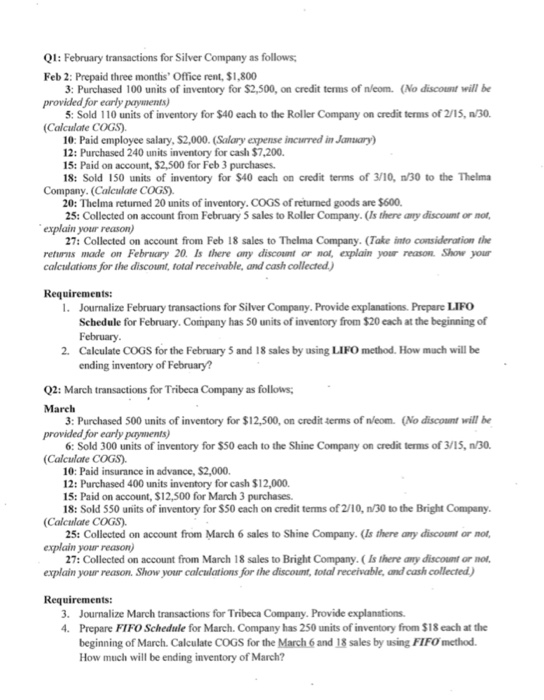

Q1: February transactions for Silver Company as follows Feb 2: Prepaid three months' Office rent, $1,800 3: Purchased 100 units of inventory for $2,500, on credit terms of n/com. (No discount will be provided for early peryments) 5: Sold 110 units of inventory for $40 each to the Roller Company on credit terms of 2/15, 1/30. (Calculate COGS). 10: Paid employee salary, $2,000. (Salary expense incurred in January) 12: Purchased 240 units inventory for cash $7,200. 15: Paid on account, $2,500 for Feb 3 purchases. 18: Sold 150 units of inventory for $40 each on credit terms of 3/10, 1/30 to the Thelma Company. (Calculate COGS). 20: Thelma retumed 20 units of inventory. COGS of returned goods are $600. 25: Collected on account from February 5 sales to Roller Company. (Is there any discount or not, explain your reason) 27: Collected on account from Feb 18 sales to Thelma Company. (Take into consideration the returns made on February 20. Is there any discount or not, explain your reason. Show your calculations for the discount, total receivable, and cash collected.) Requirements: 1. Journalize February transactions for Silver Company. Provide explanations. Prepare LIFO Schedule for February. Company has 50 units of inventory from $20 each at the beginning of February 2. Calculate COGS for the February 5 and 18 sales by using LIFO method. How much will be ending inventory of February? Q2: March transactions for Tribeca Company as follows; March 3: Purchased 500 units of inventory for $12,500, on credit terms of n/com. (No discount will be provided for early payments) 6: Sold 300 units of inventory for $50 each to the Shine Company on credit terms of 3/15, n/30. (Calculate COGS). 10: Paid insurance in advance, $2,000. 12: Purchased 400 units inventory for cash $12,000. 15: Paid on account, $12,500 for March 3 purchases. 18: Sold 550 units of inventory for $50 each on credit terms of 2/10, 1/30 to the Bright Company. (Calculate COGS). 25: Collected on account from March 6 sales to Shine Company. (Is there any discount or not, explain your reason) 27: Collected on account from March 18 sales to Bright Company. Is there any discount or not. explain your reason. Show your calculations for the discount, total receivable, and cash collected) Requirements: 3. Journalize March transactions for Tribeca Company. Provide explanations. 4. Prepare FIFO Schedule for March. Company has 250 units of inventory from $18 each at the beginning of March. Calculate COGS for the March 6 and 18 sales by using FIFO method. How much will be ending inventory of March