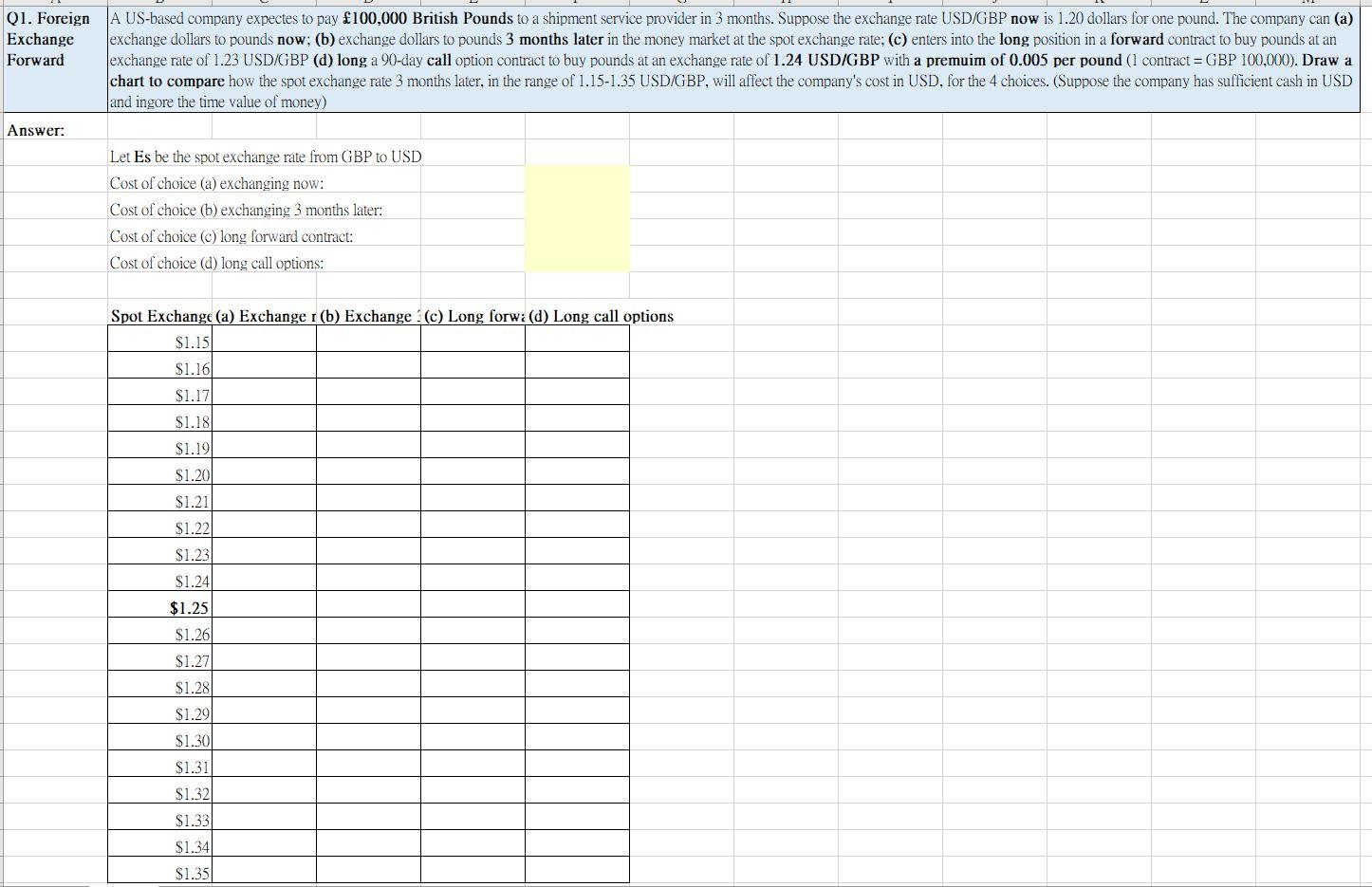

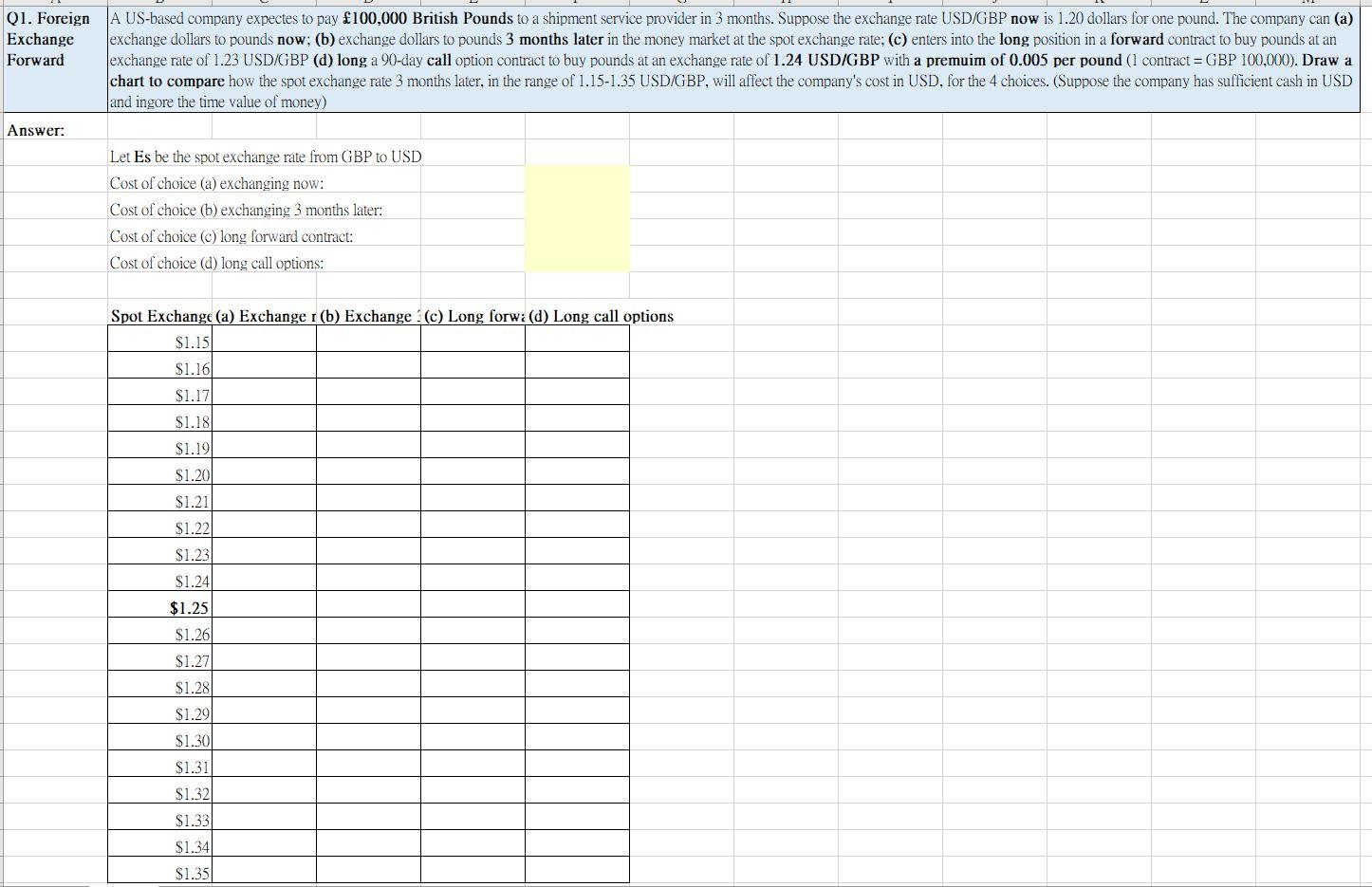

Q1. Foreign Exchange Forward A US-based company expectes to pay 100,000 British Pounds to a shipment service provider in 3 months. Suppose the exchange rate USD/GBP now is 1.20 dollars for one pound. The company can (a) exchange dollars to pounds now; (b) exchange dollars to pounds 3 months later in the money market at the spot exchange rate; (c) enters into the long position in a forward contract to buy pounds at an exchange rate of 1.23 USD/GBP (d) long a 90-day call option contract to buy pounds at an exchange rate of 1.24 USD/GBP with a premuim of 0.005 per pound (1 contract = GBP 100.000). Draw a chart to compare how the spot exchange rate 3 months later, in the range of 1.15-1.35 USD/GBP, will affect the company's cost in USD, for the 4 choices. (Suppose the company has sufficient cash in USD and ingore the time value of money) Answer: Let Es be the spot exchange rate from GBP to USD Cost of choice (a) exchanging now: Cost of choice (b) exchanging 3 months later: Cost of choice (c) long forward contract: Cost of choice (d) long call options: Spot Exchange (a) Exchange I (b) Exchange (c) Long forwa(d) Long call options $1.151 $1.16 $1.17) $1.18 $1.19 $1.20 $1.21 $1.22 $1.23 $1.24 $1.25 $1.26 $1.27 $1.28 $1.29 $1.30 $1.31 $1.32 $1.33 $1.34 $1.35 Q1. Foreign Exchange Forward A US-based company expectes to pay 100,000 British Pounds to a shipment service provider in 3 months. Suppose the exchange rate USD/GBP now is 1.20 dollars for one pound. The company can (a) exchange dollars to pounds now; (b) exchange dollars to pounds 3 months later in the money market at the spot exchange rate; (c) enters into the long position in a forward contract to buy pounds at an exchange rate of 1.23 USD/GBP (d) long a 90-day call option contract to buy pounds at an exchange rate of 1.24 USD/GBP with a premuim of 0.005 per pound (1 contract = GBP 100.000). Draw a chart to compare how the spot exchange rate 3 months later, in the range of 1.15-1.35 USD/GBP, will affect the company's cost in USD, for the 4 choices. (Suppose the company has sufficient cash in USD and ingore the time value of money) Answer: Let Es be the spot exchange rate from GBP to USD Cost of choice (a) exchanging now: Cost of choice (b) exchanging 3 months later: Cost of choice (c) long forward contract: Cost of choice (d) long call options: Spot Exchange (a) Exchange I (b) Exchange (c) Long forwa(d) Long call options $1.151 $1.16 $1.17) $1.18 $1.19 $1.20 $1.21 $1.22 $1.23 $1.24 $1.25 $1.26 $1.27 $1.28 $1.29 $1.30 $1.31 $1.32 $1.33 $1.34 $1.35