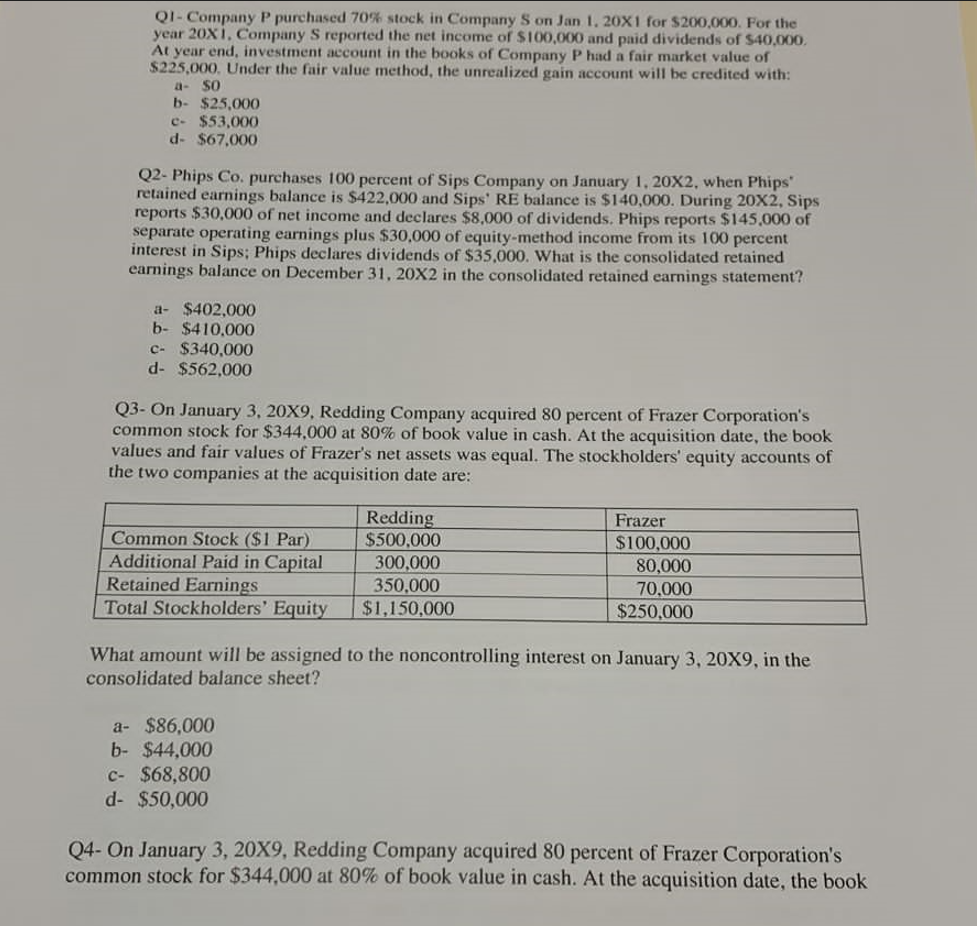

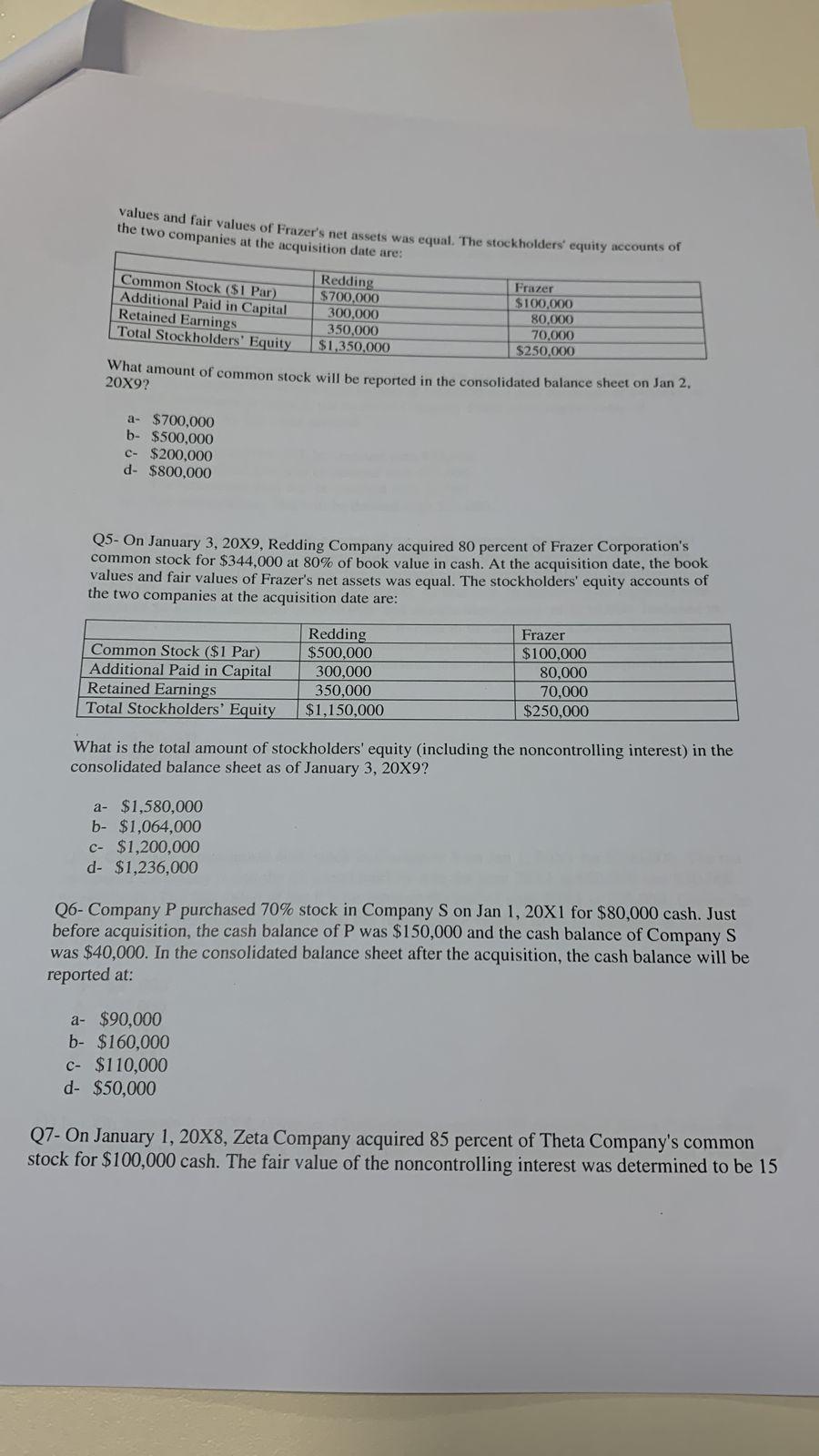

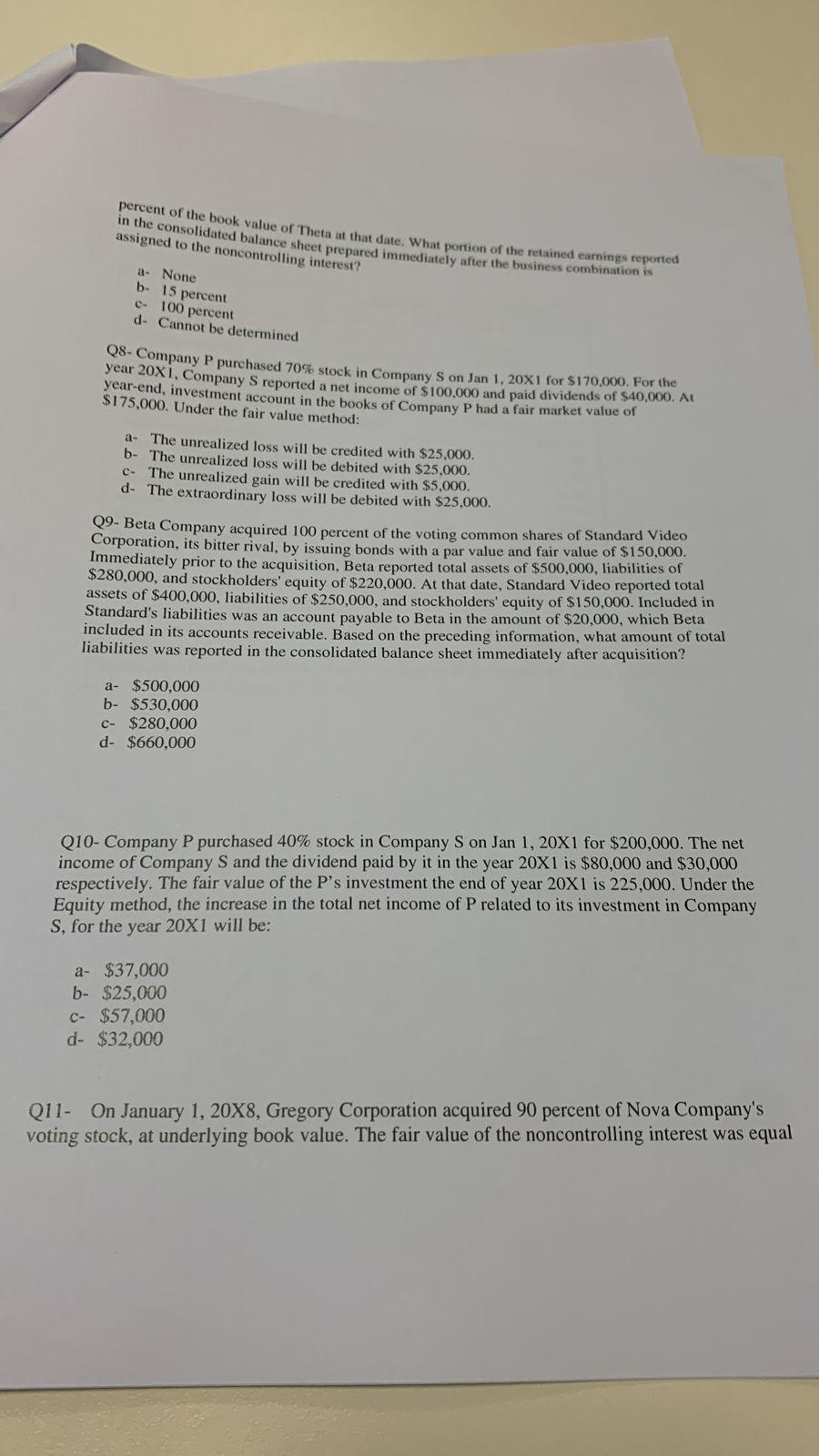

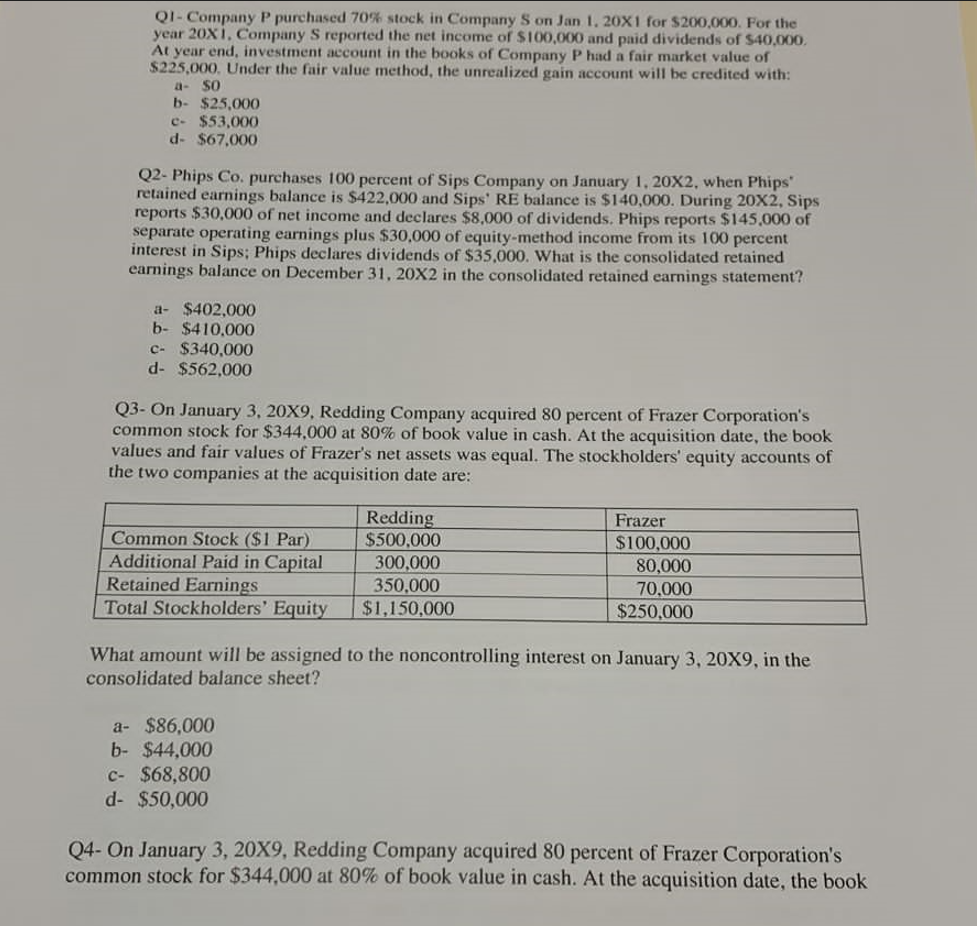

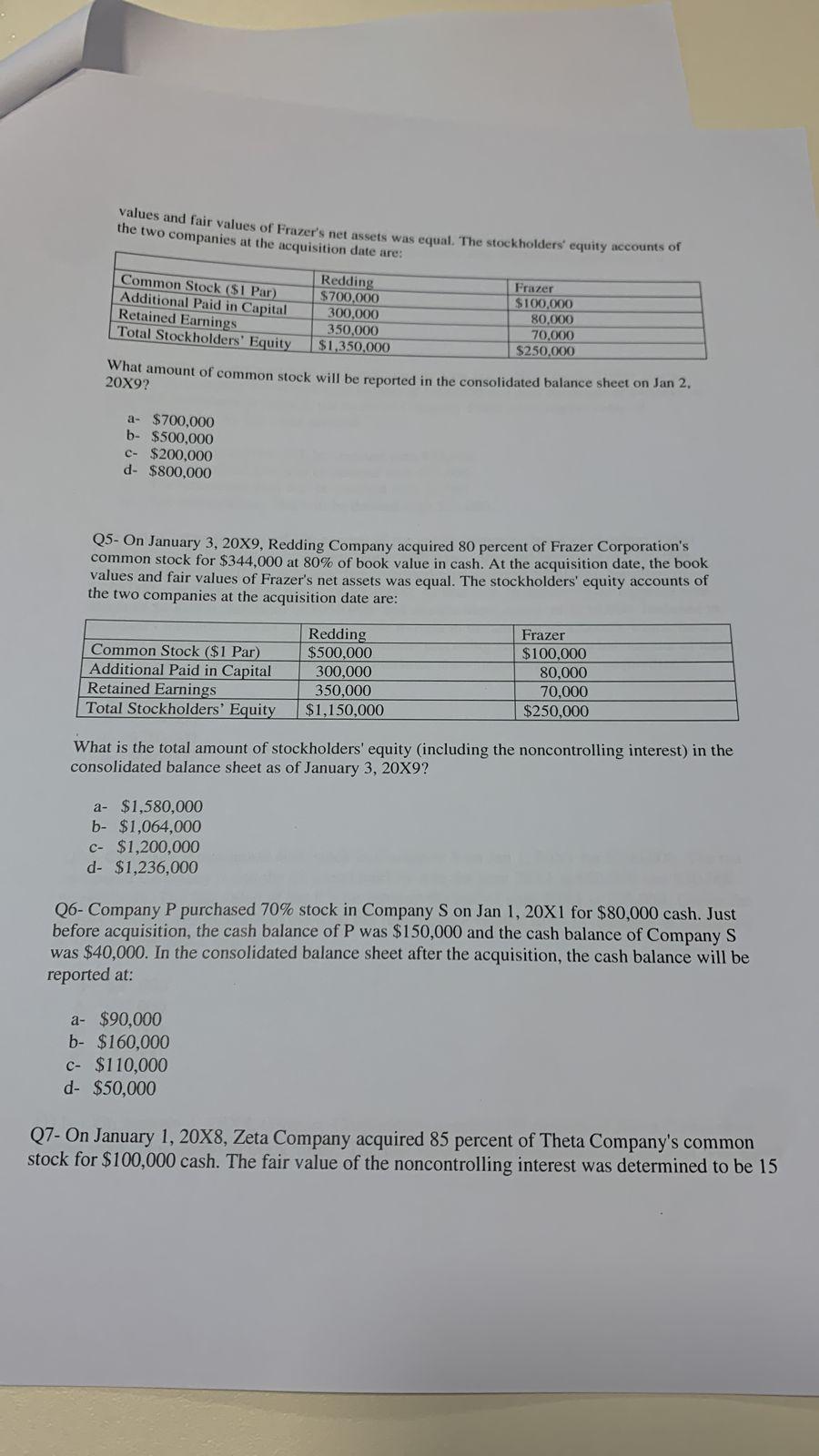

Q1- Company P purchased 70% stock in Company S on Jan 1, 20X1 for $200,000. For the year 20X1. Company S reported the net income of $100,000 and paid dividends of $40,000 At year end, investment account in the books of Company P had a fair market value of $225,000. Under the fair value method, the unrealized gain account will be credited with: a- 50 b- $25,000 c- $53,000 d- $67,000 Q2- Phips Co. purchases 100 percent of Sips Company on January 1, 20X2, when Phips' retained earnings balance is $422,000 and Sips' RE balance is $140,000. During 20X2, Sips reports $30,000 of net income and declares $8,000 of dividends. Phips reports $145,000 of separate operating earnings plus $30,000 of equity-method income from its 100 percent interest in Sips; Phips declares dividends of $35,000. What is the consolidated retained earnings balance on December 31,20X2 in the consolidated retained earnings statement? a- $402,000 b- $410,000 c- $340,000 d- $562,000 Q3- On January 3, 20X9, Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 at 80% of book value in cash. At the acquisition date, the book values and fair values of Frazer's net assets was equal. The stockholders' equity accounts of the two companies at the acquisition date are: What amount will be assigned to the noncontrolling interest on January 3,209, in the consolidated balance sheet? a- $86,000 b- $44,000 c- $68,800 d- $50,000 Q4- On January 3, 20X9, Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 at 80% of book value in cash. At the acquisition date, the book values and fair values of Frazer's net assets was equal. The stockholders' equity accounts of the two companies at the acquisition date are: What amount of common stock will be reported in the consolidated balance sheet on Jan 2 . 209? a- $700,000 b- $500,000 c- $200,000 d- $800,000 Q5- On January 3, 20X9, Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 at 80% of book value in cash. At the acquisition date, the book values and fair values of Frazer's net assets was equal. The stockholders' equity accounts of the two companies at the acquisition date are: What is the total amount of stockholders' equity (including the noncontrolling interest) in the consolidated balance sheet as of January 3,20X9 ? a- $1,580,000 b- $1,064,000 c- $1,200,000 d- $1,236,000 Q6- Company P purchased 70\% stock in Company S on Jan 1, 20X1 for $80,000 cash. Just before acquisition, the cash balance of P was $150,000 and the cash balance of Company S was $40,000. In the consolidated balance sheet after the acquisition, the cash balance will be reported at: a- $90,000 b- $160,000 c- $110,000 d- $50,000 Q7- On January 1, 20X8, Zeta Company acquired 85 percent of Theta Company's common stock for $100,000 cash. The fair value of the noncontrolling interest was determined to be 15 percent of the book value of Theta at that date. What portion of the retained earnings reported in the consolidated balance sheet prepared immediately after the business combination is assigned to the noncontrolling interest? a- None b- 15 percent c- 100 percent d- Cannot be determined Q8- Company P purchased 70\% stock in Company S on Jan 1, 20X1 for $170,000. For the year 20X1, Company S reported a net income of $100,000 and paid dividends of $40,000. At year-end, investment account in the books of Company P had a fair market value of $175,000. Under the fair value method: a- The unrealized loss will be credited with $25,000. b- The unrealized loss will be debited with $25,000. c- The unrealized gain will be credited with $5,000. d- The extraordinary loss will be debited with $25,000. Q9- Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable. Based on the preceding information, what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition? a- $500,000 b- $530,000 c- $280,000 d- $660,000 Q10- Company P purchased 40\% stock in Company S on Jan 1, 20X1 for $200,000. The net income of Company S and the dividend paid by it in the year 20X1 is $80,000 and $30,000 respectively. The fair value of the P's investment the end of year 20X1 is 225,000 . Under the Equity method, the increase in the total net income of P related to its investment in Company S, for the year 20X1 will be: a- $37,000 b- $25,000 c- $57,000 d- $32,000 Q11- On January 1, 20X8, Gregory Corporation acquired 90 percent of Nova Company's voting stock, at underlying book value. The fair value of the noncontrolling interest was equal