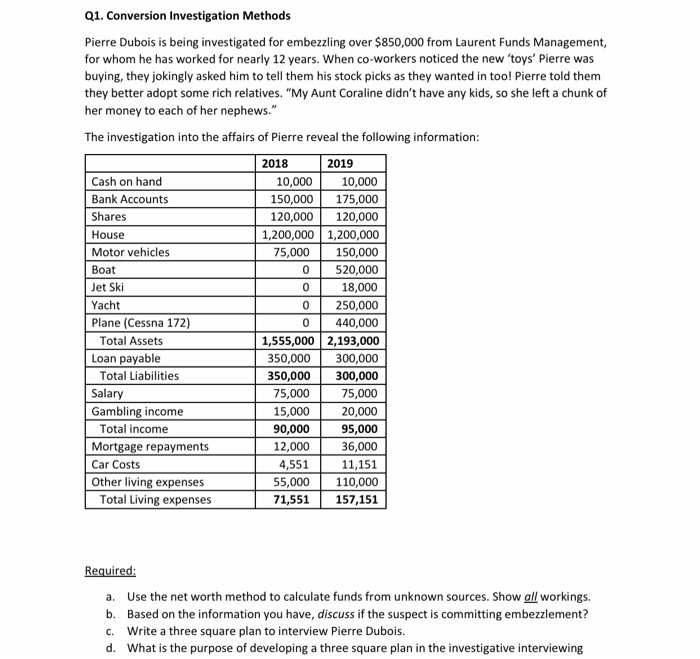

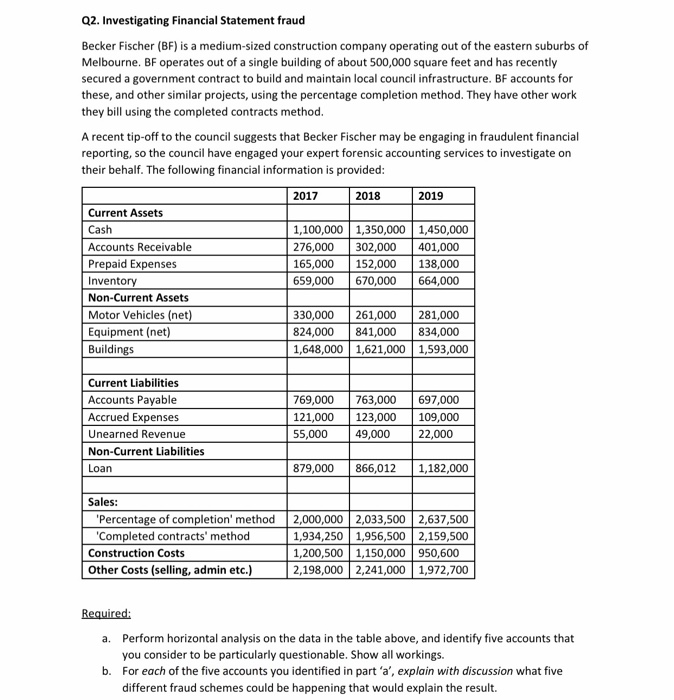

Q1. Conversion Investigation Methods Pierre Dubois is being investigated for embezzling over $850,000 from Laurent Funds Management, for whom he has worked for nearly 12 years. When co-workers noticed the new 'toys' Pierre was buying, they jokingly asked him to tell them his stock picks as they wanted in too! Pierre told them they better adopt some rich relatives. "My Aunt Coraline didn't have any kids, so she left a chunk of her money to each of her nephews." The investigation into the affairs of Pierre reveal the following information: 2018 2019 Cash on hand 10,000 10,000 Bank Accounts 150,000 175,000 Shares 120,000 120,000 House 1,200,000 1,200,000 Motor vehicles 75,000 150,000 Boat 520,000 Jet Ski 0 18,000 Yacht o 250,000 Plane (Cessna 172) 0 440,000 Total Assets 1,555,000 2,193,000 Loan payable 350,000 300,000 Total Liabilities 350,000 300,000 Salary 75,000 75,000 Gambling income 15,000 20,000 Total income 90,000 95,000 Mortgage repayments 12,000 36,000 Car Costs 4,551 11,151 Other living expenses 55,000 110,000 Total Living expenses 71,551 157,151 0 Required: a. Use the net worth method to calculate funds from unknown sources. Show all workings. b. Based on the information you have, discuss if the suspect is committing embezzlement? c. Write a three square plan to interview Pierre Dubois. d. What is the purpose of developing a three square plan in the investigative interviewing Q2. Investigating Financial Statement fraud Becker Fischer (BF) is a medium-sized construction company operating out of the eastern suburbs of Melbourne. BF operates out of a single building of about 500,000 square feet and has recently secured a government contract to build and maintain local council infrastructure. BF accounts for these and other similar projects, using the percentage completion method. They have other work they bill using the completed contracts method. A recent tip-off to the council suggests that Becker Fischer may be engaging in fraudulent financial reporting, so the council have engaged your expert forensic accounting services to investigate on their behalf. The following financial information is provided: 2017 2018 2019 Current Assets Cash 1,100,000 1,350,000 1,450,000 Accounts Receivable 276,000 302,000 401,000 Prepaid Expenses 165,000 152,000 138,000 Inventory 659,000 670,000 664,000 Non-Current Assets Motor Vehicles (net) 330,000 261,000 281,000 Equipment (net) 824,000 841,000 834,000 Buildings 1,648,000 1,621,000 1,593,000 Current Liabilities Accounts Payable Accrued Expenses Unearned Revenue Non-Current Liabilities Loan 769,000 121,000 55,000 763,000 123,000 49,000 697,000 109,000 22,000 879,000 866,012 1,182,000 Sales: 'Percentage of completion' method Completed contracts' method Construction Costs Other Costs (selling, admin etc.) 2,000,000 2,033,500 2,637,500 1,934,250 1,956,500 2,159,500 1,200,500 1,150,000 950,600 2,198,000 2,241,000 1,972,700 Required: a. Perform horizontal analysis on the data in the table above, and identify five accounts that you consider to be particularly questionable. Show all workings. b. For each of the five accounts you identified in part 'a', explain with discussion what five different fraud schemes could be happening that would explain the result. Q1. Conversion Investigation Methods Pierre Dubois is being investigated for embezzling over $850,000 from Laurent Funds Management, for whom he has worked for nearly 12 years. When co-workers noticed the new 'toys' Pierre was buying, they jokingly asked him to tell them his stock picks as they wanted in too! Pierre told them they better adopt some rich relatives. "My Aunt Coraline didn't have any kids, so she left a chunk of her money to each of her nephews." The investigation into the affairs of Pierre reveal the following information: 2018 2019 Cash on hand 10,000 10,000 Bank Accounts 150,000 175,000 Shares 120,000 120,000 House 1,200,000 1,200,000 Motor vehicles 75,000 150,000 Boat 520,000 Jet Ski 0 18,000 Yacht o 250,000 Plane (Cessna 172) 0 440,000 Total Assets 1,555,000 2,193,000 Loan payable 350,000 300,000 Total Liabilities 350,000 300,000 Salary 75,000 75,000 Gambling income 15,000 20,000 Total income 90,000 95,000 Mortgage repayments 12,000 36,000 Car Costs 4,551 11,151 Other living expenses 55,000 110,000 Total Living expenses 71,551 157,151 0 Required: a. Use the net worth method to calculate funds from unknown sources. Show all workings. b. Based on the information you have, discuss if the suspect is committing embezzlement? c. Write a three square plan to interview Pierre Dubois. d. What is the purpose of developing a three square plan in the investigative interviewing Q2. Investigating Financial Statement fraud Becker Fischer (BF) is a medium-sized construction company operating out of the eastern suburbs of Melbourne. BF operates out of a single building of about 500,000 square feet and has recently secured a government contract to build and maintain local council infrastructure. BF accounts for these and other similar projects, using the percentage completion method. They have other work they bill using the completed contracts method. A recent tip-off to the council suggests that Becker Fischer may be engaging in fraudulent financial reporting, so the council have engaged your expert forensic accounting services to investigate on their behalf. The following financial information is provided: 2017 2018 2019 Current Assets Cash 1,100,000 1,350,000 1,450,000 Accounts Receivable 276,000 302,000 401,000 Prepaid Expenses 165,000 152,000 138,000 Inventory 659,000 670,000 664,000 Non-Current Assets Motor Vehicles (net) 330,000 261,000 281,000 Equipment (net) 824,000 841,000 834,000 Buildings 1,648,000 1,621,000 1,593,000 Current Liabilities Accounts Payable Accrued Expenses Unearned Revenue Non-Current Liabilities Loan 769,000 121,000 55,000 763,000 123,000 49,000 697,000 109,000 22,000 879,000 866,012 1,182,000 Sales: 'Percentage of completion' method Completed contracts' method Construction Costs Other Costs (selling, admin etc.) 2,000,000 2,033,500 2,637,500 1,934,250 1,956,500 2,159,500 1,200,500 1,150,000 950,600 2,198,000 2,241,000 1,972,700 Required: a. Perform horizontal analysis on the data in the table above, and identify five accounts that you consider to be particularly questionable. Show all workings. b. For each of the five accounts you identified in part 'a', explain with discussion what five different fraud schemes could be happening that would explain the result