Question

Q1) For a 3 year bond with a face value of $100 and a coupon rate as well as a market rate of 7% CALCULATE

Q1) For a 3 year bond with a face value of $100 and a coupon rate as well as a market rate of 7% CALCULATE THE PRICE OF THE BOND AND THE BOND WILL SELL AT DISCOUNT, PAR OR PREMIUM AND WHY ?

Q2) Calculate the price of a 3 year bond with a face value of $10000, coupon rate of 7% annually and annual market yield of 7% annually. Coupon payments are made semi annually.

Q3) What is the yield to maturity for a 3- year bond with a face value of $100000, a coupon rate of 9%,and the current price of the bond is $75000. Coupon payments are made annually

Q4) What is the annual yield to maturity for a 10 year bond with a face value of $40000, a coupon rate of 3% being bought by an investor for $ 45000? Interest payments are made quarterly

Q5) A change in interest rates for two 10-year bonds with coupon rates of 6% and 9% respectively will sell at a discount premium or par and calculate the bond price

Q6) Securities with lower marketability have what ?

Q7) A 8 year bond with a face value of $100,000 and having a coupon rate of 8%. Coupon payments are made semi-annually. What's the present value of the first coupon payment?

Q8)Camila, as an investor, is interested in buying a preference share of a firm that pays a dividend of $0.40 every half year. If she discount such cash flows at 7% per annum, what is the price of the share?

Q9)Hawkins Ltd. has a perpetual preference share issue that pays a dividend $12 per year. Shareholders require a 12 per cent return on such an investment. What should be the price of the preference share??

Q10)Samsung's preference shares have an annual dividend of $5 (paid semi annually), a par value of $100, and an effective maturity of 20 years. If similar preference shares issues have market yields of 4%. Calculate the value of Samsung's share price.

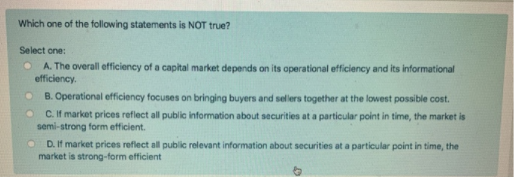

Q11) Refer to the below image and please solve the below given MCQ and provide an explanation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started