Answered step by step

Verified Expert Solution

Question

1 Approved Answer

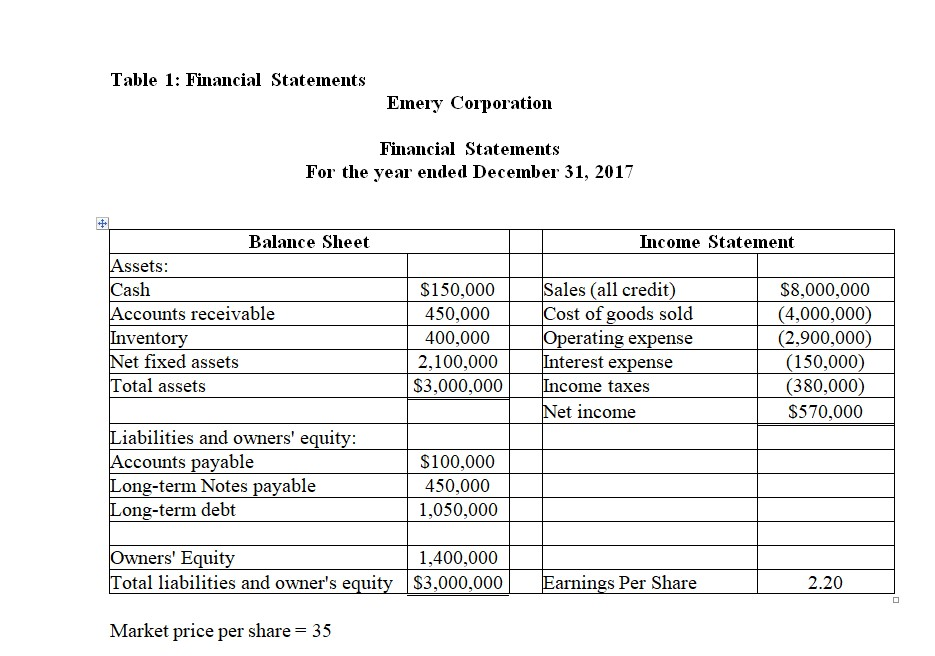

Q1- Compute the following: Current Ratio Quick Ratio Average Collection Period Operating Return on Assets Total Asset Turnover Inventory turnover Debt Ratio ROE Price Earnings

Q1- Compute the following:

- Current Ratio

- Quick Ratio

- Average Collection Period

- Operating Return on Assets

- Total Asset Turnover

- Inventory turnover

- Debt Ratio

- ROE

- Price Earnings Ratio

Table 1: Financial Statements Emery Corporation Financial Statements For the year ended December 31, 2017 Income Statement Balance Sheet Assets: Cash Accounts receivable Inventory Net fixed assets Total assets $150,000 450,000 400,000 2,100,000 $3,000,000 Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4,000,000) (2,900,000) (150,000) (380,000) $570,000 Liabilities and owners' equity: Accounts payable Long-term Notes payable Long-term debt | $100,000 450,000 1,050,000 Owners' Equity Total liabilities and owner's equity | 1,400,000 $3,000,000 Earnings Per Share 2.20 Market price per share = 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started