Answered step by step

Verified Expert Solution

Question

1 Approved Answer

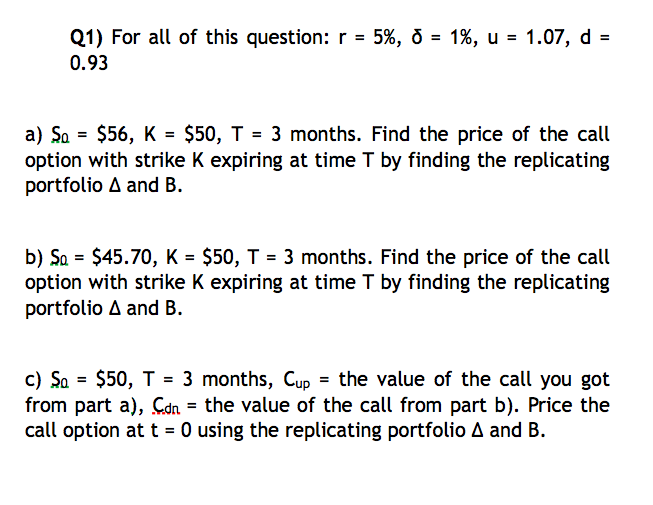

Q1) For all of this question: r = 5%, d = 1%, u = 1.07, d = 0.93 a) S = $56, K =

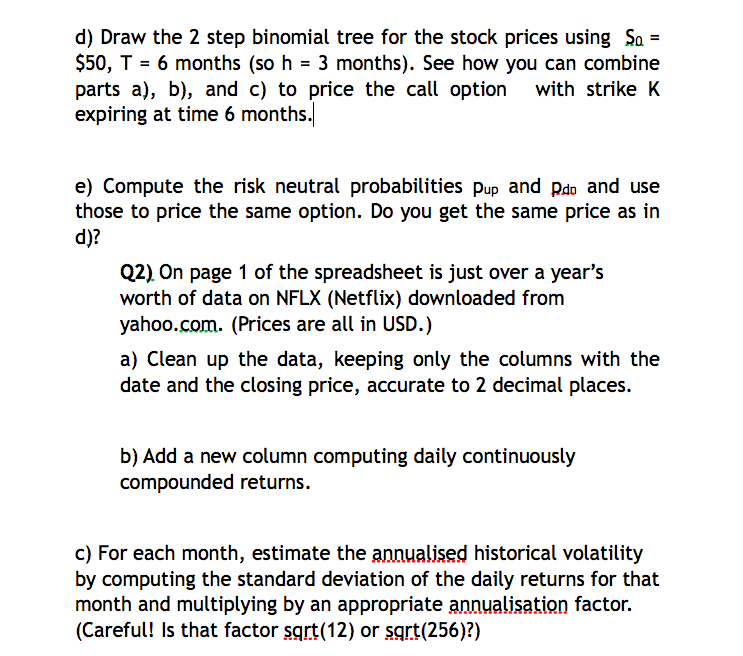

Q1) For all of this question: r = 5%, d = 1%, u = 1.07, d = 0.93 a) S = $56, K = $50, T = 3 months. Find the price of the call option with strike K expiring at time T by finding the replicating portfolio A and B. b) So $45.70, K = $50, T = 3 months. Find the price of the call option with strike K expiring at time T by finding the replicating portfolio A and B. = c) So $50, T = 3 months, Cup = the value of the call you got from part a), Cdn = the value of the call from part b). Price the call option at t = 0 using the replicating portfolio A and B. d) Draw the 2 step binomial tree for the stock prices using So = $50, T = 6 months (so h = 3 months). See how you can combine parts a), b), and c) to price the call option with strike K expiring at time 6 months. e) Compute the risk neutral probabilities pup and Pdo and use those to price the same option. Do you get the same price as in d)? Q2) On page 1 of the spreadsheet is just over a year's worth of data on NFLX (Netflix) downloaded from yahoo.com. (Prices are all in USD.) a) Clean up the data, keeping only the columns with the date and the closing price, accurate to 2 decimal places. b) Add a new column computing daily continuously compounded returns. c) For each month, estimate the annualised historical volatility by computing the standard deviation of the daily returns for that month and multiplying by an appropriate annualisation factor. (Careful! Is that factor sqrt(12) or sqrt(256)?) d) How realistic is the assumption that volatility is constant? Q3) On the second page of the spreadsheet, create a 4 step binomial tree model by replacing all the cells highlighted in yellow with the appropriate formula. (The cells highlighted in green are the inputs.) Use your completed spreadsheet to answer the following question: True/False: Doubling the volatility will double the price of an at the money call option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the questions we need to use the replicating portfolio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started