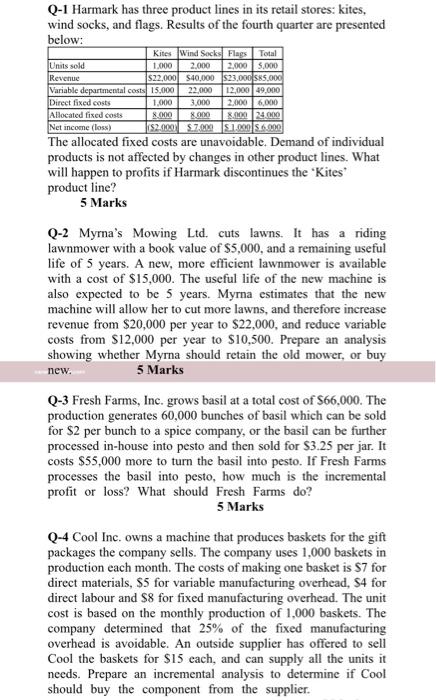

Q-1 Harmark has three product lines in its retail stores: kites, wind socks, and flags. Results of the fourth quarter are presented below: Kites Wind Socks Flags Total Units sold 1.000 2.000 2,000 5.000 Revenue S22,000 $40,000 $23,000 585.000 Variable departmental costs 15.000 22.000 12,000 49.000 Direct fixed costs 1.000 3.000 2.000 6,000 Allocated fixed costs 8.000 8000 8.000 4.000 Net income (loss) 152.000 57.00 51.000 56.000 The allocated fixed costs are unavoidable. Demand of individual products is not affected by changes in other product lines. What will happen to profits if Harmark discontinues the Kites product line? 5 Marks new Q-2 Myrna's Mowing Ltd. cuts lawns. It has a riding lawnmower with a book value of $5,000, and a remaining useful life of 5 years. A new, more efficient lawnmower is available with a cost of $15,000. The useful life of the new machine is also expected to be 5 years. Myrna estimates that the new machine will allow her to cut more lawns, and therefore increase revenue from $20,000 per year to $22,000, and reduce variable costs from $12,000 per year to $10,500. Prepare an analysis showing whether Myrna should retain the old mower, or buy 5 Marks Q-3 Fresh Farms, Inc. grows basil at a total cost of $66.000. The production generates 60,000 bunches of basil which can be sold for $2 per bunch to a spice company, or the basil can be further processed in-house into pesto and then sold for $3.25 per jar. It costs $55,000 more to turn the basil into pesto. If Fresh Farms processes the basil into pesto, how much is the incremental profit or loss? What should Fresh Farms do? 5 Marks Q-4 Cool Inc. owns a machine that produces baskets for the gift packages the company sells. The company uses 1.000 baskets in production each month. The costs of making one basket is $7 for direct materials, S5 for variable manufacturing overhead, S4 for direct labour and $8 for fixed manufacturing overhead. The unit cost is based on the monthly production of 1,000 baskets. The company determined that 25% of the fixed manufacturing overhead is avoidable. An outside supplier has offered to sell Cool the baskets for $15 cach, and can supply all the units it needs. Prepare an incremental analysis to determine if Cool should buy the component from the supplier