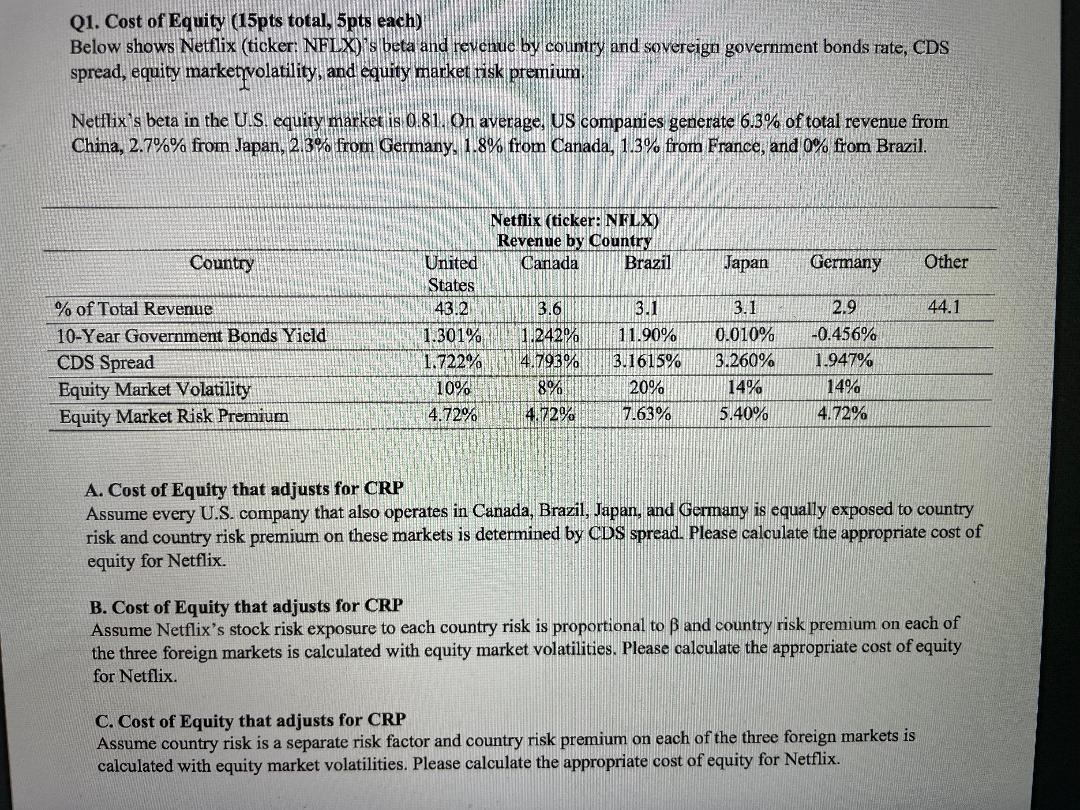

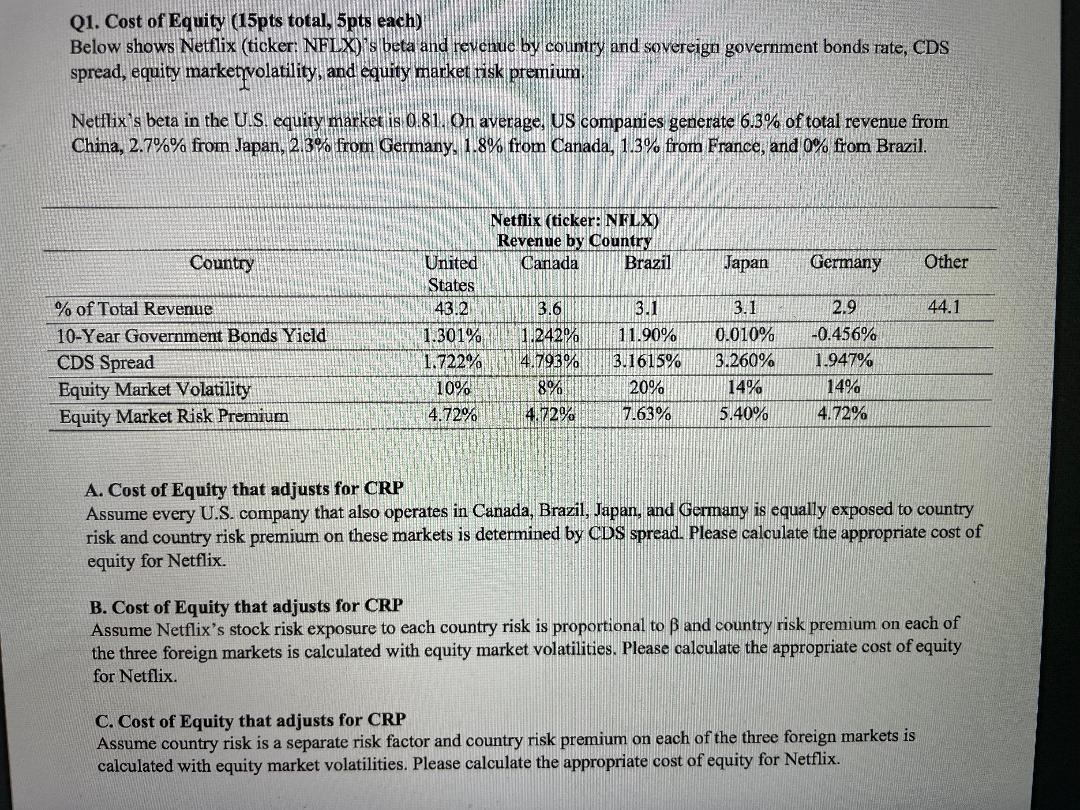

Q1. Cost of Equity (15pts total, 5pts each) Below shows Netflix (ticker: NFLX) 's beta and revenue by country and sovereign government bonds rate, CDS spread, equity marketyvolatility, and equity market risk premium, Netflix's beta in the U.S. equity market is 0.81. On average, US companies generate 6.3% of total revenue from China, 2.7%% from Japan, 2.3% from Germany. 1.8% from Canada, 1.3% from France, and 0% from Brazil. Netflix (ticker: NFLX) Revenue by Country Canada Brazil Country Japan Germany Other 44.1 % of Total Revenue 10-Year Government Bonds Yield CDS Spread Equity Market Volatility Equity Market Risk Premium United States 43.2 1.301% 1.722% 10% 4.72% 3.6 1.242% 4.793% 8% 4.72% 3.1 11.90% 3.1615% 20% 7.63% 3.1 0.010% 3.260% 14% 5.40% 2.9 -0.456% 1.947% 14% 4.72% A. Cost of Equity that adjusts for CRP Assume every U.S. company that also operates in Canada, Brazil, Japan, and Germany is equally exposed to country risk and country risk premium on these markets is determined by CDS spread. Please calculate the appropriate cost of equity for Netflix. B. Cost of Equity that adjusts for CRP Assume Netflix's stock risk exposure to each country risk is proportional to B and country risk premium on each of the three foreign markets is calculated with equity market volatilities. Please calculate the appropriate cost of equity for Netflix. C. Cost of Equity that adjusts for CRP Assume country risk is a separate risk factor and country risk premium on each of the three foreign markets is calculated with equity market volatilities. Please calculate the appropriate cost of equity for Netflix. Q1. Cost of Equity (15pts total, 5pts each) Below shows Netflix (ticker: NFLX) 's beta and revenue by country and sovereign government bonds rate, CDS spread, equity marketyvolatility, and equity market risk premium, Netflix's beta in the U.S. equity market is 0.81. On average, US companies generate 6.3% of total revenue from China, 2.7%% from Japan, 2.3% from Germany. 1.8% from Canada, 1.3% from France, and 0% from Brazil. Netflix (ticker: NFLX) Revenue by Country Canada Brazil Country Japan Germany Other 44.1 % of Total Revenue 10-Year Government Bonds Yield CDS Spread Equity Market Volatility Equity Market Risk Premium United States 43.2 1.301% 1.722% 10% 4.72% 3.6 1.242% 4.793% 8% 4.72% 3.1 11.90% 3.1615% 20% 7.63% 3.1 0.010% 3.260% 14% 5.40% 2.9 -0.456% 1.947% 14% 4.72% A. Cost of Equity that adjusts for CRP Assume every U.S. company that also operates in Canada, Brazil, Japan, and Germany is equally exposed to country risk and country risk premium on these markets is determined by CDS spread. Please calculate the appropriate cost of equity for Netflix. B. Cost of Equity that adjusts for CRP Assume Netflix's stock risk exposure to each country risk is proportional to B and country risk premium on each of the three foreign markets is calculated with equity market volatilities. Please calculate the appropriate cost of equity for Netflix. C. Cost of Equity that adjusts for CRP Assume country risk is a separate risk factor and country risk premium on each of the three foreign markets is calculated with equity market volatilities. Please calculate the appropriate cost of equity for Netflix