Answered step by step

Verified Expert Solution

Question

1 Approved Answer

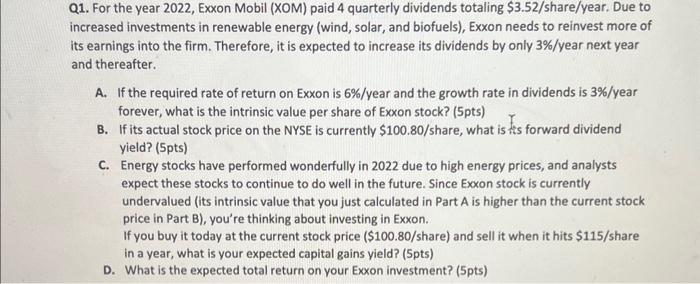

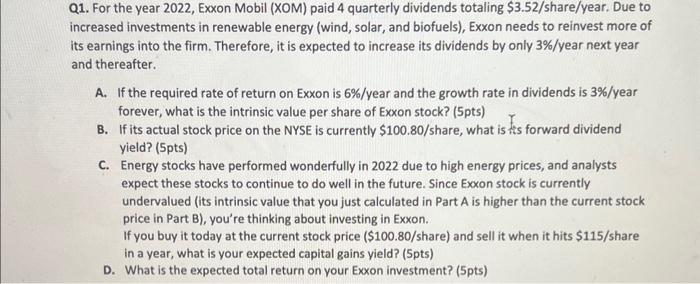

Q1. For the year 2022, Exxon Mobil (XOM) paid 4 quarterly dividends totaling $3.52/ share/year. Due to increased investments in renewable energy (wind, solar, and

Q1. For the year 2022, Exxon Mobil (XOM) paid 4 quarterly dividends totaling $3.52/ share/year. Due to increased investments in renewable energy (wind, solar, and biofuels), Exxon needs to reinvest more of its earnings into the firm. Therefore, it is expected to increase its dividends by only 3%/ year next year and thereafter. A. If the required rate of return on Exxon is 6%/year and the growth rate in dividends is 3%/year forever, what is the intrinsic value per share of Exxon stock? (5pts) B. If its actual stock price on the NYSE is currently $100.80/ share, what is its forward dividend yield? (5pts) C. Energy stocks have performed wonderfully in 2022 due to high energy prices, and analysts expect these stocks to continue to do well in the future. Since Exxon stock is currently undervalued (its intrinsic value that you just calculated in Part A is higher than the current stock price in Part B), you're thinking about investing in Exxon. If you buy it today at the current stock price ( $100.80/ share) and sell it when it hits $115/ share in a year, what is your expected capital gains yield? (5pts) D. What is the expected total return on your Exxon investment? (5pts)

Q1. For the year 2022, Exxon Mobil (XOM) paid 4 quarterly dividends totaling $3.52/ share/year. Due to increased investments in renewable energy (wind, solar, and biofuels), Exxon needs to reinvest more of its earnings into the firm. Therefore, it is expected to increase its dividends by only 3%/ year next year and thereafter. A. If the required rate of return on Exxon is 6%/year and the growth rate in dividends is 3%/year forever, what is the intrinsic value per share of Exxon stock? (5pts) B. If its actual stock price on the NYSE is currently $100.80/ share, what is its forward dividend yield? (5pts) C. Energy stocks have performed wonderfully in 2022 due to high energy prices, and analysts expect these stocks to continue to do well in the future. Since Exxon stock is currently undervalued (its intrinsic value that you just calculated in Part A is higher than the current stock price in Part B), you're thinking about investing in Exxon. If you buy it today at the current stock price ( $100.80/ share) and sell it when it hits $115/ share in a year, what is your expected capital gains yield? (5pts) D. What is the expected total return on your Exxon investment? (5pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started