Q1. Georgia produces 40 more than 3 times what Harriet can produce in one day. If Georgia's total production for the day is 160, how much does Harriet produce in one day?

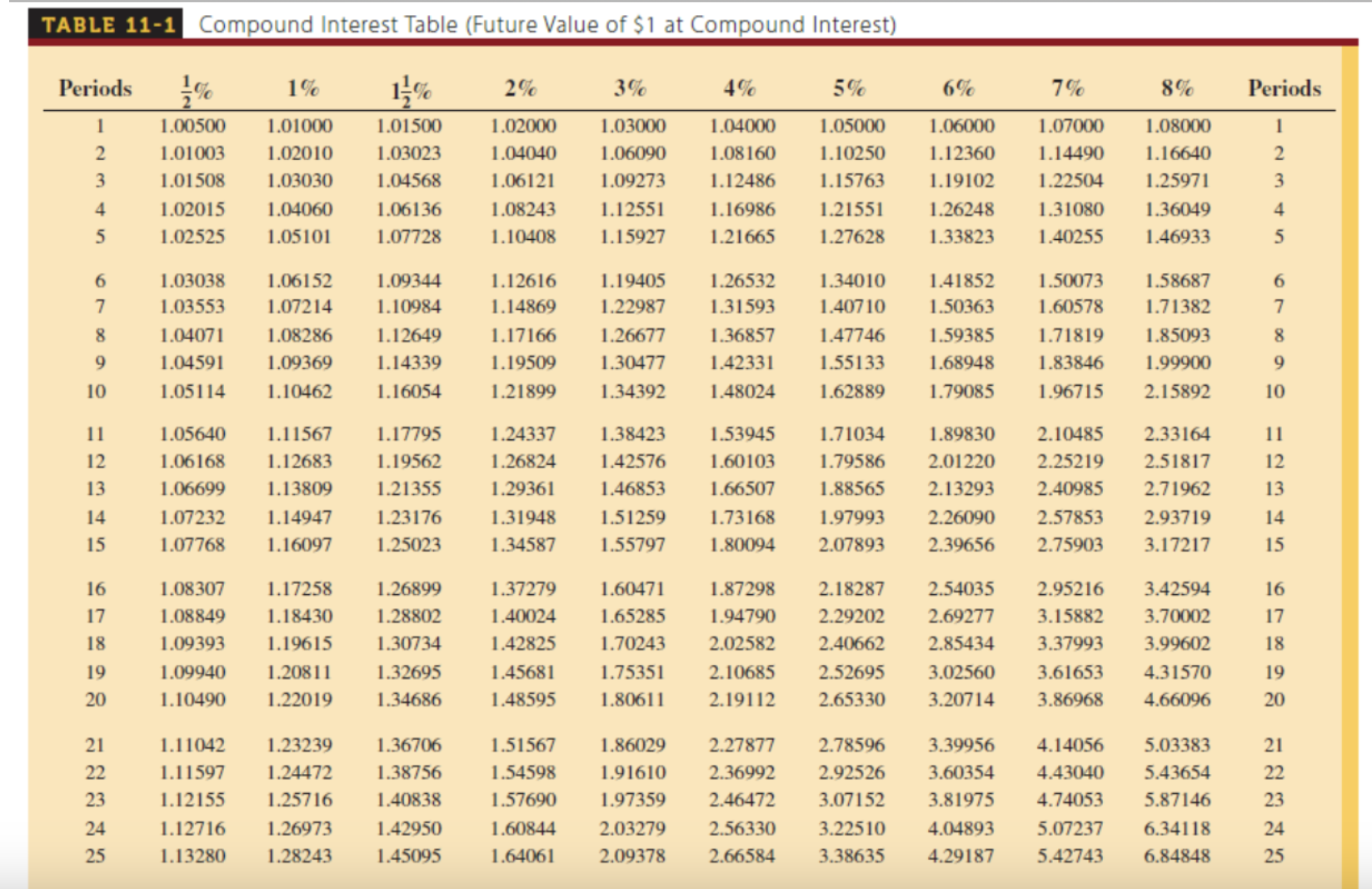

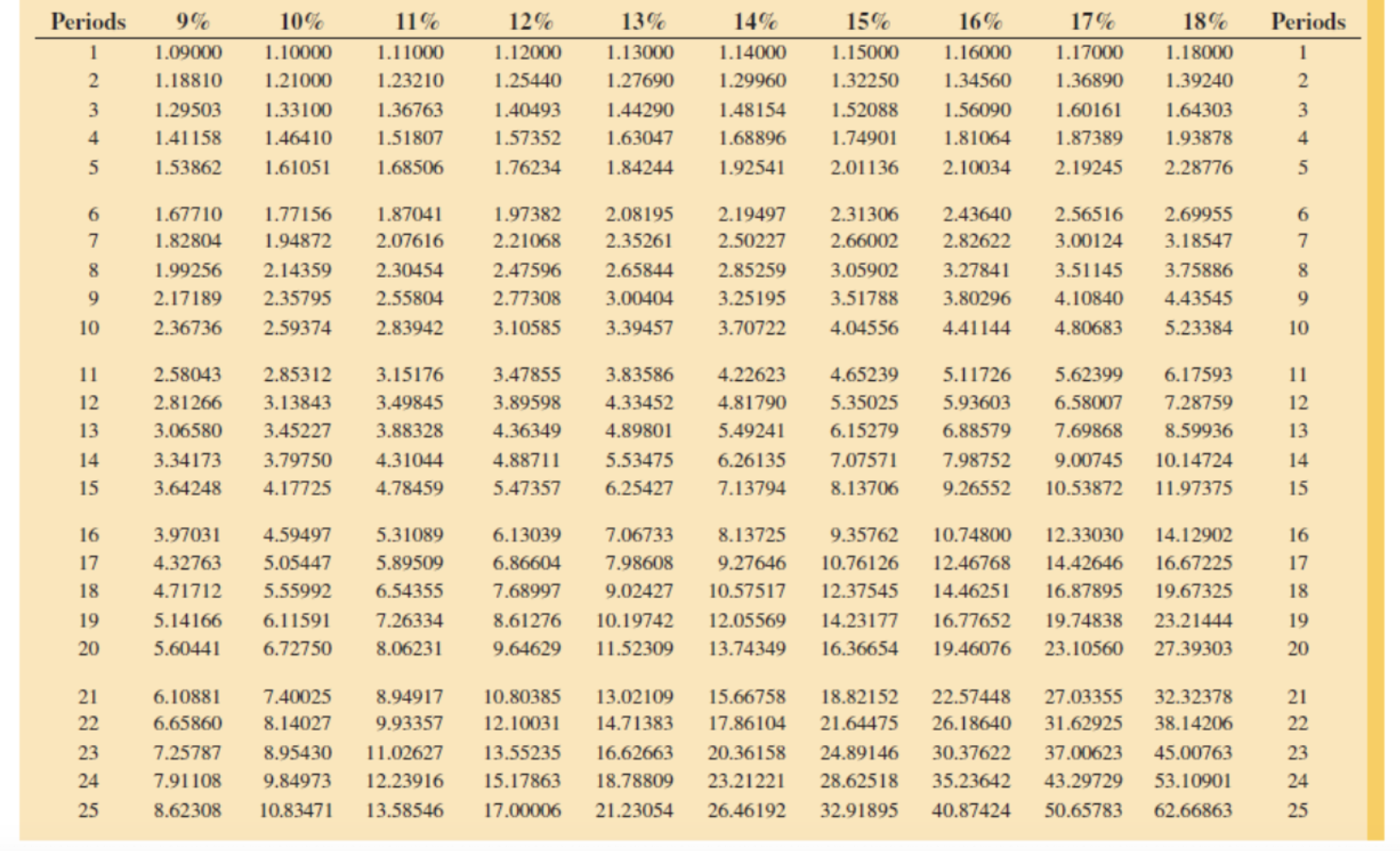

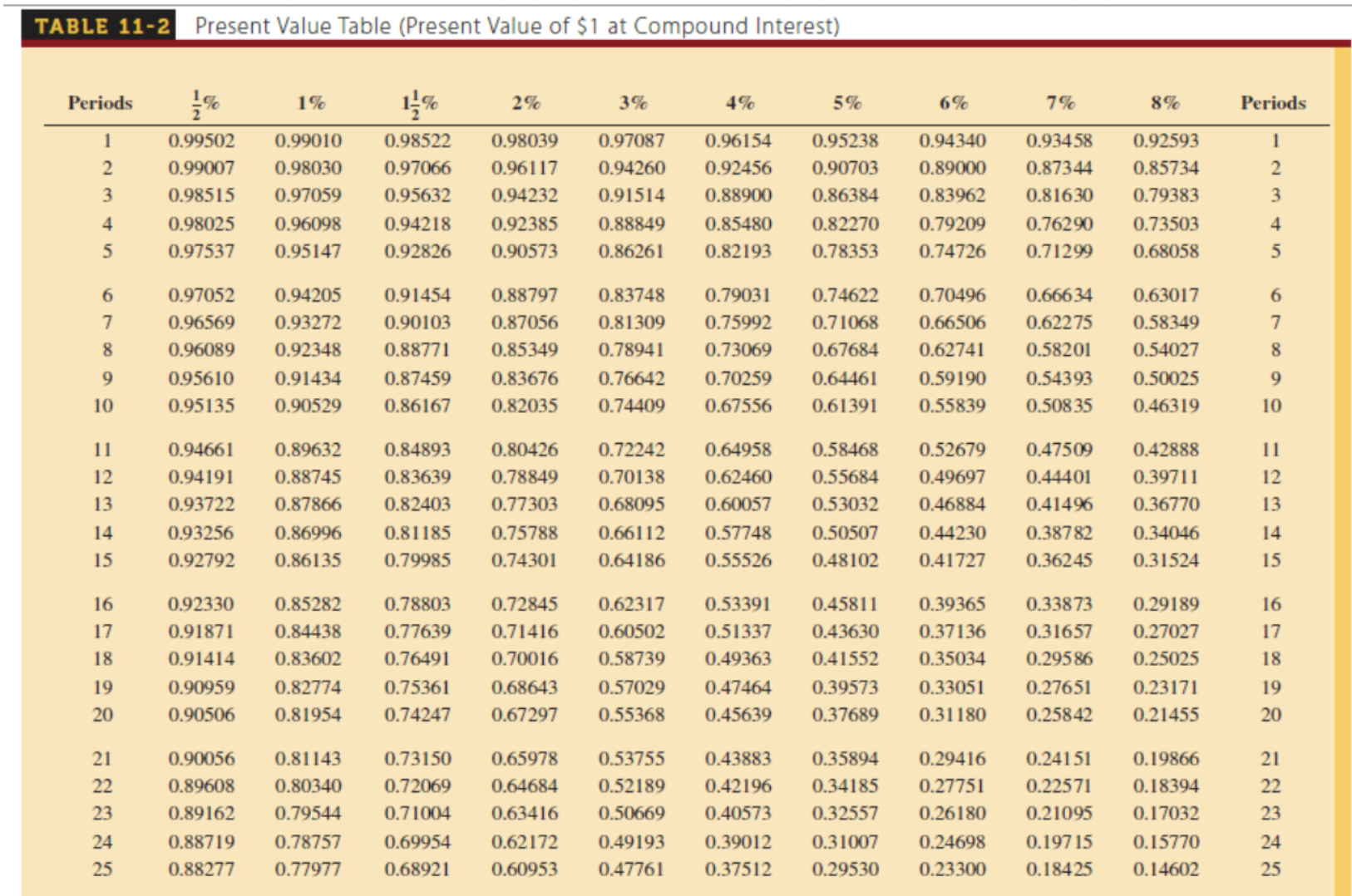

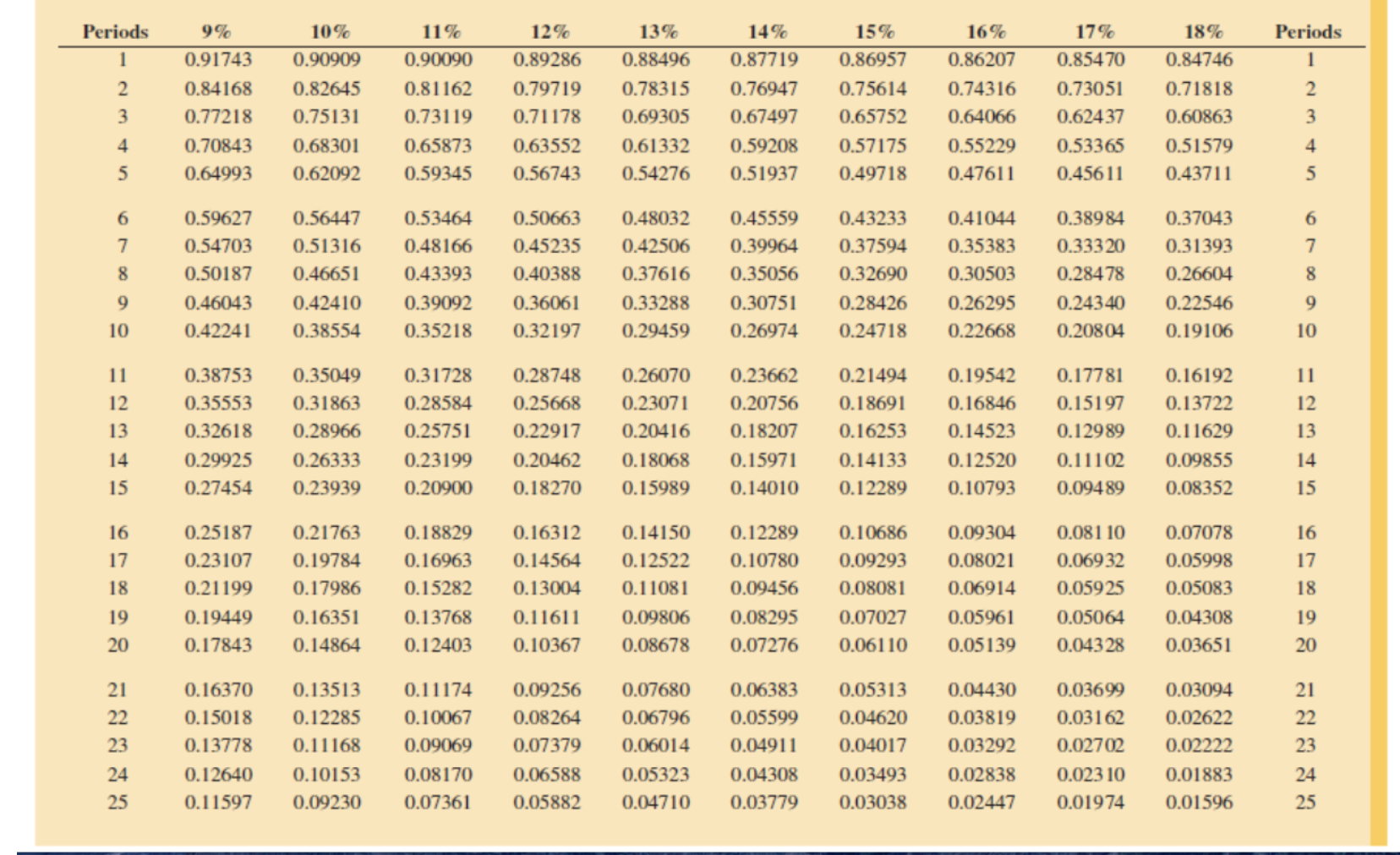

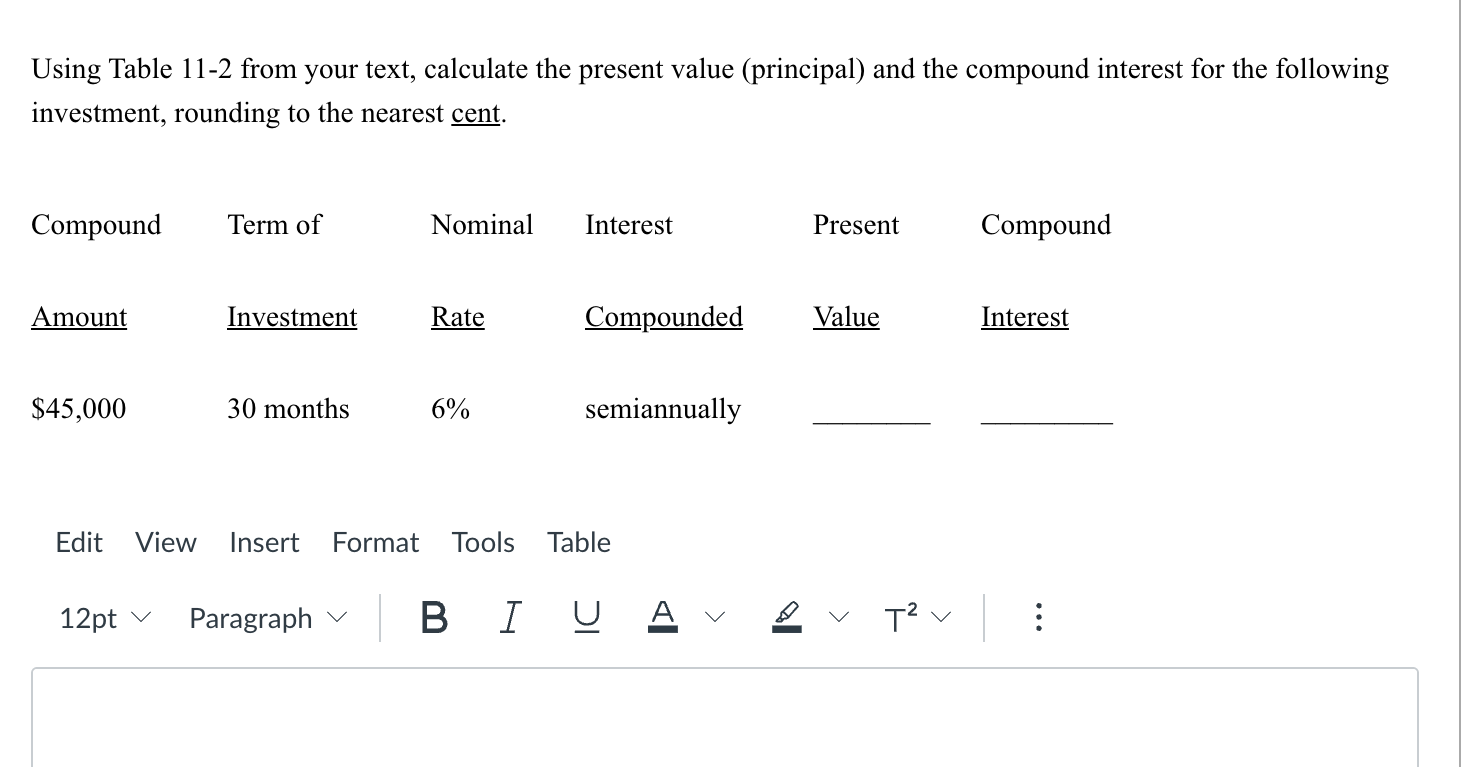

q2. Solve the following problems using either Tables 11-1 or 11-2 from your text. When necessary, create new table factors. (Round new table factors to five decimal places, round dollars to the nearest cent and percents to the nearest hundredth of a percent)

Suppose you wish to have $10,500 in 19 years. Use the present value formula to find how much you should invest now at 4% interest, compounded annually in order to have $10,500, 19 years from now

Q3.

_ Compound Interest Table (Future Value of St at Compound Interest) Periods 1% 1% 11% 2% 3% 4% 5% 6% 7% 8% Periods 22 1 1.1175(8) 1.010(1) 1.0151!) 1.02000 1.03181) 1.0411!) 1.05000 1.1511!) 1.01000 1.08111) 1 2 1.011173 1.02010 1.03023 1.04040 1.06090 1.08160 1.10250 1.12360 1.14490 1.16640 2 3 1.01508 1.03030 1.04568 1.115121 1.09273 1.12486 1.15763 1.19102 1.22504 1.25971 3 4 1.02015 1.04060 1.15136 1.08243 1.12551 1.16986 1.21551 1.26248 1.31080 1.36049 4 5 1.02525 1.05101 1.07728 1.10408 1.15927 1.21665 1.27628 1.33823 1.40255 1.46933 5 6 1.03038 115152 1.19344 1.12616 1.19405 1.26532 1.34010 1.41852 1.50073 158687 6 7 1.03553 1.07214 1.10984 1.14869 1.22987 1.31593 1.40710 1.50363 1.60573 1.71382 7 8 1.04071 I.m286 1.12649 1.17165 1.26677 1.36857 1.47746 1.59385 1.71819 1.85093 8 9 1.04591 1.09369 1.14339 1.19509 1.30477 1.42331 1.55133 1.68948 1.83846 1.99900 9 10 1.05114 1.10462 1.16054 1.21899 1.34392 1.48024 1.62889 1.79085 1.96715 2.15892 10 11 1.05640 1.11567 1.17795 1.24337 1.38423 1.53945 1.71034 1.89830 2.10485 2.33164 11 12 1.13168 1.12683 1.19562 1.26824 1.42576 1.60103 1.79586 2.01220 2.25219 2.51817 12 13 [6699 1.13809 1.21355 1.29361 1.46853 1.66507 1.88565 2.13293 2.40985 2.71962 13 14 1.07232 1.14947 1.23176 1.31948 151259 1.73168 1.97993 2.26090 2.57853 2.93719 14 15 1.07768 1.16097 1.25023 1.34587 1.55797 1.811794 2.07893 2.3%56 2.75903 3.17217 15 16 1.08307 1.17258 1.26899 1.37279 1.60471 1.87298 2.18287 2.54035 2.95216 3.42594 16 17 1.08849 1.18430 1.28802 1.40024 1.65285 1.94790 2.29202 2.69277 3.15882 3.70002 17 18 1.07393 1.19615 1.30734 1.42825 1.70243 2.02582 2.41662 2.85434 3.37993 3.99602 18 19 1.09940 1.2131 1 1.32695 1.45681 1.75351 2.1M5 2.52695 3.02560 3.61653 4.31570 19 20 1.10490 1.22019 1.34686 1.48595 1.80611 2.19112 2.65330 3.20714 3.86968 4.66096 20 21 1.1 1042 1.23239 1.36715 1.51567 1.86029 2.27877 2.78596 3.39956 4.14056 5.03383 21 22 1.1 1597 1.24472 1.38756 1.54598 1.91610 2.36992 2.92526 3.60354 4.43040 5.43654 22 23 1.12155 1.25716 1.41338 1.57690 1.97359 2.46472 3.07152 3.81975 4.74053 5.87146 3 24 1.12716 1.26973 1.42950 1.60844 2.03279 2.56330 3.2310 4.04893 5.07237 6.341 18 24 25 1.13280 1.28243 1.45095 1.64151 2.09378 2.66584 3.38635 4.29187 5.42743 6.84848 25 \f- Present Value Table (Present Vaiue of $1 at Compound Interest) Periods 5-19 196 1%96 2% 396 4% 5% 6% 7% 8% Periods I 0.99502 0.99010 0.98522 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 I 2 0.99007 0.98030 0.97066 0.961 17 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 2 3 0.98515 0.97059 0.95632 0.94232 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 3 4 0.98025 0.96098 0.94218 0.92385 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 4 5 0.97537 0.95147 0.92826 0.90573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 5 6 0.97052 0.94205 0.91454 0.88797 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 6 7 0.96569 0.93272 0.90103 0.87056 0.81309 0.75992 0.71068 0.66506 0.6275 0.58349 7 8 0.96089 0.92348 0.88771 0.85349 0.78941 0.73069 0.67684 0.62741 058201 054027 8 9 0.95610 0.91434 0.87459 0.83676 0.76642 0.7059 0.64461 059190 054393 050025 9 10 0.95135 0.90529 0.86167 0.82035 0.74409 0.67556 0.61391 0.55839 050835 0.46319 10 1 1 0.94661 0.89632 0.84893 0.80426 0.72242 0.64958 058468 0.52679 0.47509 0.42888 1 1 12 0.94191 0.88745 0.83639 0.78849 0.70138 0.62460 055684 0.49697 0.44401 0.3971 1 12 13 0.93722 0.87866 0.82403 0.77303 0.68095 0.60057 053032 0.46884 0.41496 0.36770 13 14 0.93256 0.86996 0.81 185 0.75788 0.661 12 0.57748 050507 0.44230 0.38782 0.34046 14 15 0.92792 0.86135 0.79985 0.74301 0.64186 055526 0.48102 0.41727 0.36245 0.31524 15 16 0.92330 0.85282 0.78803 0.72845 0.62317 0.53391 0.4581 1 0.39365 0.33873 0.29189 16 17 0.91871 0.84438 0.77639 0.71416 0.60502 051337 0.43630 0.37136 051657 0.27027 17 18 0.91414 0.83602 0.76491 0.70016 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 18 19 0.90959 0.82774 0.75361 0.68643 0.57029 0.47464 0.39573 0.33051 027651 0.23171 19 20 0.90506 0.81954 0.74247 0.67297 0.55368 0.45639 0.37689 0.31 1110 0.25842 0.21455 20 21 0.90056 0.81 143 0.73150 0.65978 0.53755 0.43883 0.35894 0.29416 0.24151 0.19866 21 22 0.89608 0.80340 0.72069 0.64684 0.52189 0.42196 0.34185 0.27751 0.22571 0.18394 22 23 0.89162 0.79544 0.71004 0.63416 0.50669 0.40573 0.32557 0.26180 0.21095 0.17032 23 24 0.88719 0.78757 0.69954 0.62172 0.49193 039012 0.31007 0.24698 0.19715 0.15770 24 3 0.88277 0.77977 0.68921 0.60953 0.47761 0.37512 0.29530 0.23300 0.1843 0.14602 25 \fUsing Table 11-2 from your text, calculate the present value (principal) and the compound interest for the following investment, rounding to the nearest cent. Compound Term of Nominal Interest Present Compound Amount Investment Rate Compounded Value Interest $45,000 30 months 6% semiannually Edit View Insert Format Tools Table 12pt V Paragraph V B I g A V g v 2v