Answered step by step

Verified Expert Solution

Question

1 Approved Answer

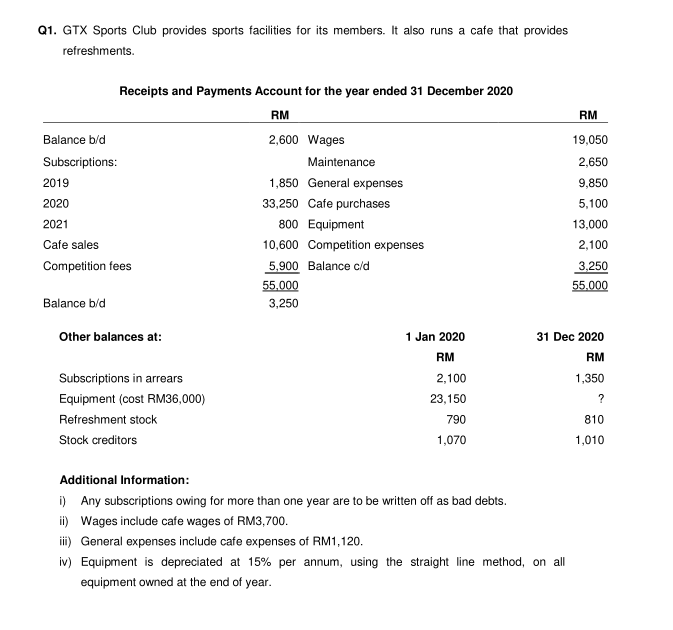

Q1. GTX Sports Club provides sports facilities for its members. It also runs a cafe that provides refreshments. RM Receipts and Payments Account for the

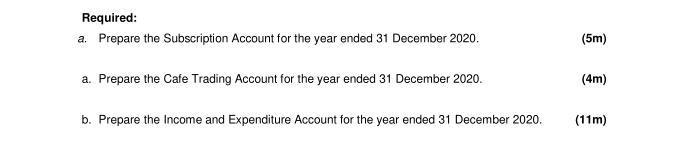

Q1. GTX Sports Club provides sports facilities for its members. It also runs a cafe that provides refreshments. RM Receipts and Payments Account for the year ended 31 December 2020 RM Balance b/d 2,600 Wages Subscriptions: Maintenance 2019 1,850 General expenses 2020 33,250 Cafe purchases 2021 800 Equipment Cafe sales 10,600 Competition expenses Competition fees 5,900 Balance c/d 55.000 Balance b/d 3,250 19,050 2,650 9,850 5,100 13,000 2,100 3,250 55.000 Other balances at: 1 Jan 2020 RM 2,100 23,150 790 1,070 31 Dec 2020 RM 1,350 ? Subscriptions in arrears Equipment (cost RM36,000) Refreshment stock Stock creditors 810 1,010 Additional Information: i) Any subscriptions owing for more than one year are to be written off as bad debts. ii) Wages include cafe wages of RM3,700. iii) General expenses include cafe expenses of RM1,120. iv) Equipment is depreciated at 15% per annum, using the straight line method, on all equipment owned at the end of year. Required: a. Prepare the Subscription Account for the year ended 31 December 2020. (5m) a. Prepare the Cafe Trading Account for the year ended 31 December 2020. (4m) b. Prepare the Income and Expenditure Account for the year ended 31 December 2020. (11m)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started