Question

Q1 . Indicate all the options in the table below that are in-the-money, out-of- the-money or at-the-money. Q2 . For all the options in the

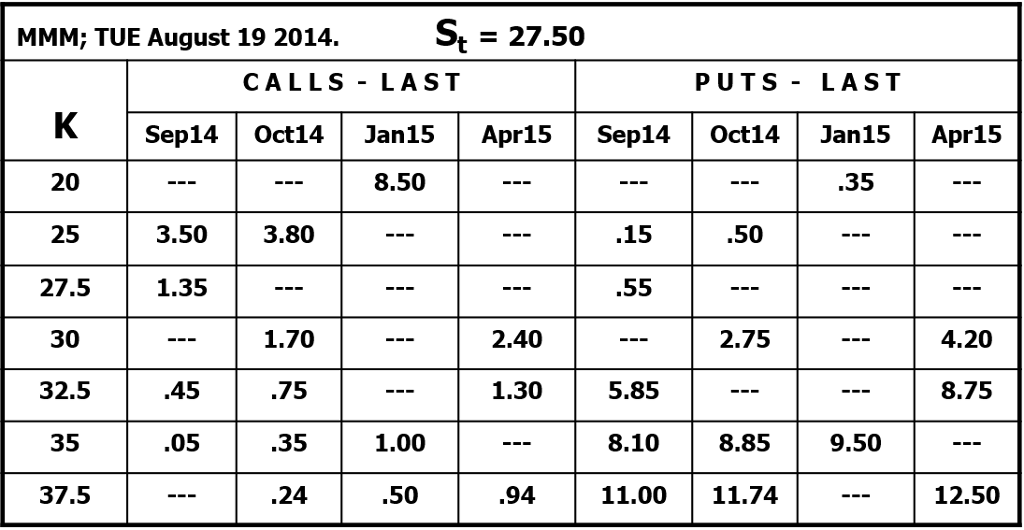

Q1. Indicate all the options in the table below that are in-the-money, out-of- the-money or at-the-money.

Q2. For all the options in the table below indicate how much of the premium is intrinsic value and how much is time value.

Q3. Options Expiration: The official expiration date for the options is:

The SAT immediately following the third FRI of the expiration month.

Indicate the official expiration dates of the options in the table.

Q4. Read the definition of stock splits in the textbook and study

Suppose that MMM had a three-for-one split right now that is on AUG 19 when the prices in the table are the market prices. Explain in details and show the new numbers the price changes, and the rest of the adjustments. Note: the adjustments are to the nearest cent.

Q5. On August 19 you bought the OCT, K=25, call and at the same time you bought the OCT, K=25 put. You hold both options to their expiration. At the options expiration which one will you exercise and what will be your profit/share or loss/share if MMMs price at expiration were:

5.1 S = 35; 5.2 S = 20; 5.3 S = 25.

NOTE: Your profit is defined as:

The per share cash flow at expiration PLUS the initial CASH FLOW per share.

Q6. On August 19 you sold the APR 15, K=30, call and at the same time you sold the APR 15 K=30 put. Suppose that both options will not be exercised till their expiration; Calculate your profit/loss per share at expiration if MMMLs price at expiration were:

6.1 S = 35; 6.2 S = 30; 6.3 S = 25.

Q7. On august 19 you bought the APR 15 , K=30 call and simultaneously sold the APR 15 K=32.5 call. The options were not exercised till their expiration.

Calculate your profit/loss per share at expiration if MMMLs price at expiration were $36.50/share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started