Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 How much is the DEFERRED gain on the like-kind exchange? $50,000 $84,226 $215,774 $265,774 Q2 How much is the REALIZED gain on the like-kind

Q1

How much is the DEFERRED gain on the like-kind exchange?

$50,000

$84,226

$215,774

$265,774

Q2

How much is the REALIZED gain on the like-kind exchange?

$50,000

$84,226

$215,774

$265,774

THANK YOU, WHAT IS THE DIFFERENCES BETWEEN THE TWO?

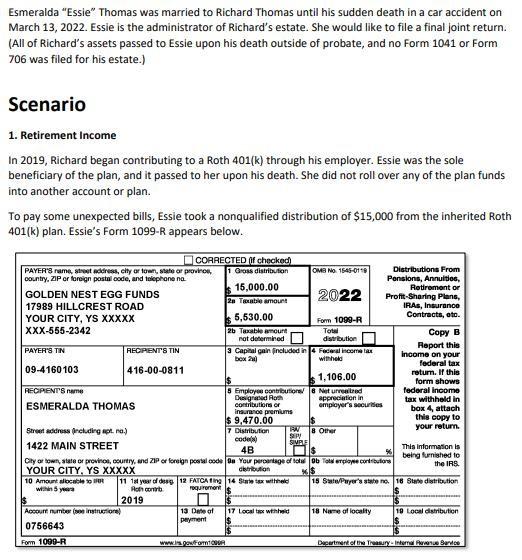

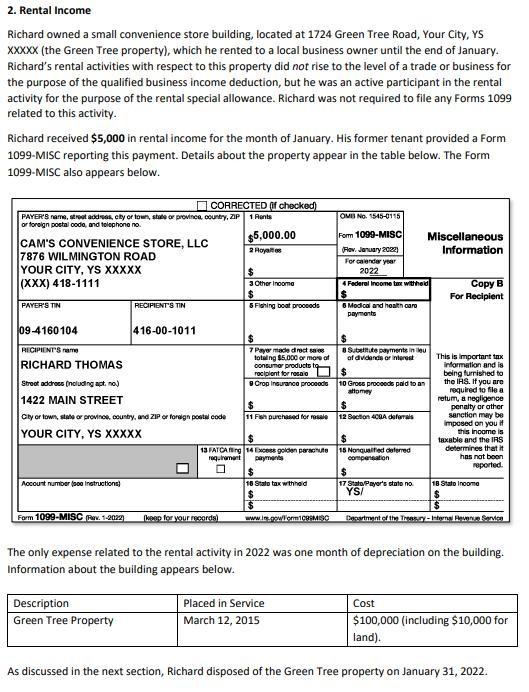

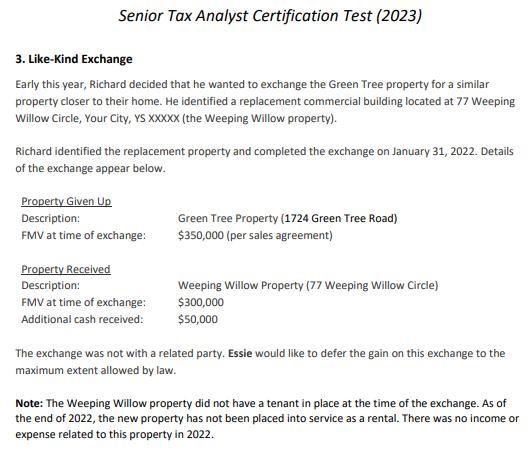

Esmeralda "Essie" Thomas was married to Richard Thomas until his sudden death in a car accident on March 13, 2022. Essie is the administrator of Richard's estate. She would like to file a final joint return. (All of Richard's assets passed to Essie upon his death outside of probate, and no Form 1041 or Form 706 was filed for his estate.) Scenario 1. Retirement Income In 2019, Richard began contributing to a Roth 401 (k) through his employer. Essie was the sole beneficiary of the plan, and it passed to her upon his death. She did not roll over any of the plan funds into another account or plan. To pay some unexpected bills, Essie took a nonqualified distribution of $15,000 from the inherited Roth 401(k) plan. Essie's Form 1099-R appears below. 2. Rental Income Richard owned a small convenience store building, located at 1724 Green Tree Road, Your City, YS XXXXX (the Green Tree property), which he rented to a local business owner until the end of January. Richard's rental activities with respect to this property did not rise to the level of a trade or business for the purpose of the qualified business income deduction, but he was an active participant in the rental activity for the purpose of the rental special allowance. Richard was not required to file any Forms 1099 related to this activity. Richard received $5,000 in rental income for the month of January. His former tenant provided a Form 1099-MISC reporting this payment. Details about the property appear in the table below. The Form 1099-MISC also appears below. The only expense related to the rental activity in 2022 was one month of depreciation on the building. Information about the building appears below. As discussed in the next section, Richard disposed of the Green Tree property on January 31, 2022. Senior Tax Analyst Certification Test (2023) 3. Like-Kind Exchange Early this year, Richard decided that he wanted to exchange the Green Tree property for a similar property closer to their home. He identified a replacement commercial building located at 77 Weeping Willow Circle, Your City, YS XXxxX (the Weeping Willow property). Richard identified the replacement property and completed the exchange on January 31, 2022. Details of the exchange appear below. The exchange was not with a related party. Essie would like to defer the gain on this exchange to the maximum extent allowed by law. Note: The Weeping Willow property did not have a tenant in place at the time of the exchange. As of the end of 2022 , the new property has not been placed into service as a rental. There was no income or expense related to this property in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started