Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 In June Mahabeer received his bank statement which showed that he had an over-drawn balance of $7 225 on his bank account. His

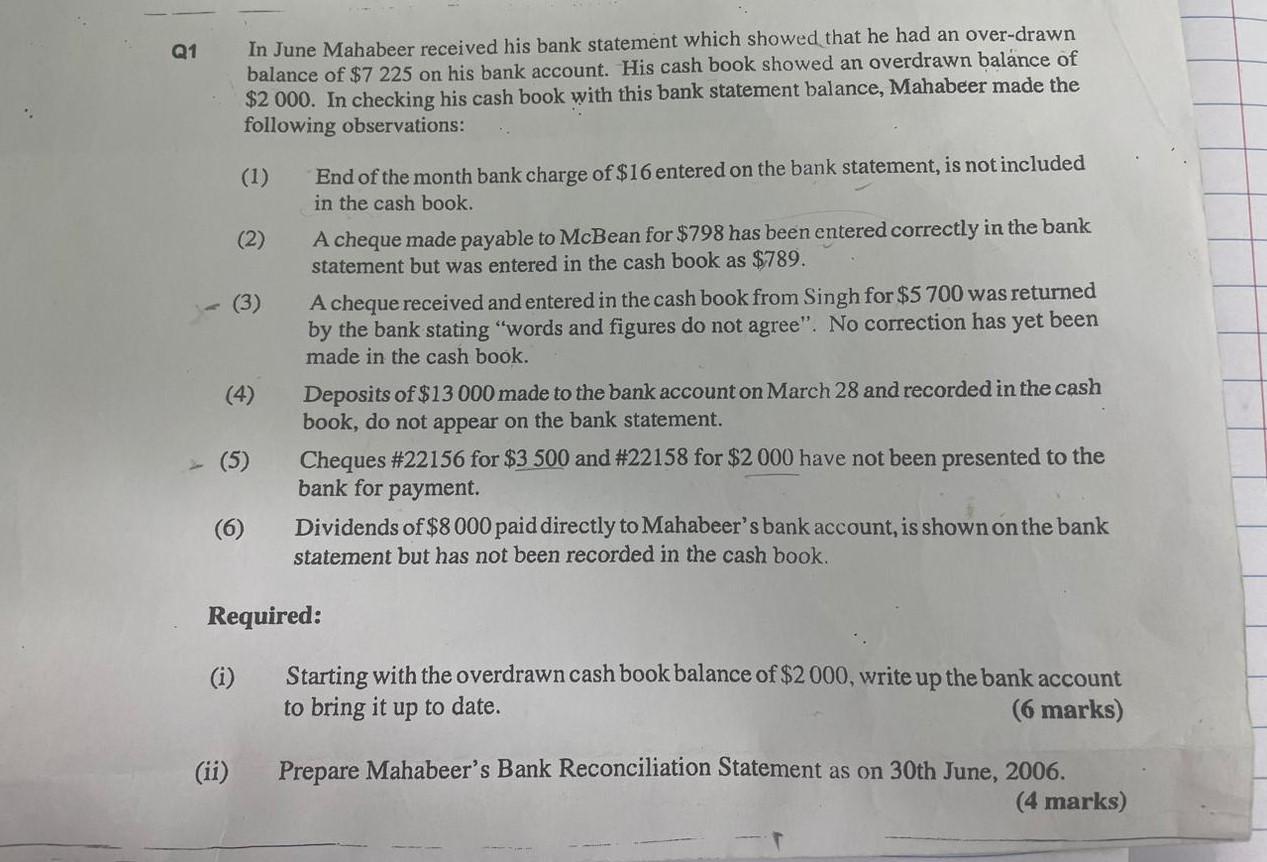

Q1 In June Mahabeer received his bank statement which showed that he had an over-drawn balance of $7 225 on his bank account. His cash book showed an overdrawn balance of $2 000. In checking his cash book with this bank statement balance, Mahabeer made the following observations: (1) (2) (3) (4) (5) (i) (ii) (6) End of the month bank charge of $16 entered on the bank statement, is not included in the cash book. A cheque made payable to McBean for $798 has been entered correctly in the bank statement but was entered in the cash book as $789. A cheque received and entered in the cash book from Singh for $5 700 was returned by the bank stating "words and figures do not agree". No correction has yet been made in the cash book. Deposits of $13 000 made to the bank account on March 28 and recorded in the cash book, do not appear on the bank statement. Cheques #22156 for $3 500 and #22158 for $2 000 have not been presented to the bank for payment. Required: Dividends of $8 000 paid directly to Mahabeer's bank account, is shown on the bank statement but has not been recorded in the cash book. Starting with the overdrawn cash book balance of $2 000, write up the bank account to bring it up to date. (6 marks) Prepare Mahabeer's Bank Reconciliation Statement as on 30th June, 2006. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Bank account to bring it up to date Date June 1 June 1 June 3 June 5 June 9 June 15 June 20 June 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started