Answered step by step

Verified Expert Solution

Question

1 Approved Answer

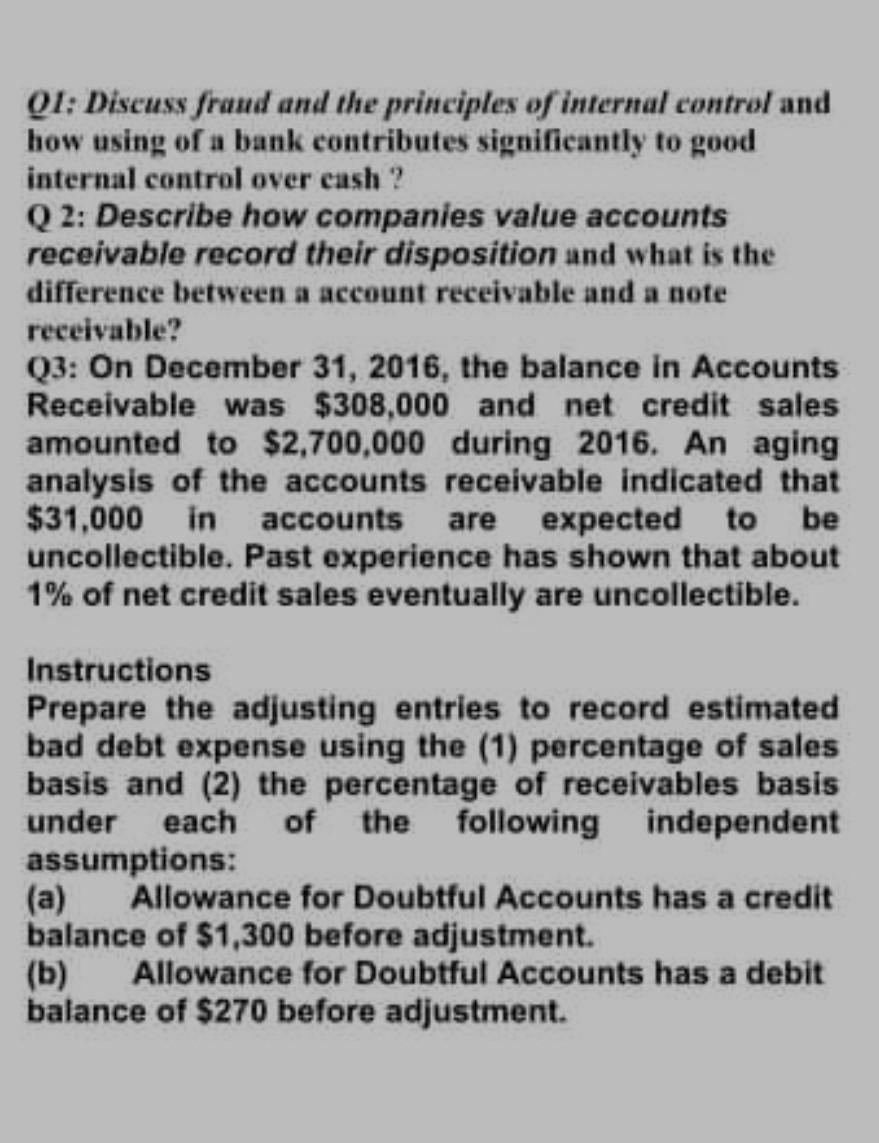

Q1: Discuss fraud and the principles of internal control and how using of a bank contributes significantly to good internal control over cash ? Q

Q1: Discuss fraud and the principles of internal control and how using of a bank contributes significantly to good internal control over cash ? Q 2: Describe how companies value accounts receivable record their disposition and what is the difference between a account receivable and a note receivable? Q3: On December 31, 2016, the balance in Accounts Receivable was $308,000 and net credit sales amounted to $2,700,000 during 2016. An aging analysis of the accounts receivable indicated that $31,000 in accounts are expected to be uncollectible. Past experience has shown that about 1% of net credit sales eventually are uncollectible. Instructions Prepare the adjusting entries to record estimated bad debt expense using the (1) percentage of sales basis and (2) the percentage of receivables basis under each of the following independent assumptions: (a) Allowance for Doubtful Accounts has a credit balance of $1,300 before adjustment. (b) Allowance for Doubtful Accounts has a debit balance of $270 before adjustment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started