145 Gross profit Operating expenses Research and developme... Sales, General and adm... Restructuring, merger Other operating expens... Total operating expens... Operating income 2,646 149 2,130 3,886 (78) - 135 78 (149) 3,989 3,855 (135) 4,295 (253) 2,267 (667) 4,636 1,994 6,016 3,212 (1,632) 80 199 471 663 685 748 583 Interest Expense Other income (expense) Income before taxes 120 (89) (92) 131 (106) (2,209) (60) (665) (746) (1,005) 1,154 2,760 Provision for income to 27 32 58 110 292 453 Net income from contin... (773) (2,241) (1,063) (775) 852 2,307 Other 98 279 86 (87) (862) (172) 690 (157) 2,150 Net Income (675) (1,961) (976) Net income available to (675) (1,961) (976) (862) 690 2,150 Earnings per share Basic Diluted (1.14) 0.74 2.25 (0.94) (0.94) (2.37) (2.37 (0.98) (0.98) 0.64 1.93 Weighted average share Basic 721 329 853 956 885 885 933 1,083 Diluted 721 853 1,138 EBITDA 400 (102) 1,559 2,174 4,224 5,847 Annual As of Reported Ascending 2016-2020 S Fiscal year ends in December USD in Milion except per share data Assets 2016-12 2017-12 2018-12 2019-12 2020-12 V Current assets V Cash 3,393 3,368 3,686 6,268 19,384 Cash and cash equivale... Short-term investments Total cash 3,393 3,368 3,686 6,268 19,384 Receivables 499 515 949 1,324 1,886 4,101 Inventories 2,067 2,264 3,113 3,552 194 268 366 713 1,346 Prepaid expenses Other current assets Total current assets 106 155 193 246 6,260 6,571 8,306 12, 103 26,717 Non-current assets 22,436 29,447 Property, plant and eq... Gross property, plant... Accumulated Depreciati... Net property, plant an... Goodwill 16,055 (1,018) 15,037 (1,944) 22,886 (3,195) 19,691 31,925 (11,726) 20,199 198 20,492 (6,072) 23,375 207 60 68 376 362 282 339 313 Intangible assets Other long-term assets Total non-current asse... 991 1,171 22,085 1,391 21,433 29,740 1,536 25,431 16,404 22,664 1,470 22,206 34,309 Total assets 28,655 52,148 Liabilities and stockh... Liabilities Current liabilities 997 1.150 2,222 1,758 1,399 52 Short-term debt Capital leases Accounts payable 67 489 671 1,860 2,390 3,771 3,404 349 660 6,051 777 2,134 153 186 611 Taxes payable Accrued liabilities 1,005 1,257 1,427 1,122 1,423 983 1,869 1,008 1,534 1,889 792 Deferred revenues Other current liabilit... Total current liabilit... 2,210 658 18 5,827 7.675 9,992 10,667 14,248 Non-current liabilitie... 9,418 8,410 Long-term debt Capital leases 5,978 1,408 10,402 2,225 1,734 2,706 8,513 2,348 151 Deferred taxes liabili... Accrued liabilities 150 276 547 745 989 Deferred revenues 852 1,178 991 1,207 1,284 785 997 834 849 850 Minority interest Other long-term liabil... Total non-current liab... 2,911 1,336 1,596 1,540 3,140 16,743 24,418 12,084 17,911 17,024 14,824 24,816 15,675 29,923 Total liabilities 27,691 0 0 0 1 Stockholders' equity Common stock Additional paid-in cap... Retained earnings 9,178 (4,974) 27,260 (5,399) 7,774 (2,997) (24) 4,753 22,664 Accumulated other comp... Total stockholders' eq... Total liabilities and ... 33 10,249 (5,318) (8) 4,923 29,740 12,737 (6,083) (36) 6,618 363 4,237 22,225 52,148 28,655 34,309 Moody'ss - Moody's investors Sorvie is a registered credit al ng pancy in credit tatinos tor solactod eorporate bonds reported on TRA the rolative futuro credit risk associated with such bonus Moody ratings are not recommendations to purchase, nold Soil socuros nor do they comment on the suitabity of an investment for any pas via our websito at moodys.com for complota logul cars and conditions governing use of Moody's credit rating intomation 2021 Moody's Co Analyecs, Inc and or their consors and to collectively. Woody All nights reserved Moody's ratings and other intomaton "Moody concora and are protected by copyright and other into lo cual properly towa. Moodyss information concedio buto bu Ma